Since the naira was introduced in 1973, replacing the pound as Nigeria’s currency, its value against the dollar has steadily declined, largely due to the priorities of different governments. At first, 1 USD was worth 68 kobo.

As of now, after the Central Bank of Nigeria ceased subsidizing the naira, 1 USD is valued at ₦1,621 at the official rate and ₦1,665 on the black market.

In this article, we’ll explore how Nigerian presidents have shaped the naira’s journey from 1973 to 2024, offering you a clear timeline of events.

The Naira: An Overview

Introduced on January 1, 1973, the Naira symbolized a new era for Nigeria, replacing the British Pound. Initially, it was pegged to the Pound, with an exchange rate of 68 Kobo to 1 US Dollar.

Over time, economic challenges led Nigeria to adopt a more flexible monetary policy, allowing the Naira to float—meaning its value would be determined by the market rather than being fixed.

Despite ongoing economic pressures and devaluation, the Naira remains vital to Nigeria’s economy. The government has pursued various strategies to stabilize the currency, focusing on curbing inflation and attracting foreign investment.

The evolution of Nigeria’s currency is closely linked to its political history and economic policies.

Up next, we’ll explore how Nigeria’s presidents have influenced the Naira’s journey from 1973 to 2024.

Nigeria’s Presidents and the Evolution of the Naira

From pre-colonial trade by barter to the introduction of modern currency, Nigeria’s monetary system has undergone significant changes influenced by colonial rule, military regimes, and modernization efforts.

Pre-colonial Era (Before 1700-1900s)

Before modern currency, Nigeria relied on a barter system with items like cowries and manillas used as money. Cowries, with 40 forming a “string,” 50 strings making a “head,” and 10 heads comprising a “bag,” were common. Manillas, introduced by Europeans, were also used, with 12-15 brass manillas purchasing one slave.

Colonial Era (Early 1900s)

In 1912, the British established the West African Currency Board, introducing paper money in Nigeria. Despite resistance, cowries were phased out by the 1920s. Emergency currency was issued in 1918, but it wasn’t until the 1928-1941 period that higher-quality notes gained acceptance.

General Yakubu Gowon (1966-1975): Introduction of the Naira (1973)

General Yakubu Gowon’s regime aimed to modernize Nigeria’s currency, leading to the introduction of the Naira on January 1, 1973. The Naira replaced the Pound and was initially pegged to it, with denominations including 1, 5, 10, 20, and 50 Kobo, and 1, 5, 10, 20, and 100 Naira. The Naira was introduced at an exchange rate of 68 Kobo to 1 USD.

General Murtala Mohammed (1975-1976): The 20 Naira Note (1977)

In memory of General Murtala Mohammed, who was assassinated in 1976, a Twenty Naira (₦20) note was introduced in 1977. It became the highest denomination and the first Nigerian currency to feature the portrait of a Nigerian, serving as a tribute to the late Head of State.

General Olusegun Obasanjo (1976-1979): New Naira Notes (1979)

Under General Olusegun Obasanjo, in 1979, the Naira notes were redesigned to feature portraits of Nigerian national heroes like Alvan Ikoku, Sir Tafawa Balewa, and Sir Herbert Macaulay. This redesign celebrated Nigeria’s cultural identity and heritage.

Shehu Shagari (1979-1983)

During Shehu Shagari’s presidency, there were no major changes to the Naira. His administration focused more on economic policies like the Green Revolution. However, economic downturns and political instability contributed to the beginning of the Naira’s depreciation.

General Muhammadu Buhari (1983-1985): Re-colouring the Naira (1984)

In 1984, General Muhammadu Buhari’s military administration reissued all Naira notes in different colors, excluding the 50 Kobo note. This move aimed to combat currency trafficking.

General Ibrahim Babangida (1985-1993): Devaluation of the Naira

Under General Ibrahim Babangida, the introduction of the Second-Tier Foreign Exchange Market (SFEM) in 1986 significantly devalued the Naira. This devaluation was part of broader economic reforms aimed at liberalizing Nigeria’s currency exchange system.

