Josh, who loves trading, comes across the term Securities Exchange Commission in related news. He wonders what the agency does. Soon, he discovers that there’s SEC in many countries across the globe. This further spurs his curiosity.

He wants to know how this agency may affect trading values and opportunities.

If you’re in the same shoes as Josh, you should continue reading. This Monierate article seeks to

What Is the Securities Exchange Commission (SEC)?

The Securities Exchange Commission (SEC) is generally a monitoring and regulatory body. To be specific, the institution fosters control, standardization, and development in a capital market.

Most countries around the globe have “SEC”, including Nigeria. For a few others, however, the same agency is known by another name.

Security and Exchange Commissions are an important regulatory faculty. They work individually to set and create the best capital markets in their local countries, Also, they may work as an international group, setting a global scope.

History of SEC Nigeria

Creation of the Capital Issues Committee

SEC Nigeria is the industry name of the local Securities Exchange Commission. The agency’s becoming began in 1962. In that year, the Capital Issues Committee was unofficially created.

The Committee operated under the Central Bank of Nigeria (CBN). Its purpose was to sort out the ongoing struggles in the capital market. Precisely, this involved prompt clearance of applications coming from companies.

CBN received humongous amounts of applications to raise capital from the capital market. However, with the Capital Issues Committee present, this problem was well addressed.

Creation of the Capital Issues Commission

Time went on and the country’s economic activities grew. Growth of such nature always creates a wind of change. In this case, it was the need for a legal and legitimate institution to handle the applications. The outcome was the establishment of the Capital Issues Commission in March 1973.

A total of nine members made up the new commission. A chairman was chosen from the apex bank, CBN. Eight other people from different national sectors joined him.

This team carried on their duties for over six years. In 1979, a Financial System Review Committee recognized the increased activities of the capital market. It, therefore, moved to enhance the capability of the existing Capital Issues Commission.

And guess what the review committee proposed?

Transforming into SEC Nigeria

Exactly as you would think. First was the creation of the Securities Exchange Commission through Decree 71. Second, the commission could determine the prices of issues and plan securities allotment.

An outstanding difference between the SEC and previously established commissions existed. That was the disjointment of the latest commission from the central bank. In essence, SEC Nigeria was allowed to operate as an independent body.

The new agency took off operations on January 1, 1980. It had 51 staff and sported a 12-man board to oversee things. Like before, the board chairman came from the CBN. Other members came from institutions such as the Nigeria Stock Exchange, the Ministry of Finance, and the Ministry of Trade and Industries.

Joining the IOSCO

In June 1985, SEC Nigeria became a part of the IOSCO. This stands for the International Organization of Securities Commissions. It is a body of Security Exchange Commissions worldwide.

The IOSCO have a goal of standardizing and cooperating on the development and adherence of securities market regulation.

SEC Nigeria gained an Appendix ‘A’ Signatory to the IOSCO MMOU in 2006. Through this membership, the agency continues to measure its standards against those of the international body. It, however, does so with an understanding of the uniqueness of the local market.

The ISA and Even Greater Powers for the SEC

A series of legislative decisions were executed nine years after SEC was formed. One, Decree No. 7 of 1979 was changed to Decree No. 29 of 1988. Two, a team of seven conducted an investigation of the existing capital market.

Their goal was to understand the intricacies of this market. Once achieved, they made recommendations that spurred “The Investment and Securities Act No. 45 of 1999”. This act was published on May 26 of the same year.

The ISA did well in expressing the SEC’s powers and potential. As a result, it was reviewed, amended, and passed into law in 2007.

Functions of the Securities Exchange Commission in Nigeria?

The responsibilities of the Securities and Exchange Commission are enormous. It might not look so at first sight but it always does later. This section elaborates on the broad and narrow functions of SEC Nigeria.

Creating Fair Markets:

The Securities Exchange Commission in Nigeria has the responsibility of creating fair markets. One of the ways in which it ensures this is through monitoring.

SEC monitors market participants. It checks to ensure that only suitable candidates are permitted to conduct activities.

Enforcement:

SEC essentially has the power to ban a market participant. It could be a market user or a market maker - it doesn’t matter. Also, they have the power to restrict the degree of participation of one or more participants.

The enforcement ability of SEC further goes on to cover assets, software, and other kinds of entities.

