You’ve probably made a quick Google search for the best way to send or receive money internationally, and Payoneer keeps making it to the top 5 recommendations but you need more juice before dipping your toes in.

Thankfully, this review will cover everything you need to know about the Payoneer platform: how it works, its fees, how it compares to other payment methods, and how to get started.

What we will cover

- What is Payoneer?

- What are Payoneer’s Core Services?

- How does Payoneer work?

- How can you use Payoneer?

- What are Payoneer’s Fees?

- Does Payoneer have a Mobile App?

- Is Payoneer Safe and Regulated?

- How can you get Support with Payoneer?

- How does Payoneer compare to PayPal?

- What are the Alternatives to Payoneer?

- Conclusion and FAQs?

| Pros | Cons |

|---|---|

| 👍🏾 An end-to-end international business solution | 👎🏾 Limited payment method options for customers outside of the USA |

| 👍🏾 Hands on account management and Virtual Bank support | 👎🏾 Cards are restricted to USD, GBP, EUR, and CAD, with a 3.5% currency conversion fee for other currencies |

| 👍🏾 Pay VAT, manage business expenses and receive invoice payments | 👎🏾 No forward contracts or limit orders |

| 👍🏾 Pairs with over 2,000 marketplace and finance apps | 👎🏾 PayPal is not a supported payment method |

| 👍🏾 Can withdraw to a local bank account | 👎🏾 Sign up process is lengthy |

| 👎🏾 Frequent cases of unreturned funds, blocked accounts, and inadequate customer support |

What is Payoneer and when did it start?

Payoneer is just like one of the many digital wallets that lets you send and receive money from anywhere in the world. Having a bank account that receives money without border restrictions these days gives you a sense of security and convenience from anywhere in the world.

Founded in 2005, Payoneer has become a trusted platform for millions of people and businesses also supporting global commerce. Whether you’re a freelancer, online seller, or simply someone who needs to send money abroad, Payoneer can help.

With Payoneer, you can get paid from clients and marketplaces around the world, withdraw funds to your local bank account, or use the Payoneer Mastercard for in-person purchases. It’s not complicated at all.

What sets Payoneer apart is its wide reach. Available in over 200 countries and supporting payments in 150 currencies, it’s a versatile platform for people and businesses of all sizes.

Features of the platform Include:

- International Payments: You can easily send and receive payments in multiple currencies with competitive conversion rates.

- Bank Transfers: International Businesses can transfer money to bank accounts worldwide with Payoneer.

- Virtual Bank Accounts: Yes, there’s a dedicated virtual account in different currencies you can use to accept payments globally.

- Payment Cards: You can request and use Payoneer debit cards to withdraw cash at ATMs or make payments online and in stores.

- E-Commerce Solutions: Payoneer facilitates cross-border transactions for e-commerce merchants by providing solutions for receiving payments from major trading platforms and marketplaces.

- Wealth Management: The platform also helps to optimize your finances with services designed to improve cash flow and operations.

- Tax Services: Payoneer provides tax management services, which is especially important for clients doing international business.

- Credit Solutions: To support business growth, Payoneer gives you access to a variety of short-term loans and lines of credit when necessary.

Quick list of Payoneer’s core services:

To answer the question of what Payoneer offers across its diverse user base, here’s a quick overview:

| For Online Sellers | For Freelancers, Agencies or Service Providers | For Individuals |

|---|---|---|

| - Receive payments from major e-commerce platforms like Amazon, eBay, and Walmart. | - Get paid by leading marketplaces including Upwork, Fiverr, Getty Images, etc. | - Receive payments from family and friends globally. |

| - Manage multiple store payments in one place. | - Get paid by your global clients | - Withdraw funds to your local bank account at low rates. |

| - Withdraw your earnings to your local bank account at low rates. | - Withdraw your earnings to your local bank account at low rates | - Use the Payoneer card to access funds at ATMs and make purchases. |

| - Pay your suppliers and vendors directly from your Payoneer account. | - Withdraw funds at ATMs | - Pay bills and other expenses directly from your Payoneer account. |

| - Pay your suppliers and subcontractors for free |

So as a Vacation Rental Host, a Payoneer account will let you:

- Receive payments from platforms like Airbnb, Booking.com, and Vrbo.

- Manage multiple property payments in one account.

- Withdraw your earnings to your local bank account at low rates.

- Pay property management fees and other expenses directly from your Payoneer account.

As an Affiliate Marketer, you can also:

- Get paid by affiliate networks like CJ Affiliate, ShareASale, and Rakuten.

- Consolidate payments from multiple networks.

- Withdraw your earnings to your local bank account at low rates.

