In Africa, paying for things online is becoming as natural as buying groceries at the market. Digital payments have surged over the last five years, with transaction volumes increasing by an impressive 37%, according to the 2024 State of Inclusive Instant Payment Systems in Africa (SIIPS) Report released last Friday. This exciting shift has paved the way for innovative solutions like Paystack, an e-commerce platform built in Africa for Africans.

In Africa, paying for things online is becoming as natural as buying groceries at the market. Digital payments have surged over the last five years, with transaction volumes increasing by an impressive 37%, according to the 2024 State of Inclusive Instant Payment Systems in Africa (SIIPS) Report released last Friday. This exciting shift has paved the way for innovative solutions like Paystack, an e-commerce platform built in Africa for Africans.

Paystack empowers businesses to seamlessly accept payments from anywhere—whether your customer is down the street in Obalende, Lagos, or shopping from across the globe. With over 17,000 businesses processing millions of dollars through Paystack, it’s clear why it’s a popular choice. But is it the right fit for your business? By the end of this review, you’ll have all the details you need—features, fees, security—to decide if Paystack is the perfect payment solution for your online store.

Pros and Cons

Here’s what’s great about Paystack:

- Global reach

- Developer-friendly

- Wide range of payment options

- Detailed reporting and analytics

- It’s available to both registered and unregistered businesses

For the not-so-great:

- Support is inconsistent

- Manual fee offsetting

- Currency conversion limitations

- Higher fees compared to alternatives

- No direct integration with time-management apps like Calendly yet

Understanding Paystack

Paystack makes it easy for businesses in Africa to accept payments from anyone, anywhere in the world. Founded in 2015 by Ezra Olubi and Shola Akinlade, it was created to solve the payment challenges many African businesses faced. Today, Paystack helps businesses grow with simple, reliable payment solutions that work both online and offline.

Who does Paystack cater to?

Paystack primarily serves startups, payroll companies, small businesses, and medium-sized enterprises, whether registered or not. It’s designed to meet the needs of entrepreneurs, established companies, and even individual sellers, making it an ideal choice for businesses at all stages of growth.

Core Services and Features

Paystack provides these essential services:

- Payment Gateway: This is the foundation of Paystack. It allows businesses to securely accept online payments via various methods, including cards, bank transfers, and mobile money.

- Payment Processing: Paystack handles the entire payment process, from securely collecting customer payment information to transferring funds to your business account.

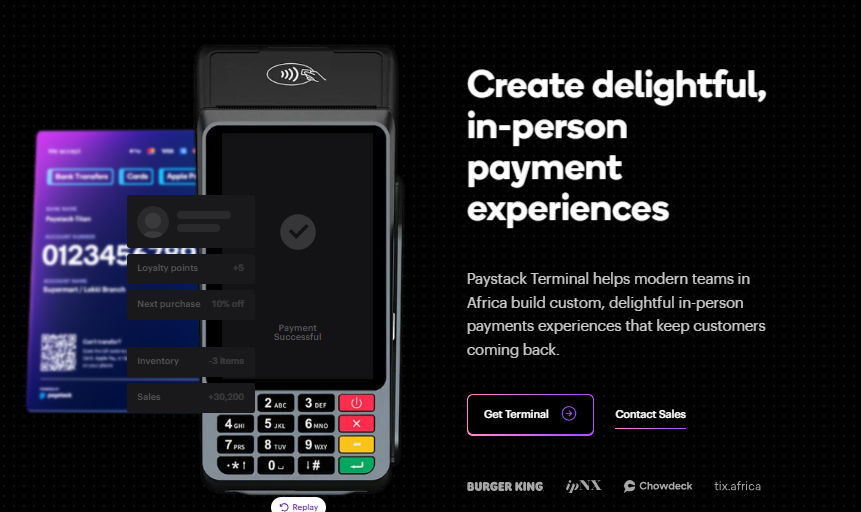

- Offline Payments: Paystack provides flexible solutions for in-person transactions as well. They offer physical POS terminals for businesses that prefer traditional card readers, and their innovative Virtual Terminal allows you to accept payments through QR codes generated on your phone or computer.

Key Features

What makes Paystack stand out are the features that enhance these core services:

- Diverse Payment Channels: From card payments to mobile money to USSD, Paystack supports a wide array of options that cater to how people prefer to pay in Africa. This ensures businesses can reach more customers and reduce abandoned carts.