Capital Formation:

Market systems basically rely on the provision and availability of capital. As such, the Securities Exchange Commission in Nigeria facilitates easy access to capital formation opportunities. The agency scrutinizes providers of stocks and bonds and equally keeps an eye out for fairness of processes.

Securities Market Regulation:

From banning crypto trading to defining the powers of market actors, SEC leads market regulation. It oversees the implementation of beneficial rules. It also investigates the impact of existing regulations and may forecast likely future changes.

Generally, the Nigerian SEC architects the regulatory landscape of capital markets.

Ensuring Corporate Disclosure:

Corporate disclosure involves the release of sensitive information by a corporate body. This is often required during a court case or legal investigation. However, financial institutions sometimes refuse to give out relevant information when necessary.

It is, therefore, the work of the Securities Exchange Commission to ensure adherence.

This is no easy task. The SEC will first have to analyze the surrounding situation. Next, it would make a decision and have to follow up with the involved parties.

We should mention one thing here. A company’s refusal to disclose information does not automatically imply that it is involved in a crime. Yes, information from corporate disclosures could implicate a company or its partners. Nevertheless, that is not always the case.

Corporate disclosures may conflict with data and privacy policies, creating a challenge.

Protect Investors:

SEC lives for investors. The agency generally works to assure the safety of asset buyers. How it achieves this is by banning fraudulent actors and suspicious activities. As discussed above, it also comes up with favorable and protective policies.

Quick Actions on the SEC Nigeria Website

SEC Nigeria website offers some useful features for users to take advantage of. Below, we reveal what these are and the quick actions you can make with them.

Check if an Investment Entity is Registered:

You can make a quick search on an investment entity using the SEC website. Using this link, you’d find a search field where you can input the name of a person or company. The result will tell if such entity is registered to do investment business in Nigeria.

Check if you have any Unclaimed Dividends:

Unclaimed dividends are becoming a concern within the local capital market. As a result, the SEC website allows users to easily discover theirs. You can click on this link, and input your first and last names to search.

Further instructions are available below the search button. This tells users what to do if their names appear in the search.

Request for an Interpretation of a Law, Code, Rule, or Guideline:

This feature means no more misinterpretation of regulations passed by the agency. Users who need help understanding a law, code, rule, or guideline are welcome to use it.

How to use it? Simply click on this link and fill out the Interpretive Guidance Notes (IGN) form. This form contains space for your questions and comments. Ensure you read the Scope of the IGN and other content available on the page before making an inquiry.

