Chipper Cash accounts have two wallets: NGN and USD. You can send money from either wallet to a bank account in Nigeria. You can send money to a naira bank account or a domiciliary bank account.

Send money to a Naira bank account:

- Open the Chipper Cash app.

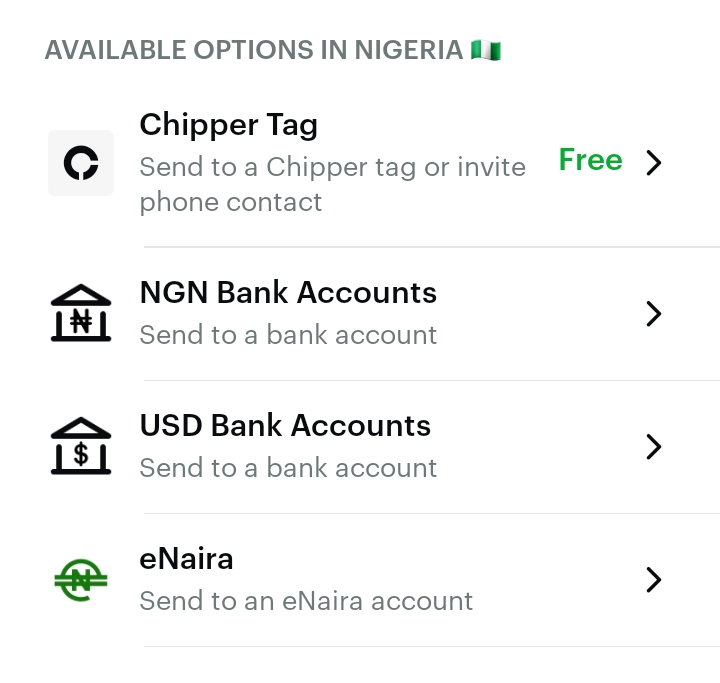

- Tap the “Send” button.

- Choose “NGN Bank Accounts” from the list of options.

- Enter the recipient’s bank account details.

- Enter the amount you want to send.

- Select a reason for the payment, such as “Business expense”.

- Confirm the transaction.

Your money will be sent to the recipient’s Naira bank account.

Send money to a Domicilliary bank account

- Open the Chipper Cash app.

- Tap the “Send” button.

- Choose “USD Bank Accounts” from the list of options.

- Select or enter the recipient’s domicilliary bank account details.

- Enter the amount you want to send.

- Select a reason for the payment, such as “Business expense”.

- Confirm the transaction.

Your money will be sent to the recipient’s USD domicilliary account.

Some tips:

- If you are sending money to a domiciliary account, it is best to send it from your USD wallet.

- Not all domiciliary bank accounts are supported by Chipper Cash. Zenith bank domiciliary account is one of the banks that work well with Chipper Cash.

- Make sure you enter the correct account details. There are no reversals for failed transactions.

FAQ

Are there any fees for sending money to a bank account in Nigeria? There is no fee for sending money to a Naira bank account. But there is a $2 fee for withdrawing money to a USD domiciliary bank account in Nigeria.

How long does it take for the transaction to be successful? Sending money to a Naira bank account is instant. Sending money to a domiciliary account takes up to 48 business hours to be processed.

Can I reversed a mistaken transaction? There are no reversals as long as the transaction as been sent.

Can I send NGN to a USD Dom account? You need to transfer your money from your USD wallet to a USD domiciliary account first.

Hope it helps!