General Sani Abacha (1993-1998): Stability Amid Market Pressures

General Sani Abacha’s regime maintained a stable official exchange rate despite significant disparities in the black market rate for the Naira.

Olusegun Obasanjo (1999-2007): The Push for Naira Stability

During Olusegun Obasanjo’s second term, efforts were made to stabilize the Naira by introducing the Interbank Foreign Exchange Market (IFEM) in 1999. Higher-denomination banknotes, including ₦100 in 1999, ₦200 in 2000, ₦500 in 2001, and ₦1000 in 2005, were introduced with advanced security features.

Umaru Musa Yar’Adua (2007-2010)

No significant currency changes occurred during Umaru Musa Yar’Adua’s presidency, as his administration focused on broader economic issues.

Goodluck Jonathan (2010-2015): Efforts to Stabilize the Naira

During Goodluck Jonathan’s presidency, efforts continued to stabilize the Naira amid global oil price fluctuations and domestic challenges.

Muhammadu Buhari (2015-2023): The E-Naira (2021)

President Muhammadu Buhari’s second term saw the launch of Nigeria’s digital currency, the eNaira, in 2021, aimed at promoting financial inclusion. In 2022, the Central Bank of Nigeria (CBN) announced a redesign of the N200, N500, and N1,000 notes to boost security features and manage currency in circulation.

The redesign faced challenges, including difficulties in accessing new currency and protests in the cash-reliant informal sector.

Bola Ahmed Tinubu (2024-present)

As of 2024, Bola Ahmed Tinubu’s administration is focused on addressing Nigeria’s economic challenges and stabilizing the Naira. His policies and their impact on the currency are still unfolding, but efforts are expected to stabilize and strengthen the Naira amidst ongoing economic pressures.

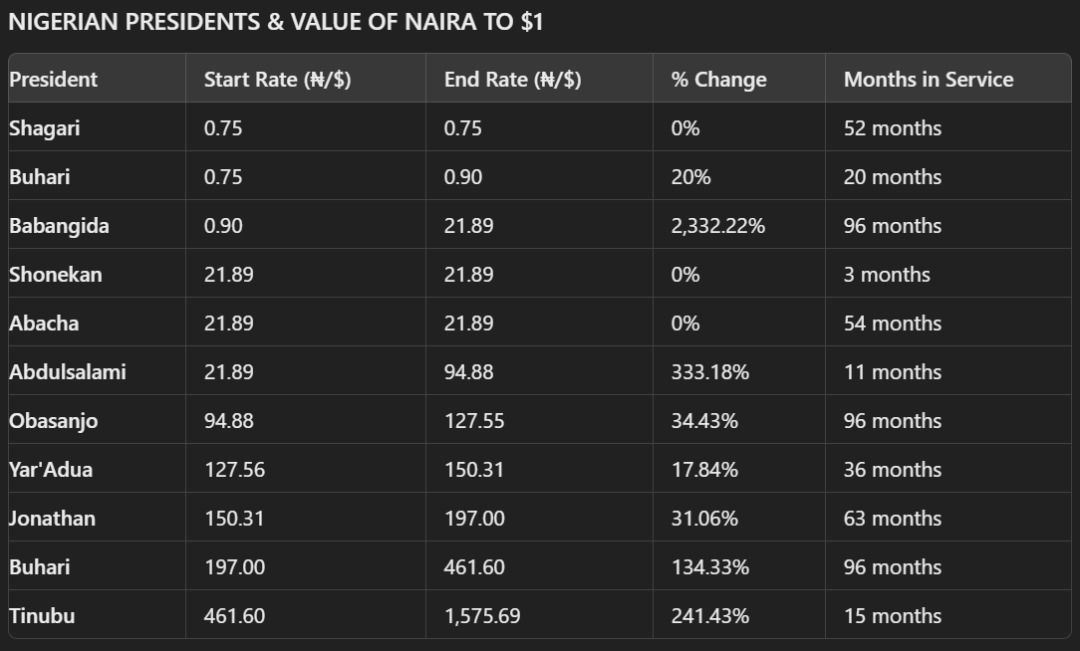

Value of the Naira to the US Dollar (1970 - 2024)

The exchange rate between the Naira and the US Dollar has shifted dramatically since the 1970s, reflecting Nigeria’s changing economy. In the 1970s and early 1980s, the Naira was strong, trading at about 90 kobo to $1, thanks to Nigeria’s oil boom. This made the Naira one of the strongest currencies in Africa at the time.