- Effortless Integration: Developers can connect Paystack to their website and even offline systems with ease. They have plugins for popular platforms like WooCommerce and Shopify and a well-documented API.

- Clear Transaction History and Reporting: Paystack provides a detailed breakdown of every transaction, successful or not. Merchants are also able to gain insights into payment trends, channel performance, and transaction statuses with full transparency.

- Paystack Go: This mobile app has been a lifesaver for users. They can track payments and manage accounts from anywhere, even without an internet connection.

- Bulk Transfers: Paystack allows businesses to send money to multiple recipients at once, simplifying payroll, vendor payments, and other bulk disbursements. This saves time and reduces the hassle of making individual transfers.

- Mobile Money: The Paystack mobile app (Paystack Go) is a fast and convenient option designed to help businesses manage their transactions on the go.

How Paystack works

The good news is: pretty much anyone can set up a Paystack account.

But, here’s the deal. Only businesses that submit an activation request and are subsequently approved will be able to receive online payments.

If you’re not activated yet? You’ll be limited to running test payments—helpful for practice, but not much else.

So, how does Paystack work for businesses? Well, it’s versatile enough to suit just about any setup. The right option depends on how your business operates, the kind of payments you want to accept, your technical skills, and the features you need. Paystack offers user-friendly tools like Payment Pages and Paystack Invoices.

- Paystack Invoices lets you create professional invoices and send them to customers. Once they get it, they can pay you directly—no need for them to sign up for anything.

- Payment Pages work similarly but are even simpler. You create a custom URL, send it to your customers, and they can pay through the page. Perfect for freelancers and small businesses that don’t have a website yet.

But if you already have a website, you can use Paystack plugins for platforms like WordPress, Shopify, or Magento. These make it easy to start accepting payments without building a payment system from scratch.

For custom setups, developers can use Paystack Studio, which includes APIs and SDKs, to integrate and fully customize how Paystack works for their business.

Accepting Payments

Your customers can pay with any of the payment options that Paystack supports:

- Cards: Visa, Mastercard, and American Express

- Bank Transfers: Direct bank transfers from various Nigerian banks

- Mobile Money: MTN MoMo, PocketApp, Vodafone Cash, AirtelTigo Money, and M-PESA (depending on the country)

- USSD

- Scan-to-pay using Visa QR codes

Receiving Funds

Paystack allows you to accept payments from anywhere in the world, but you’ll need to request this feature and provide business registration details. Funds are settled in Naira based on your bank’s exchange rate.

You can also choose to manually withdraw funds to your bank account or opt for automatic

next-day payouts on weekdays.

Getting Started

It’s as easy as 1, 2, 3!

- Head over to the Paystack website and sign up for free.

- Provide the necessary information to activate your account and start accepting live payments.

- Select the option that best fits your business (payment pages, invoices, plugins, or API).

And that’s it on using Paystack in a nutshell. It simple to use, has tons of options, and is built for businesses of all shapes and sizes.

Paystack Fees

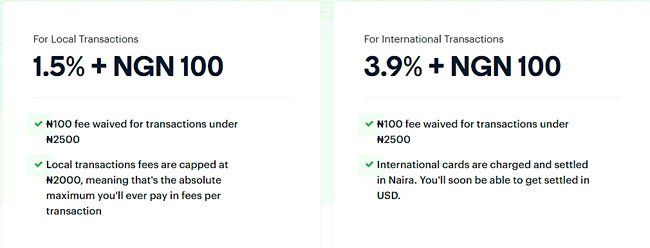

Setting up a Paystack account is free. You only pay when you start receiving payments. The fees depend on your customer’s location.

For local transactions, Paystack charges 1.5% of the transaction amount plus ₦100. Transactions under ₦2,500 are exempt from the flat fee, and fees are capped at ₦2,000, even for large amounts.

International transactions cost 3.9% plus ₦100, with the same ₦2,500 exemption for the flat fee. However, Paystack caps the fee at ₦2,000.

The pricing model has one major advantage: you can offset fees by adjusting your product prices. But, Paystack doesn’t support automatic fee offsetting, so you’ll need to manually add the applicable fees to each product price. While a bit of a hassle, it’s worth considering to save on costs.

Check their website for a detailed information on pricing

Security

To answer the burning question of if Paystack is secure, the answer is a solid yes.

As a PCI Service Provider Level 3 payment gateway, it follows the highest standards for protecting your transactions. All data is encrypted over HTTPS, and your card details are protected with AES-256 GCM encryption. Even Paystack can’t access your card info because decryption keys are kept on separate servers.