- Use the Payoneer card to access funds globally.

How does Payoneer work?

Payoneer works in three basic steps:

- Create Your Account: Sign up for free on Payoneer’s website (https://www.payoneer.com/accounts/) as an individual or a business. You’ll need basic information like your name, email, and contact details.

- Receive Funds: Once your account is approved (usually within 1-3 business days), you can start receiving payments from over 1,000 online platforms and marketplaces. Some clients might even pay you directly through Payoneer.

- Access Your Money: Withdraw your funds to your local bank account, use your Payoneer debit Mastercard at ATMs worldwide, or even shop online and in stores.

There are a few things to keep in mind though:

- Payoneer may require proof of US activity for a local US account.

- A minimum of $2,000 in transactions per year is needed to keep your account active. You will be charged if 12 months pass and you have received less than 2,000.00 USD (or equivalent) in payments.

- Payoneer isn’t for personal transactions—sending money to friends or family could get your account closed.

Using Payoneer: Bank Transfers, Payoneer Transfers, MasterCard and Transfer Speed

Payoneer makes managing your money easier, especially if you deal with regular international transactions.

Transferring money from Payoneer to your bank account is straightforward and reliable. Payoneer supports bank transfers to accounts in Nigeria, the UK, and many other countries, providing flexibility for international transactions. Unlike PayPal, which restricts Nigerian accounts from receiving funds or transferring them to a bank, Payoneer allows both receiving and transferring money to your bank.

For Payoneer-to-Payoneer transfers, the process is simple. You only need the recipient’s Payoneer email address to send money. There are no transaction fees for this service, making it an economical option for transferring funds between Payoneer accounts.