Organogram of Nigeria’s Security and Exchange Commission

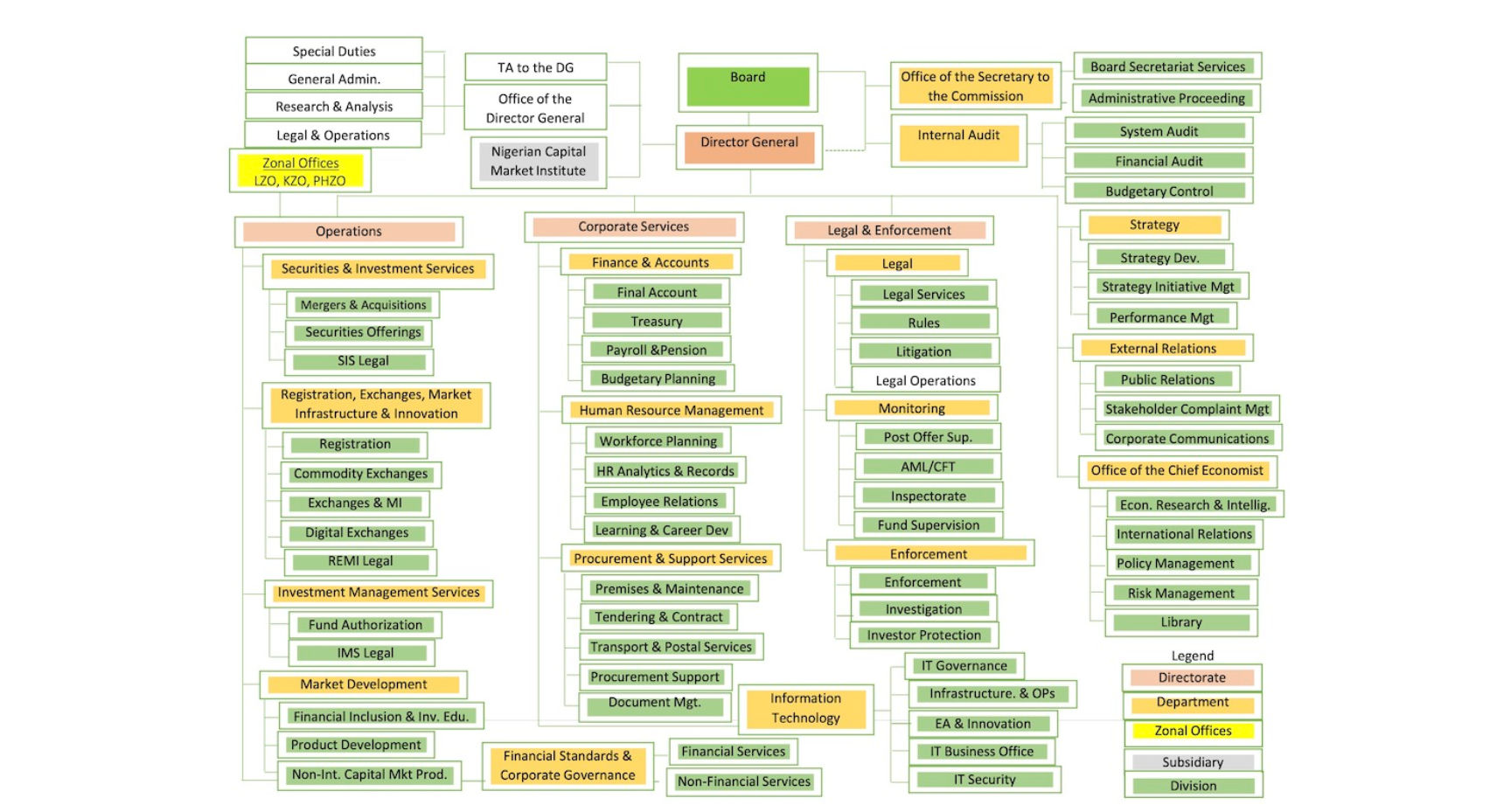

SEC Nigeria as it is called, has an impressive organizational structure. At the top of this hierarchy is the SEC board and the Director General’s office. Assisting alongside, you got the Office of the Secretary to the Commission and the Internal Audit office.

There’s also the leadership of both the SEC zonal offices and the Nigeria Capital Market Institute.

The above-mentioned offices all spearhead the activities of four Directorates. These directorates spearhead the activities of Departments. In turn, these Departments govern over several Divisions.

The four available directorates are Operations, Corporate Services, Legal & Enforcement, and Strategy. Five departments exist under Operations, Four under Corporate Services, Three under Legal & Enforcement, and Three directly under the SEC DG’s watch.

From the SEC Nigeria organogram, it is clear that the agency is well structured. This detail is intended to promote the smooth operation of the whole body. It is evident in the active involvement of the SEC.

Recent Regulatory Rulings by SEC Nigeria

Some of the recent regulatory rulings by SEC Nigeria are as follows:

Virtual Asset Service Providers (VASPs) Must Own an Office to Operate Legally:

One of SEC Nigeria’s most recent directives will impact the presence of crypto firms. This is based on a circular released on June 21, 2024.

The new regulation mandates local crypto firms to establish a physical office in the country. To get started, they must complete an application on the SEC ePortal. This application and onboarding falls within the Accelerated Regulatory Incubation Program (ARIP).

All crypto firms are expected to turn in their application within 30 days time. Failure

Delisting the Nigerian Naira from Crypto P2P Trading Platforms:

SEC Nigeria also carried out a controversial action on P2P trading of the Naira.

Just a few months ago, the agency pushed for the delisting of the Nigerian Naira from crypto platforms. It argued that these platforms aid the manipulation of the currency’s value. This came on the heels of the rapid devaluation of the Naira - something many attribute to other factors.

However, despite the controversies, popular P2P trading platforms promptly followed the SEC’s directive. Today, the Naira option is turned off for P2P trading worldwide.

Conclusion

The Securities Exchange Commission Nigeria is a powerful agency. It bears the responsibility of creating a fulfilling capital market for every Nigerian. Besides, it has to make difficult decisions regarding regulation and enforcements. This makes the work of the agency more complex.