In Q1 2024, a total of 27 DMBs, 65 MFBs, 20 PSPs. 5 MMOs, 2 PSBs, 3 EFTs, and 15 OFIs reported their fraud data in line with the CBN directive of June 2015. This quarterly activity allows for accurate and complete industry insights.

Below in this article, we analyse the report, pointing out the key takeaways and other relevant information.

DMBs - Deposit Money Banks

MFBs - Microfinance Banks

PSPs - Payment Service Providers

MMOs - Mobile Money Operators

EFTs - Electronic Fund Transfer Services

OFIs - Other Financial Services

Brief on NIBSS

NIBSS is the central system responsible for the settlement of inter-bank transactions within Nigeria. Known as the Nigeria Inter-bank Settlement System, this platform connects Deposit Money Banks (DMBs), Mobile Money Operators (MMOs), Switches, and Payment Service Providers (PSPs).

You can find more details about NIBSS in this previously published Monierate article.

About the NIBSS Fraud Report

The NIBSS Fraud Report is a documentation on fraud activities (whether attempted or successful) and related metrics identified by local financial institutions or agencies. These financial entities report through the NIBSS fraud portal.

The NIBSS Industry Fraud Desk makes a compilation of all reported fraud incidents within a quarter period, analysing them, and delivering the industry-wide report which we detail below.

NIBSS Q1 2024 Report

Compared to the first quarter of last year (2023), there was a significant decrease in fraud counts this year (2024). The figures went down from 27,555 to 20,638.

Additionally, the total amount of losses recorded also fell significantly. In Q1 of this year, this value was 3.007 billion naira whereas it was 5.06 billion naira in Q1 of last year.

More details about the report are in the next section.

Key Takeaways from the NIBSS Q1 2024 Report of Fraud in Nigeria

Key takeaways from the NIBSS Q1 2024 fraud report are as follows:

State with the Highest Fraud Event:

The highest occurrence of fraud happened in Lagos State. This region, precisely, accounted for about 57% of the country’s fraud cases and about 55% of the total loss value recorded in the period, Q1 2024.

Month with the Highest Fraud Event:

Fraud in Nigeria was highest in February both in terms of fraud count and actual loss recorded. The fraud count was 7,243 while the loss amounted to N1.047billion.

Most Used Fraud Technique:

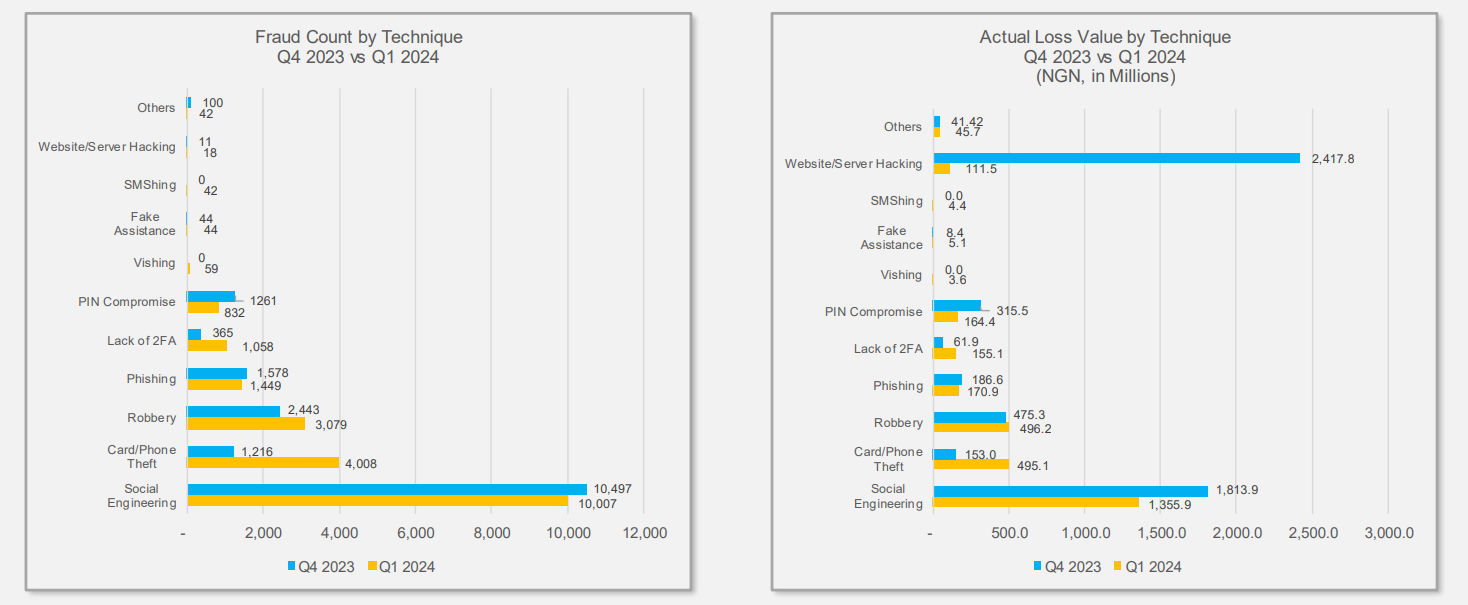

NIBSS confirms that there is a change in the popularity of fraud techniques. For Q1 2024, the most used fraud technique was Social Engineering. This method involves hackers manipulating individuals or employees to divulge information, allowing them unauthorized access to bank accounts, or business products and solutions.

Despite increasing by 10% in the count, Social Engineering resulted in a 59% lesser loss this year compared to Q4 2023.

Most Used Channel of Fraud:

On fraud channels, the NIBSS realized that criminals are making more use of mobile phones compared to others.

A 19% increase in usage between Q4 2023 and Q1 2024 confirms this.

Most Used Method of Utilizing Fraud:

Criminals are changing the way they utilize fraud proceeds. The recently popular option is through withdrawals, according to NIBSS’ findings.

This method increased in count by 10% but at the same time, the value of funds retrieved was down by 59%.

More Details on Fraud in Nigeria

Fraud methods identified by the Nigeria Inter-Bank Settlement System (NIBSS) are Social Engineering, Card Theft, Robbery, Phone Theft, and Phishing. Occurrences of these different forms of fraud increased between the last quarter of 2023 and the first quarter of 2024. The reported incidents went from 17,515 to 20,638, representing a 17% rise.

But guess what?

Despite the increase in incidents, the new year came with fewer people attempting fraud and lesser value of actual fraud loss. Good for the industry, we would say.

Fraud Channels Identified by the NIBSS

The NIBSS report on fraud in Nigeria identifies a total of six channels exploited by financial criminals. These channels are mobile, web, Point-of-Sale (POS), e-commerce, internet banking, and ATM.

By the statistics, fraudsters majorly abused the mobile phone, web, and POS channels - in descending order. This was the pattern in Q3 2023. The same pattern also remerged in Q1 2024, but with a greater fraud count than in the previous quarter.

The next highest channel of fraud was Internet banking. This channel turned out to have a higher fraud count in Q4 2023 than in Q1 2024 - unlike all the other channels.

Talking about other channels, e-commerce appears to be one of the least exploited. Even though the fraud count more than doubled from 318 to 860, online commerce systems are shielded from most of the dangers of a cyber scam.

It is relevant to point out the need for vigilance from users and providers of services within these three channels.

Loss Value Recorded for Each Fraud Channel

In Q3 2023, e-commerce fraud resulted in a significant loss of 2,445.6 million naira.

Every other channel (mobile, POS, web, internet banking, and across the counter) recorded much lesser fraud losses of 1,034.5 million and below. Interestingly, the least exploited channel was over-the-counter. Losses recorded here were a mere 12.1 million in Q1 2023.

This result may point to the efficiency of human intervention over machines or technology in improving security.

In Q1 2024, fraud losses were down to between 1,286.7 million and 38.4 million. The least loss was recorded from the over-the-counter channel and the highest loss was recorded from the mobile channel.

Summary of the NIBSS Q1 2024 Report

Page 15 of the NIBSS Q1 2024 Report identifies that 17,618 unique individuals were defrauded. Out of these figures, about 62% were male victims and over 72% of the entire number were people aged 30 years and above.

The above data implies that Nigerian males who are over the age of 30 must take extra care when conducting financial transactions. Their use of banking services or technologies and their dependence on agents must be done cautiously.

Moreover, the NIBSS advises individuals and businesses to watch out for phishing attacks, phone and card theft, and social engineering. A range of techniques could be applied here; including 2FA or MFA, email authentication, digital controls, and user education.