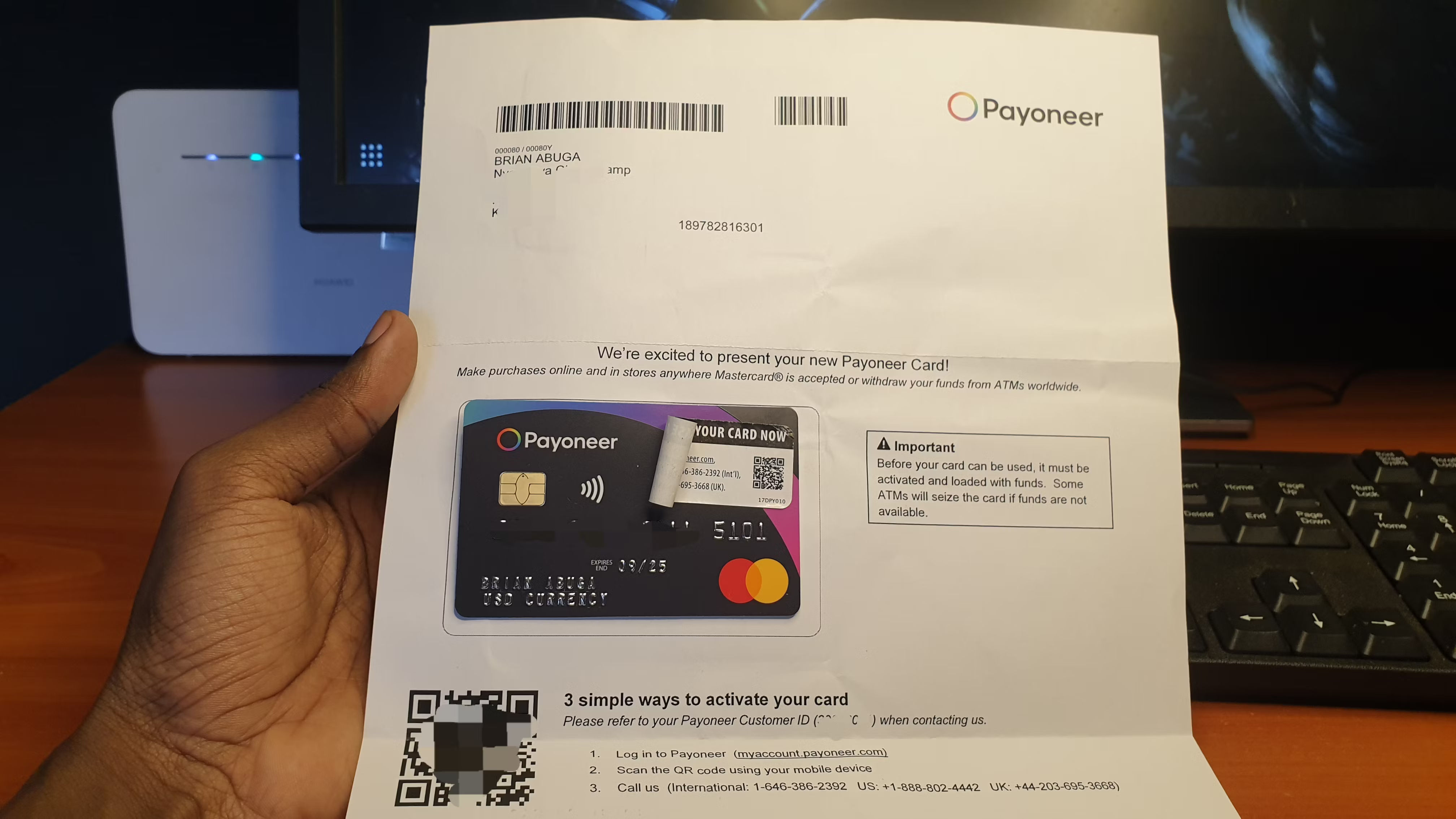

Using the Payoneer MasterCard is another gem available to all account holders. This debit card can be used for online and in-store purchases, as well as for ATM withdrawals. To get the card, you must create a Payoneer account and receive at least $200 into your Payoneer balance.

In terms of transfer speeds, it’s generally quick, with batch payments processed instantly. For example, sending $10,000 from USD to EUR can be completed within a few hours. However, the time it takes to receive payments from a marketplace depends on the marketplace itself, not Payoneer. If you’re expecting a large payment, it’s advisable to contact support in advance to prevent delays due to payment flags.

How much does Payoneer charge?

Using Payoneer comes with certain fees depending on the services you use. While having an account is free, certain transactions come with costs. Here’s a breakdown:

| Category | Service | Fee |

|---|---|---|

| Account Fees | Account Maintenance | No monthly fee. $29.95 inactivity fee if account remains inactive for a year. |

| Receiving Money | From Clients (Bank Transfer) | Free |

| From Marketplaces | Fees are determined by the respective marketplace (e.g., Fiverr, Upwork, Airbnb, Wish). | |

| Sending Money | Payoneer to Payoneer Transfers | Free |

| Sending to Another Account | 2% fee applies when sending money to another person’s bank account. | |

| Withdrawing Money | To a Local Bank Account | $1.50 per transaction. |

| Currency Conversion | Up to 2% above the mid-market exchange rate. | |

| Adding Funds | Credit Card Funding | 3% fee for adding money using a credit card. |

| ACH Bank Debits (US Only) | 1% fee for funding via ACH bank transfer from a US bank account. |

Card Fees Payoneer offers physical and virtual cards, which come with various fees:

- Annual Card Fee: The first card costs $29.95 annually. Additional cards are free.

- Transactions in the Same Currency: Free.

- Transactions with Currency Conversion: Up to 3.5% above the mid-market rate.

- ATM Withdrawals: $3.15 (USD), €2.50 (EUR), or £1.95 (GBP) per withdrawal.

- Balance Inquiry at ATMs: $1.00 (USD), €0.87 (EUR), or £0.65 (GBP).

- Card Replacement: $12.95 (USD), €9.95 (EUR), or £9.95 (GBP).

- Card Delivery Fee: Standard delivery is free, while express delivery via DHL costs $40.

Virtual cards are available at no extra cost, with the same currency conversion fees applied as with physical cards.

Additional Considerations

- Minimum Transaction Requirement: To keep your account active, you need to have at least $2,000 in transactions annually. Failing to meet this threshold could lead to account closure, especially if transactions are flagged as personal payments rather than business-related.

- Card Spending Limits: Payoneer commercial cards have a daily spending limit that can go up to $200,000, making them suitable for high-volume business transactions.

These fees can vary based on location or the specific service being used, so it’s always wise to check Payoneer’s website for the latest information.

Does Payoneer have a Mobile App?

Yes, Payoneer provides a mobile app for both Android and iPhone users, making it easy to manage your account on the go. This app is especially useful for business customers who need to stay on top of their financial activities without relying on a desktop.

Key Features of the Mobile App:

| Feature | Description |

|---|---|

| Account Management | Monitor payments, make payments, withdraw funds, request payments, and manage currencies. |

| Balance and Transaction Tracking | Instantly check currency and card balances, review transaction history, and track available funds. |

| Card Management | Order, activate, and manage Payoneer Prepaid Mastercards®, with real-time updates via push notifications. |

| Sharing Receiving Account Details | Share account details with clients through platforms like WhatsApp, Outlook, or Messenger. |

| Notifications | Receive immediate alerts for transactions, special offers, and other account activities. |

| Secure Access | Login securely with Face ID or Touch ID, depending on your device. |

| Referral Program | Refer friends to Payoneer and earn rewards through the app. |

| Customer Support | Create and send support tickets directly to Payoneer’s Customer Care team through the app. |

The Payoneer app is available in over 20 languages, making it a versatile tool to manage your global payments anywhere, anytime.

