Payday, a financial technology company founded by Favour Ori, is one of those companies making headlines since it launched in 2021. Having raised $5.1M to date, the company has a user base of over 700,000 users, and growing at a user rate of 4000+ new users per day.

In this in-depth article, we will explore the innovative business model behind this growing fintech company and discuss how their innovative product approach to global payments has garnered widespread adoption and trust among young Africans.

We will explore what Payday is about, its mission statement, how it makes money, and who owns it. Additionally, we will consider details like competition, its strengths, weaknesses, opportunities, and threats surrounding the company.

Payday Business Review

Payday product offerings

Payday is a fintech platform that offers global payment solutions. Some of its product offerings include foreign bank accounts, virtual cards, cash transfers, and bill payments.

Who owns Payday?

Payday is a financial technology company founded by Favour Ori in 2021. The company is not owned by a single individual, it is backed by various investors and venture capital firms. Some prominent institutional stakeholders include Techstars, Venture Platforms, Moniepoint, Ingressive Capital and Microtraction. Other individual investors include Olugbenga Agboola, Prosper Otemuyiwa, and Adegoke Olubusi. As a privately held company, ownership is divided among these investors and other shareholders, making it a collaborative and successful venture in the global remittance market.

How much capital has Payday raised?

Payday raised $100,000 from Techstars a few months after its launch in 2021, after which it then raised $1M from a couple of individual investors and venture capital firms. Recently, it raised $3M led by Moniepoint. As of this writing, the company has collectively raised a total of $5.1M.

What is the mission statement of Payday?

As a VC-backed startup, the mission statement of Payday is to facilitate an inclusive, accessible & connected global financial system for Africans no matter where they are. Their objective is to simplify how Africans send & receive money within & beyond Africa.

How does Payday make money

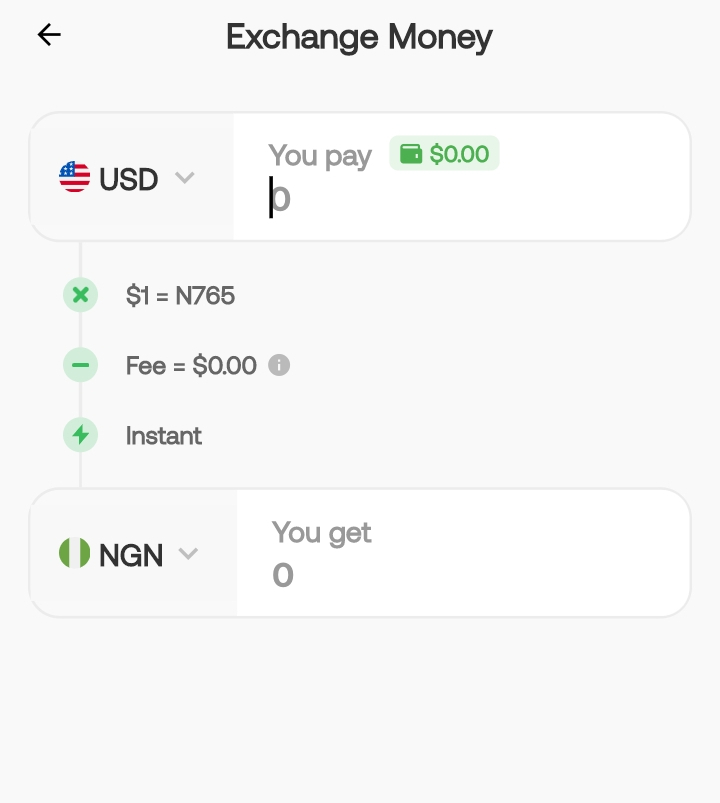

Payday is a financial technology company that specializes in offering cross-border money transfer and payment services. There are two primary ways Payday generates revenue. The first is by charging a small percentage fee on the amount being transferred or exchanged and the second way is from the spread in exchange rates.

The fee Payday charge is considerably lower than traditional banks, which allows Payday to attract about a million customer base seeking affordable global money transfer options. However, the spread in their exchange rates is relatively high.

Per our record, Payday has had one of the highest spreads in exchange rates for the last 3 months compared to other currency exchange platforms.

Which companies are the competitors of Payday?

