USDT, or Tether, is one of the most popular and widely used cryptocurrencies in the world. Unlike most cryptocurrencies, which have volatile and unpredictable prices, USDT is designed to maintain a stable value that is equal to the US dollar.

This makes USDT a convenient and reliable way of exchanging value on the blockchain, especially for traders and investors who want to hedge against market fluctuations and lock in their profits.

In this article, we will explain what USDT is, how it works, and how you can use it in Nigeria to trade, invest, and transact with cryptocurrencies.

What is USDT

USDT is a type of cryptocurrency that is also known as a stablecoin. A stablecoin is a crypto that is pegged to another asset, such as a fiat currency, a commodity, or another crypto and tries to maintain a stable and consistent value in relation to that asset.

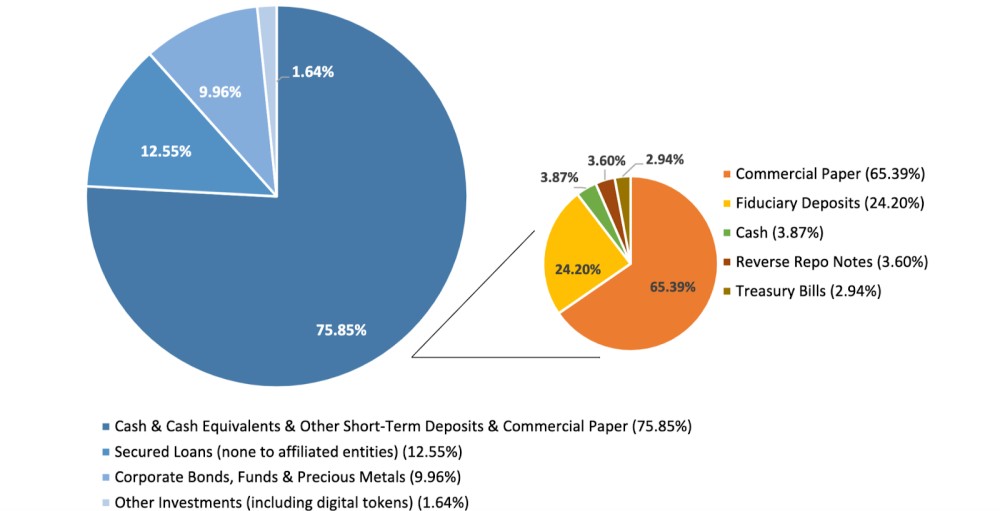

USDT is pegged to the US dollar, meaning that one USDT token is always supposed to be worth one US dollar. USDT is issued and managed by a Hong Kong-based company called Tether, which claims to back every USDT token with an equivalent amount of US dollars or other assets in its reserves. Tether publishes its reserve holdings daily on its website and also undergoes periodic audits by independent firms to verify its claims.

Founders of USDT

USDT is a controversial stablecoin that was created in 2014 by Brock Pierce, Reeve Collins, and Craig Sellars as Realcoin, and later renamed to Tether. It runs on the Bitcoin blockchain using the Omni Protocol and claims to be backed by US dollar reserves.

However, its issuer, Tether, has faced many issues, such as banking problems, lack of transparency, legal disputes, and market manipulation allegations. In 2019, Tether and its partner exchange, Bitfinex, settled a lawsuit with the New York Attorney General for $18.5 million.

What makes Tether stand out from other stablecoins

Tether is still the center of speculation in cryptocurrency markets and blockchain networks, with many users not trusting their liquidity and stability. However, it has some unique features that set it apart from other stablecoins. Some of them include:

Stability

The main feature of USDT is its stable value. Each USDT token is meant to be equal to 1 USD, which makes it a dependable way of storing and exchanging value in the crypto space.

Reserve Backing

To keep this value stable, Tether says that it has the same amount of US Dollars in reserve as the number of USDT tokens that are out there. This reserve backing is checked regularly by audits to make sure that it is true and follows the rules.

Liquidity

USDT is accepted by many cryptocurrency exchanges and platforms, making it a popular option for traders and investors who want to move money in and out of the crypto market quickly and avoid the price changes of other cryptocurrencies.

Transparency

Tether has tried to be more transparent by giving regular updates on the reserve holdings and letting third-party auditors check them. This transparency aims to create trust among users and regulators.

How USDT works

USDT works by issuing tokens based on demand and backed by a reserve of US dollars. It is traded on cryptocurrency exchanges and adjusted to keep its value at 1 US dollar.

Tether Ltd., the company behind USDT, creates and sends tokens to users who pay with US Dollars and claims to hold enough US dollars in a bank account to redeem the tokens when needed.

Tether may also create or redeem tokens to keep its supply and demand in balance.

How to use USDT in Nigeria

Tether (USDT) is very useful for different things in the crypto world, such as:

Trading: Nigerian Traders like to use USDT as a main currency to trade other cryptos. When they think the market will go down, they can change their assets to USDT to keep their value and avoid losing money because of price changes.

Hedging: USDT can help you to hedge against market changes. Investors can move their assets to USDT to keep their money safe during times of trouble in the market.