Is Payoneer safe and regulated?

When it comes to safety, Payoneer takes security seriously. It’s regulated under an e-money license in the European Union and holds various licenses across the United States. This means Payoneer is treated with the same level of scrutiny as any traditional bank.

Some of which include:

- Transaction Verification: Every transaction is closely monitored. For large transfers or transactions involving new contacts, Payoneer staff manually verify the details before processing.

- Bank Account Matching: Before you can withdraw funds to a bank account, Payoneer ensures that the name on the bank account matches exactly with the name on the Payoneer account. This helps prevent unauthorized withdrawals.

- Transfer Reason: Whenever you send money from your Payoneer account to another Payoneer user, you must clearly state the purpose of the transfer. This adds an extra layer of transparency and security.

- Immediate Notifications: As soon as you request to send funds, Payoneer sends an email notification to the account owner. This immediate alert allows you to act quickly if the transaction wasn’t authorized.

- Customer Support: Payoneer provides round-the-clock customer support. You can reach them via phone, email, or live chat, ensuring help is available whenever you need it.

Outside of this, there are more security measures put in place:

2-Step Verification: This adds an extra layer of protection by requiring a verification code sent to your phone before certain actions can be completed on your account.

CAPTCHA Requests: To prevent automated attacks, Payoneer uses CAPTCHA tests to ensure that actions on the website are performed by real users, not bots.

RSA Adaptive Authentication: This system assesses the risk of a transaction based on factors like location and device. If something seems off, additional authentication steps may be required.

Account Takeover Prevention: Payoneer monitors for unusual activity, such as sudden changes in account settings or login attempts from unfamiliar locations, to protect against unauthorized access.

Risk Model and Behavior Profiling: By analyzing user behavior, Payoneer can quickly identify and respond to potential security threats, keeping your account safe from fraud.

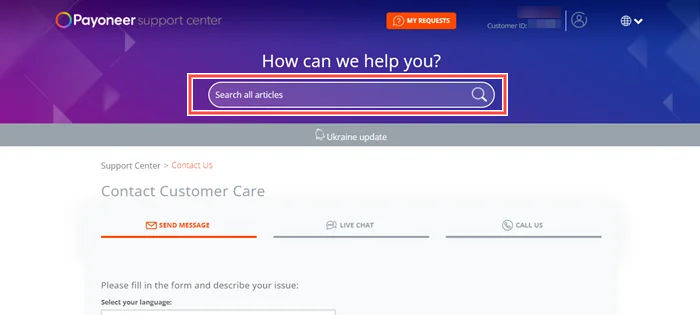

Payoneer Support and Account Management

Payoneer offers various ways to get help when you need it. You can reach out through their website, app, or by phone. While they have a team available to assist you around the clock, the level of support can vary depending on your specific needs.

For general questions or troubleshooting, the online help center is a good starting point. It covers a wide range of topics and can often answer your questions without needing to contact support directly.

If you prefer to talk to someone, Payoneer offers phone and live chat support in different languages. Keep in mind that live chat might involve waiting in a queue, especially during busy times.

For complex issues or large transactions, Payoneer offers dedicated account managers. This service is typically reserved for businesses or high-volume users.

While Payoneer’s support team is generally helpful, remember they focus on technical assistance rather than financial advice. If you need help with investment strategies or economic forecasts, you might want to consult a financial advisor.

While Payoneer’s support team is generally helpful, remember they focus on technical assistance rather than financial advice. If you need help with investment strategies or economic forecasts, you might want to consult a financial advisor.

Payoneer vs. Paypal

Today, Payoneer and PayPal are key players in online payment services. They both allow users to send and receive money but cater to slightly different markets.

Payoneer is often favoured by businesses and professionals who need to handle international transactions, while PayPal is widely used for personal and commercial purposes.

