The following summary comes from a release titled the Investment Case for Bitcoin Report. The well-articulated document is the work of the ETC Group.

If you’re reading this, you probably have a keen interest in the finance market - like we do. This means market trends, policies, and of course, traditional and digital currencies. And talking about cryptocurrencies, this article brings you an interesting summary of the Investment Case for Bitcoin Report.

Want a depth exploration of Bitcoin as an investment mechanism? You should read this article till the end.

Authors of the Investment Case for Bitcoin Report

The below summary comes from a release titled the Investment Case for Bitcoin Report. The well-articulated document is the work of the ETC Group.

ETC stands for Exchange Traded Cryptocurrencies. The ETC Group has interest in traditional and digital financial services and works to strengthen the interrelationship of both worlds. Just a year after its establishment in 2019, it launched the world’s first centrally cleared bitcoin ETF on Europe’s largest reading venue, Deutsche Borse XETRA.

Furthermore, in 2023, the ETC Group initiated a crypto basket ETP on an MSCI digital asset index. The company continues to lead innovation at the crossroads of crypto and traditional finance.

What is Bitcoin?

There would be no Bitcoin report if there were no Bitcoin. So we must begin this article with a rundown of what Bitcoin is.

Bitcoin is the first-ever cryptocurrency. It was developed many years ago in 2008, by an individual known by the pseudonym of Satoshi Nakamoto. The true identity of the Bitcoin creator is hidden but the same cannot be said of his invention.

The asset, Bitcoin, brought the terms cryptocurrency, blockchain, and digital assets to life. Although many systems representing/utilizing digital currency and cryptography already existed such as DigiCash and Liberty Reserve, none other have experienced a successful implementation or adoption as Bitcoin.

Properties that Make Bitcoin a Notable Investment Option

The Investment Case Report for Bitcoin begins with an executive summary. This forms the basis from which this section of our article was derived.

Scarcity

Like any typical financial instrument, Bitcoin is scarce. The scarcity factor ensures that the asset maintains value. It is the same thing that happens with governments controlling the printing of money and limiting the amount in circulation.

But Bitcoin’s scarcity is human influenced. Mechanisms like halving and proof-of-work consensus instead control availability and supply, taking it out of the hands of a central bank or any government or financial institution that could manipulate the system out of ignorance or for profit.

So, unlike traditional money that can be made scarce or abundant by a controlling body, Bitcoin is on a one-way path to perpetual scarcity. This is particularly thanks to the halving event.

The blockchain upon which Bitcoin operates comes forged with a mechanism called “halving”. This slashes the amount of Bitcoin that is released (through mining) into the crypto market by half. The halving happens every four years and will only end when 21 million asset units have been mined.

In the words of the ETC’s report, “The Halving event is essentially a supply shock to the system.”

Security

Bitcoin security is portrayed by the high level development attained within its blockchain network. Compared to other cryptocurrency assets, there are “more than 18k full nodes which validate transactions based on the common consensus rules of the Bitcoin algorithm.”

Besides, the concern of hacking the Bitcoin network is minimal for several reasons. One is that bitcoin miners themselves utilize some of the most advanced computational systems, which is what a hack of such nature would require.

Potential

The investment case report highlights the market resilience and incremental adoption which has accompanied Bitcoin since its inception. The acceptance Bitcoin has received - with certain countries considering it to be legal tender, its increasing use cases, and the fact that it stands clear of political and institutional manipulation have great influence on investors and the financial markets.

This creates enormous potential for the cryptocurrency, especially when compared to contemporary investment options.

How Bitcoin Stands Out from Traditional Financial Instruments

An important table of facts from the report showed how Bitcoin performs in several metrics. The key asset scored green in all of the seven aspects considered, beating major market alternatives like gold and fiats like USD, EUR, and GBP.

Below is a screenshot taken from the report.

Impeccable right?

The above comparison spells out Bitcoin’s superior adaptability and usability. “In other words, Bitcoin offers a combination of so-called spatial transferability (across space) and temporal transferability (across time).” It beats gold since it is not location dependent and it beats fiats since it is does not possess counterparty risks and is not control by any central authority.