Transferring Funds: USDT allows you to send and receive money fast and safely across crypto exchanges or wallets without worrying about the price changes of other tokens.

Holding Stable Value: USDT gives you a way to store your assets stably without the need to change them back to naira or other currencies.

Arbitrage: Some traders use USDT to make money from crypto arbitrage, which is when you use the price differences between exchanges to buy and sell cryptos quickly and make a profit.

What are USDT transaction fees

To make the most of the use cases above, it’s important to be aware of the fees typically involved in processing and verifying transactions on the blockchain and how they can influence your USDT/NGN trading experiences and otherwise:

The Blockchain Network: The fees depend on the blockchain network that you use for the USDT transaction. For example: On the Ethereum network (ERC-20 USDT), fees are measured in Ether (ETH) and can change based on network traffic. Ethereum’s fees can go from a few cents to several dollars, depending on network demand. On the Tron network (TRC-20 USDT), transactions usually have lower fees than Ethereum.

The Network Congestion: When the blockchain network has many transactions, fees go up as users try to have their transactions processed fast. During times of high demand, you may have to pay more fees to make sure your USDT transaction is processed quickly.

The Wallet or Exchange Fees: Some wallets or cryptocurrency exchanges may add more fees for processing USDT transactions. These fees can be different between service providers.

Transaction Type: The fee can also change depending on the type of USDT transaction. For example, sending USDT from one wallet to another may have a different fee than changing USDT for another cryptocurrency.

To know the exact transaction fees for your USDT transaction, you should check with the wallet or exchange that you use. They often give fee estimates or let you choose the transaction fee that you want, which can affect how fast your transaction is confirmed on the blockchain.

Also, blockchain explorers for specific networks can give real-time information on current transaction fees.

Where to buy USDT in Nigeria

You can buy USDT on various cryptocurrency exchanges, such as Binance, Luno, Dart Africa, etc. The process typically involves creating an account on an exchange, depositing funds (fiat or other cryptocurrencies), and then using those funds to purchase USDT.

Some of these exchanges are user-friendly while others are not. For example, Binance offers a gift card option to buy crypto on its platform, and that might be easier for you.

Compare the fees, rates, and security of each platform before making a transaction.

Some USDT FAQs?

Is USDT Legal in Nigeria?

USDT is not illegal, but not regulated by the SEC or CBN.

How can I convert USDT to Naira?

You can use a crypto exchange, a P2P platform, or a gift card to trade USDT for Naira.

Can I make money with USDT in Nigeria?

Yes, you can make money with USDT in Nigeria. USDT is a stablecoin that follows the US dollar. You can use it to hedge against the naira, trade for other cryptocurrencies, and stake to earn interest on your holdings. But avoid using USDT to speculate as you may end up losing all your money.

Is it safe to buy USDT in Nigeria?

Buying USDT in Nigeria is not without risks, as there are no regulations or protections. You should use trusted platforms in Nigeria, a secure wallet, and be aware of the potential issues surrounding Tether.

Can I withdraw USDT to my bank account in Nigeria?

You can withdraw USDT by selling it for Naira first. You should check the withdrawal limits, fees, rates, and bank availability of the same exchanges or platforms that you used to buy USDT to sell it for Naira.

Can I use USDT to send money to other countries from Nigeria?

Yes, you can use USDT to send money to other countries from Nigeria, as long as the recipient has a USDT wallet address or an account on a platform that supports USDT.

Can I receive USDT from abroad in Nigeria?

Yes, you can receive USDT from abroad in Nigeria, if you have a USDT wallet or account. You can provide the sender with your USDT address or QR code and receive USDT in your wallet or account.

Which USDT network is best in Nigeria?

USDT today runs on different networks, such as Ethereum, TRON, and others. Each network has its pros and cons. You should compare them and choose the one that fits your needs. You should also ensure your wallet or platform supports it.\ If you care about low fees, you should transact USDT on TRON (TRC 20), Solana, or Binance Smart Chain (BEP 20) as the feeds on those networks are very low compared to Ethereum (ERC 20).

Can I save and invest in USDT in Nigeria?

You can save and invest in USDT in Nigeria by holding or staking it. Platforms such as Binance, Trust Wallet, and Venus make it easy to save and invest your USDT and earn some daily returns. You can check StakingRewards to see platforms where you can save your USDT and earn returns.\ However, USDT may not be the best option for making money with crypto when you save, as it always equals $1 and the interest is low compared to non-stable coins.

Will USDT Crash?

USDT should not crash significantly, unlike other volatile cryptocurrencies. However, USDT is not immune to external factors, such as market demand, supply, and liquidity. It is also dependent on the reserves and regulations of its issuer, Tether as there is always a possibility that USDT could lose its peg or face other challenges that could affect its price and stability.

In conclusion

USDT is a popular stablecoin that is pegged to the US dollar and can be used on various blockchain platforms, including TRON. It can help you hedge against volatility, lock in profits, trade easily, and access global markets.

However, the stablecoin is not without risks, as it depends on the reserves and regulations of its issuer, Tether. Therefore, you should always do your own research and use other stablecoins or decentralized alternatives if you are concerned about the security and transparency of USDT.