The table below might help you decide which one best suits your needs:

| Feature | Payoneer | PayPal |

|---|---|---|

| Year Established | 2005 | 1998 |

| Active Customers | 4 million | Over 179 million |

| Service Type | Payment solutions for businesses and professionals | Payment processing for online vendors, auction sites, etc. |

| Company Size | Small to medium businesses and freelancers | Large enterprises |

| Transfer Type | Online with phone assistance | Online only |

| Fees | Receiving: FREE / 1% | Receiving: 0.005% + 4-5% above market rate |

| Pricing Model | Quote-based | Monthly payment |

| Convenience | Access funds via MasterCard at ATMs | Withdraw to bank account or use for payments directly |

| Speed | 0 – 3 Days | 0 – 3 Days |

| Regular Payments | Not specified | Not specified |

| Mobile App | Yes | Yes |

| Minimum Transfer Amount | Varies by customer | $0 |

| Travel Debit Card | Yes | No |

| Global Bank Accounts | Yes | No |

| Languages Supported | English, Turkish, Dutch, Polish, Swedish | English |

| Integrations | Custom API integrations available | Integrates with platforms like Shopify, WooCommerce, Magento |

| Features | Single and mass payouts, multi-currency support, escrow payments | Accepts PayPal payments, Visa, MasterCard, American Express, and more |

Bottom Line

As you can see, both Payoneer and PayPal have their strengths and can be the right choice depending on what you’re looking to achieve. Payoneer shines when it comes to international transactions and often has lower fees for receiving payments.

It’s particularly advantageous for larger transactions and cross-border payments. On the other hand, PayPal offers a user-friendly experience with broad acceptance and integration options for various e-commerce platforms.

Payoneer is beneficial if you need to access funds quickly through a debit card or handle transactions in different currencies. PayPal, however, is convenient for straightforward transactions and is widely accepted across various online platforms.

If you’re deciding between the two, consider your specific needs regarding transaction volume, international accessibility, and integration with other services.

Other Alternatives to Payoneer

If Payoneer does not cut it for you, you might want to consider these options:

- Crypto: You guessed right! Cryptocurrency platforms like Bitcoin, Ethereum, and Litecoin offer secure, decentralized solutions for global money transfers.

Other notable contenders include:

- World Remit: A versatile option for international transfers.

- Grey Finance: Known for its user-friendly interface and efficient services.

- Flutterwave: A robust platform supporting various payment methods.

- Geegpay: Offers flexible payment solutions.

- ChipperCash: A popular choice in Africa for cross-border payments.

- Stripe: Ideal for online businesses with comprehensive payment processing tools.

- Wise: Known for transparent fees and competitive exchange rates.

- Cleva: Provides innovative financial solutions for businesses and individuals.

Stay in the loop for our upcoming reviews where we’ll dive deeper into these alternatives.

Conclusion

Choosing the right service for your business depends on factors like cost, convenience, and how well it aligns with your needs. Payoneer has steadily gained popularity, particularly among freelancers and professionals working globally.

With its broad reach, Payoneer allows seamless international transactions, making it a reliable option for those in regions where other payment services like PayPal aren’t available.

Its prepaid Mastercard, virtual bank accounts, and other financial tools have made it a preferred choice for many.

This service not only provides access to global markets but also ensures you can withdraw funds easily, no matter where you are in the world. A strong choice if you ask me!

Based on this review, would you recommend Payoneer?

Our community is the best way to stay informed on the latest exchange rates. Join us here.

FAQs

What does Payoneer charge monthly? Payoneer does not have monthly fees or charges for sending money between Payoneer balances. For ACH bank credit payments, the fee is 1%. Credit card payments incur a fee of 3%.

Is it safe to keep money with Payoneer? Yes, Payoneer is a well-regulated platform with the necessary licenses in the countries where it operates, functioning similarly to a traditional bank. It is monitored by governmental institutions and uses advanced cybersecurity measures, including RSA adaptive authentication, to protect your funds.

How do credit card transaction fees with Payoneer compare to PayPal? PayPal charges a fee of 2.9% plus a fixed fee of $0.30 per credit card transaction. Payoneer has a simpler fee structure with a 3% charge for credit card payments.

Does Payoneer have an affiliate program? Yes, Payoneer offers an affiliate program. You can earn commissions by sharing unique registration links on your website, blog, or social media. You receive payment for every new customer who signs up using your link.

How much does registration cost? Registration with Payoneer is free. There are no fees associated with signing up.

How long does the registration process take? The registration process is quick. It takes just a few minutes to complete the forms, and your account should be activated within up to 48 hours. The entire process can be done online.

Who would benefit from having an account with Payoneer? Payoneer is especially useful for freelancers, entrepreneurs, startup founders, frequent travelers, and those who shop online. Its features cater well to these groups.

Are there any fees for internal transactions? Internal transactions between Payoneer accounts are free.

How can I get a Payoneer card, and what does it cost? You can apply for a Payoneer card through your account. The card itself is free, but there is an annual fee of $29.95 for card service.

What is the typical application review and approval time? The review and approval process usually takes 2-7 business days. Payoneer reviews each application to verify identity, banking information, and other details. The exact time may vary depending on the completeness of your application and any additional verification needed.