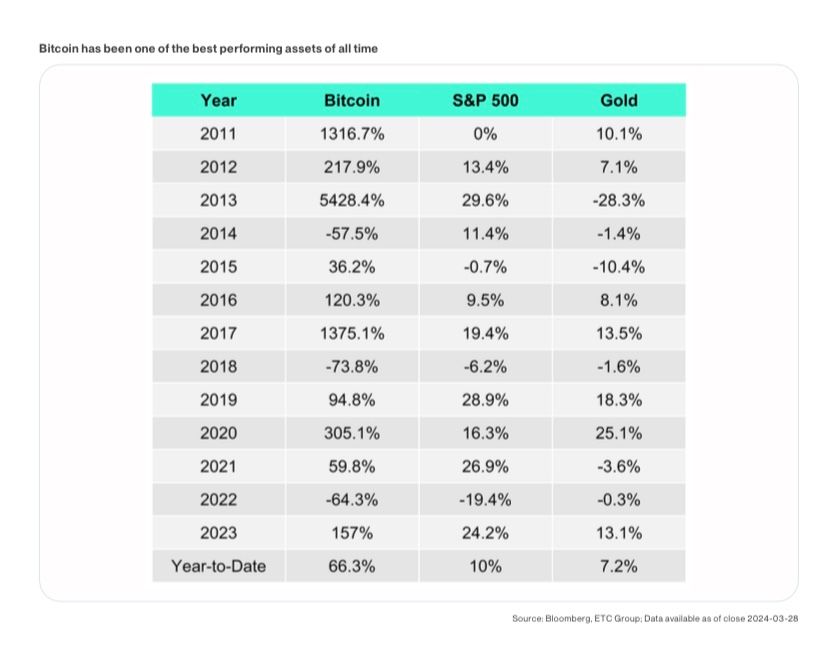

The Investment Case for Bitcoin

At page 29, we reach the nitty gritty of the report, being actual information on the investment case for Bitcoin. This section opens readers up to the lifetime performance of Bitcoin in the financial market. It doesn’t take long for anyone to notice that the key asset has maintained a high, attractive output that outpaces US equities and gold for more than 10years.

Here, see for yourself:

On Whether Bitcoin is an Inflation Hedge or Not

The question on whether Bitcoin is an inflation hedge or not has been asked for many years, often by Bitcoin enthusiasts and investors seeking to test the waters. Page 42 of the Investment Case for Bitcoin Report delves into a factual answer.

It reads that the disinflationary supply growth schedule coupled with increasing scarcity makes the Bitcoin asset a suitable hedge against inflation.

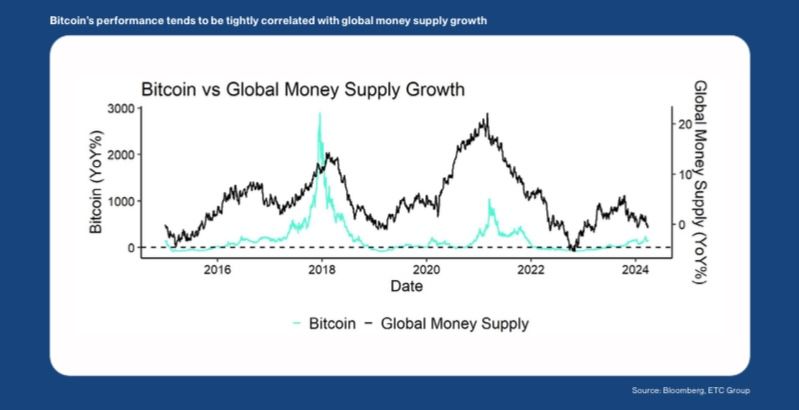

Moreover, while it is impossible to completely tell the future, past and present events prove really helpful for conducting predictions and forecasts. The case in point here is the behavior of Bitcoin in correlation with global money supply.

Let’s explain.

Prior to the covid-19 pandemic, Bitcoin price had nothing to do with the amount of money in circulation worldwide. However, a noticeable change began in 2020 when governments printed large amounts of money for aid and stimulus packages. Coincidentally, the Bitcoin ecosystem witnessed a halving event that same year.

The excess availability of physical cash globally led to an inflation in many economies whereas on the other hand, Bitcoin price and market value was on the increase thanks to the halving.

These opposing events (the global inflation due to increased money printing and the increased stability of Bitcoin due to the halving event) convinced investors of the potential and sturdy characteristics of Bitcoin against inflationary pressures. As a result, investors have since moved to purchase or trade Bitcoin in response to inflation or the expectation of such.

This activity explains Bitcoin’s recent behavior in correlation with global money supply. It also forms the basis for which the digital asset is believed to serve as an inflation hedge.