And to go the extra mile, Paystack uses AI to scan transactions for fraud, blocking risky ones automatically. Plus, businesses in sensitive industries get additional verification. Regular scheduled maintenance ensures everything stays secure, and Paystack Vault lets you store card info securely for faster payments with OTP protection.

Paystack support

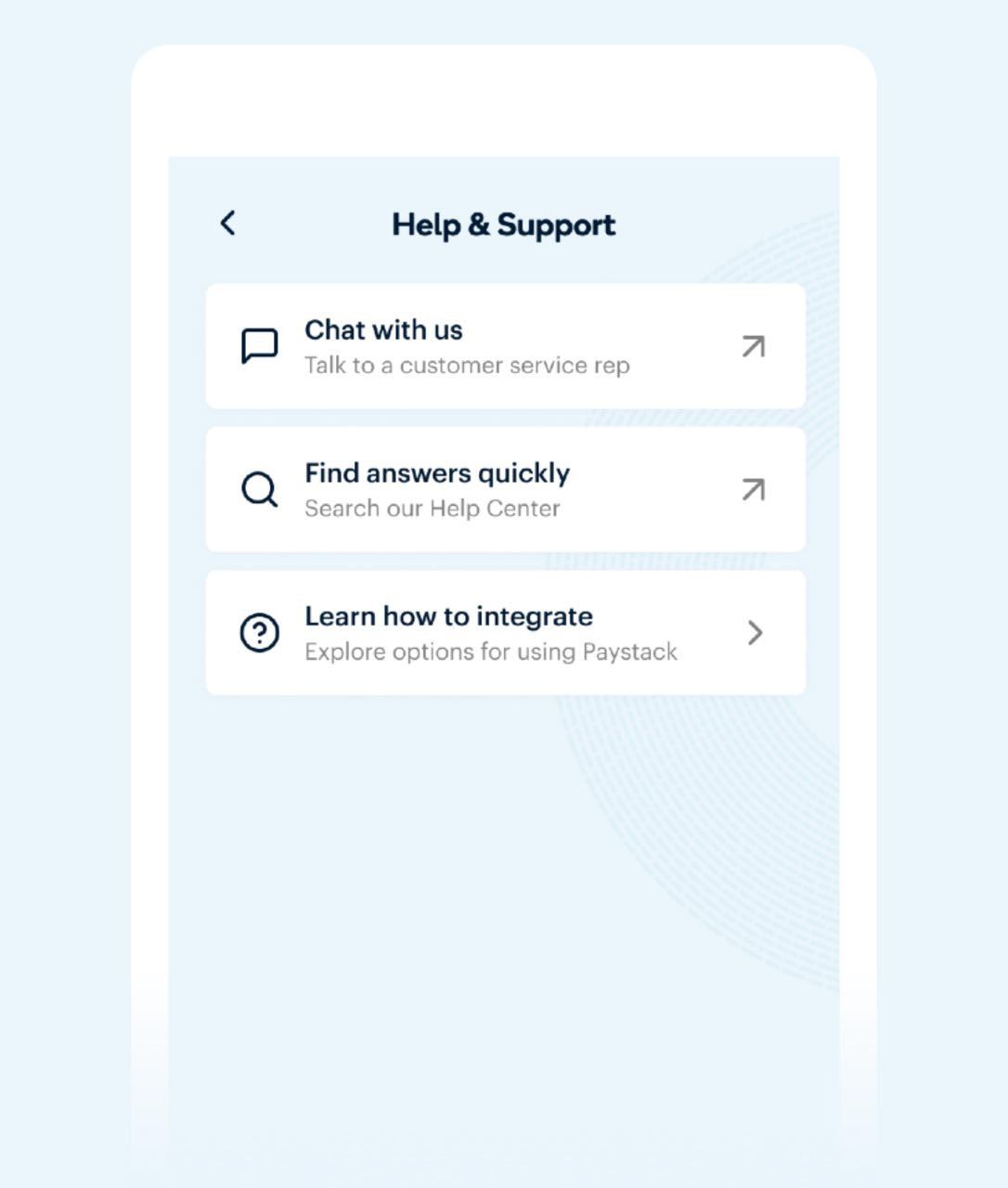

Paystack seems to have a pretty decent support system in place. They’ve got a ton of helpful information on their website, including detailed documentation and user manual. Plus, they’re pretty active on social media, so you can usually get a quick response there, even for minor issues.