However, the economic downturn and political instability that followed led to significant depreciation. During General Ibrahim Babangida’s regime (1985–1993), the Naira plummeted from 89 kobo to $1 to as much as ₦17 to $1, particularly after the introduction of the Structural Adjustment Program (SAP) in 1986, which let market forces dictate the exchange rate.

Under General Sani Abacha’s regime (1993–1998), the Naira was officially pegged at ₦22 to $1, but in the parallel market, it traded closer to ₦88 to $1, reflecting the economic challenges of the time.

By the end of President Olusegun Obasanjo’s administration in 2007, the Naira had further declined, trading between ₦148 and ₦164 to $1. This trend continued with subsequent administrations, driven by global economic shifts, inflation, and fluctuating oil prices.

As of 2024, the Naira has lost nearly 99.8% of its value since the 1980s, with the exchange rate now around ₦1670 to $1. This sharp devaluation highlights the ongoing challenges the Naira faces due to economic policies, global market dynamics, and internal pressures.

Recent government policies aim to stabilize the Naira, but their impact remains to be seen. Global events, like the COVID-19 pandemic, have also contributed to the Naira’s depreciation by disrupting trade and oil prices.

See the figure below to see the historical exchange rates of the Naira against the US Dollar from 1970 to 2024:

Role of Central Bank of Nigeria (CBN) in Naira’s Evolution

Established in 1958, the Central Bank of Nigeria (CBN) plays a key role in managing the Naira, including issuing and redesigning the currency. Since Nigeria’s independence, the CBN has made 14 changes to the Naira, with the most recent in 2022. Under Governor Godwin Emefiele, the N200, N500, and N1,000 notes were redesigned to improve security, fight counterfeiting, and cut currency management costs.

However, the rollout wasn’t smooth. Many Nigerians, especially in cash-heavy areas, struggled to access the new notes. This redesign stirred more controversy than past changes, like the introduction of polymer notes in 2007 and the switch from the pound to the Naira in 1973. To ease the situation, the Supreme Court ruled that the old notes would stay legal until the end of 2023, giving people more time to adjust.

The CBN’s currency management efforts are part of its broader mission to modernize and stabilize Nigeria’s financial system. Despite dealing with issues like inflation, currency depreciation, and economic instability, the CBN continues to play a critical role in shaping Nigeria’s economy and pushing for stability and growth.

Other factors affecting the Naira’s Value

If you think about it, the presidents are just momentary steering wheels. There are some underlying factors that consistently influence the Naira’s value, regardless of who is in power:

Oil Prices and Production: Nigeria’s heavy reliance on oil exports makes the Naira sensitive to global oil price fluctuations. Declining oil prices can weaken the Naira, while higher prices can strengthen it by boosting foreign exchange reserves.

Monetary Policies and Currency Management: The CBN’s monetary policies, including interest rates and foreign exchange interventions, significantly impact the Naira’s stability. Tightening policies can help curb inflation, while loose policies might lead to depreciation.

Political Stability and Leadership: Political instability can lead to capital flight and reduced foreign investment, weakening the Naira. Conversely, stable governance can attract investment and support the currency’s value.

Structural Adjustment Policies and IMF/World Bank Influence: Policies such as the SAP and international financial institutions’ advice have historically affected the Naira. While aimed at economic stabilization, these policies can cause short-term economic pain and currency depreciation.

To Conclude

Experts caution that without major economic reforms, the naira will keep facing challenges. Diversifying the economy and reducing reliance on oil are crucial for long-term stability. Although the CBN introduced a managed float for the naira in June 2023, previous efforts have struggled due to deeper issues like low production, high unemployment, and a weak economy.

In the end, fixing these underlying problems matters more than just changing exchange rate policies. The government still has a chance to make the needed reforms and bring stability to both the naira and the economy. From 1973 to 2024: How Nigerian Presidents Influenced the Naira.