Payday is a prominent African company in the international money transfer market. Its competitors include prominent financial services providers such as Western Union, MoneyGram, Mpesa, Wise(formerly TransferWise), and Sendwave. Additionally, fintech startups like Chippercash, Eversend, Grey, Wave, and LemFi also pose a competitive threat to Payday as they all aim to simplify and reduce the costs associated with international money transfers for Africans. Furthermore, traditional banks offering cross-border payment services may still be considered competitors, despite the fact that companies like Payday have managed to capitalize on their higher fees and slower processing times.

Payday SWOT analysis

Payday is a company that specializes in providing fast, and secure global payments. A SWOT analysis examines the strengths, weaknesses, opportunities, and threats that the company faces.

Strengths: Payday has gained popularity due to its ease of use and product offerings. The startup has rapidly built a strong reputation for providing global bank accounts and virtual payment cards. The company’s innovative product offerings enable it to meet the payment needs of digital workers. Its expansive customer base and growing presence globally demonstrate customer trust in its services. Additionally, Payday is well-capitalized compared to other competitors with similar founding dates.

Weaknesses: As a new player in the financial sector, Payday still faces challenges in terms of building trust with certain customer groups and regulators. Furthermore, the company’s heavy reliance on technology can be a double-edged sword, as it exposes the company to potential security risks and tech failures (something very common since it exists). Additionally, Paday’s limited product offerings compared to traditional banks could make it less appealing to some customers.

Opportunities: Payday is well-positioned to capture the growing trend of globalization and the consequent increase in cross-border transactions. As people continue to move, work, and conduct business internationally, the demand for affordable, transparent, and rapid global payment services will only increase. Moreover, Paday has the potential to expand its product offerings to attract a wider customer base and compete more effectively with traditional banks and fintech.

Threats: The financial sector is highly regulated, and regulatory changes or increased scrutiny in the countries where Payday operates could potentially impact its business model. Additionally, increased competition from other fintech startups, as well as established banks, could challenge Payday’s market share. Lastly, the company must remain vigilant against potential cyber threats and tech failures that could undermine customer trust and confidence in its services.

Payday displays a strong market presence in Nigeria and enjoys customer trust due to its innovative and easy-to-use global payment platform. However, the company must navigate potential challenges such as regulatory changes, increasing competition, and ensuring the security of its technology. With the right strategies, Payday has significant opportunities for growth and expansion in the evolving global financial landscape.

Conclusion

In conclusion, Payday’s innovative business model has successfully disrupted the traditional money transfer sector by offering its customers a faster, cheaper, and more transparent solution. By utilizing virtual bank accounts and virtual card technology, the company delivers a faster, cheaper and more convenient alternative for Africans to send and receive money across borders compared to most banks. As a result, Payday has not only gained immense popularity among customers but is also one of the leading global remittance apps for Africans boasting 40,000 transactions per day. Though faced with increasing competition and ever-evolving regulations, the company’s commitment to adapting and refining its business model and product offerings puts it in a strong position to maintain its growth trajectory and revolutionize the world of international transactions further.

FAQ

What is Transferwise, and how does it work?

Payday is a Financial Technology company helping Africans send and receive money globally. It works by providing multicurrency accounts (USD, EUR, NGN, KES and more) for Africans to hold and exchange currencies. Payday is growing mostly because of its better product offerings and marketing compared to banks.

How long does it takes for a Transaction to be completed on Payday?

Payday transactions are mostly instant. The company’s unique solution of offering multi-currency wallets makes it easy to convert from one currency to another and then send to a recipient bank/mobile account or fund a virtual card.

What countries can I receive money from?

With Payday, you get to receive money from anywhere in the world.

What countries can I send money to?

Currently, money can only be sent from your Payday account to any local Nigerian bank account and to your MOMO account as a Rwandan.

What are the exchange rates of Payday?

Payday strives to offer the fairest exchange rates. However, at the time of purchasing or selling a foreign currency with your local currency, the rates are always higher than most market rates. You can track the exchange rate of Payday here.

Are there transfer limits when using Payday?

Yes, there are limits on transactions you can make on Payday. The transfer limit for your account is 1m NGN per day, 1m per transaction, $1333 per day and per transaction, and RF 1,000,000 per day.

Are there charges for sending or receiving money into a Payday account?

Yes, depending on the service you want to use, Payday charges a fee. While there are no charges for receiving money into your foreign account, you will be charged a flat fee of 8 GBP / EUR and 0.5% capped at $25 to send out USD from your account. There are also fees for exchanging currencies and creating virtual cards.

Where is Payday located?

On its website, it is stated that the company is headquartered both in Canada & Rwanda. It also has virtual locations in the United States and the United Kingdom.