But if you need more personalized help, you can always reach out to their support team directly through email (support\@paystack.com) or their contact form.

What users are saying

We’ve been keeping an ear to the ground, and it seems like most folks have good things to say about Paystack. Developers seem to love how easy their API is to use, and everyday users are raving about the smooth checkout experience. But of course, no platform is perfect. Here’s a taste of what people are saying, the good and the not-so-good:

“Paystack’s API is a breeze. Their documentation is so easy to follow, it feels like I’m just copying and pasting into Typescript.” - Dev_umar

“Paystack actually did a madness with Pay-with-PocketApp. Just tried it and wow! It’s so seamless.” - Stephanie

“Nobody is going to make checkout like Paystack mhen.” - ayomide.eth

“Transactions have been failing on Paystack lately, I’ve had 2 failures within 2 weeks.” - Elizabeth Gaskell

The customer support is a mixed bag for most. But firsthand we’ve found that Paystack’s response time depends on when you contact them. If you reach out early in the morning, you’ll usually hear back the same day.

But if you message them later in the day, it might take until the next day to get a response. We reached out to them on a Sunday via X and got a reply in about 20 hours. On a weekday, it was faster. So, it seems like they generally aim to respond within 24 hours, but your mileage may vary.

So, is Paystack the right fit for your business?

If you’re running a business in Africa and you want a payment system that’s reliable and easy to use, then Paystack is definitely worth checking out.

One of the best things about Paystack is that it’s made for Africa. They understand how people like to pay here, so they offer all the popular options like mobile money and bank transfers, alongside the usual card payments.

But keep in mind that no system is perfect. Some users have reported problems with failed transactions, and higher fees and it seems like their customer support can be a bit inconsistent.

At the end of the day, the best way to know if Paystack is right for you is to give it a shot and see if it clicks with your business.

Alternatives to Paystack

Here are a few other payment gateways popular in Africa and beyond:

| Alternative to Paystack | Core Service |

| Flutterwave | A versatile platform with a wide range of payment options, including mobile money and card payments. Strong API support for developers. |

| Monnify | Focuses on bank transfers, cards, and USSD payments. Offers competitive fees and recurring billing. Also provides offline payment solutions through Moniepoint POS terminals. |

| Stripe | Known for its developer-friendly tools and global reach. Supports various payment methods and currencies. |

| Seerbit | Simple platform with fast payment processing and excellent customer support. Accepts local and international payments. |

| Fincra | Specializes in secure and fast card payments in multiple currencies. A reliable option for businesses needing quick settlements. |

Frequently asked questions about Paystack

Q: What do I need to open a Paystack account?

A: Generally, all you need to open a Paystack account is a valid email address and phone number. However, if you’re opening a business account on Paystack, you must have registered your business, especially if it falls into the category of businesses that must be registered.

Q: Is Paystack free to use?

A: Paystack is completely free to use. It only charges a paltry fee on each transaction you make. Aside that, there are no subscription or setup fees.

Q: Can I connect my Calendly account to Paystack?

A: Currently, there’s no direct integration between Paystack and Calendly. However, you can work around this by creating a private Calendly link and providing it to customers after they complete a payment through Paystack.

Q: How does Pay with Pocket work?

A: Customers select “Pay with Bank” on Paystack Checkout, choose PocketApp, and authenticate to complete payment directly through the Pocket app.

Q: Can Paystack handle International Payments?

A: Yes, Paystack supports international payments. You’ll need to request activation and submit your business documents for approval. Payments in foreign currencies are converted to Naira before being sent to your account, with exchange rates depending on your bank.

Q: Which countries are transfers available to?

Transfers are available to all Paystack merchants, including Nigeria, Kenya, South Africa, and Ghana.

Q: What happens if a customer overpays or underpays using a Paystack virtual account?

A: If a customer pays the wrong amount through a virtual account, Paystack automatically refunds the difference. You don’t need to do anything.

Q: How does Paystack’s Direct Debit work?

A: Paystack’s Direct Debit lets businesses charge customers’ bank accounts with their consent. Customers authorize this by creating a mandate, verified through a fund transfer. Once approved, an authorization code allows recurring debits. This service is available to Nigerian businesses via Paystack’s API.

Q: How can I withdraw?

You can either withdraw funds manually or enable next-day automatic payouts. Payouts only happen on weekdays, with a minimum threshold of ₦50 above charges. Transactions from weekends or public holidays roll over to the next working day.