This guide covers everything you need to know about Grey before deciding whether or not to receive international payments with it in Nigeria.

Overview

| Features | Grey |

|---|---|

| Core Offering | International money transfers, currency exchange, virtual foreign accounts, bill payments, invoicing and expense management, gift cards. |

| Target Audience | Freelancers, remote workers, digital nomads, businesses. |

| Supported Countries | Supports money transfers and inward payment collection in 80+ countries, including Ghana, Kenya, Nigeria, the Philippines, Tanzania, the UK, South Africa, Uganda, Rwanda. |

| Supported Currencies | NGN, USD, GBP, EUR, TZS, KES, UGX |

| Withdrawal Method | Bank transfer, mobile money (e.g., M-Pesa in Kenya), virtual bank accounts with Silvergate Bank for USD transactions. |

| Funding Method | Bank transfers and debit or credit cards (limited). |

| Fees | Charges fees for deposits, withdrawals, currency conversion, card creation, and cross-border transactions |

| Card Services | Yes |

Grey is a for anyone in Africa who needs to manage money across borders. It’s a platform that lets you open foreign currency accounts, send and receive international payments, and even get a virtual USD debit card.

This means you can easily get paid by clients overseas, shop on international websites, or manage your finances while traveling. It’s especially helpful for freelancers, remote workers, and businesses dealing with different currencies.

Grey is one of the go-to international money transfer platforms in Nigeria that offer a more convenient and often cheaper alternative to traditional banks for international transactions. Plus, their virtual card can come in handy for online payments where other cards might not be accepted.

Before you continue reading, note that Grey’s USD virtual cards work with Apple-related payments, but you must set your Apple region to the US, as the cards are issued there. This is a common limitation for USD virtual cards and not unique to Grey. Consider this when using the virtual USD cards for Apple services.

Pros and Cons

Here’s what’s great about Grey:

- It’s super convenient to use, with apps for both Apple and Android.

- You can easily send money to friends and family, no matter where they are.

- Getting paid by international clients is a breeze.

- For online shopping, their virtual dollar card is a lifesaver.

- You can even buy gift cards for your loved ones.

For the not-so-great:

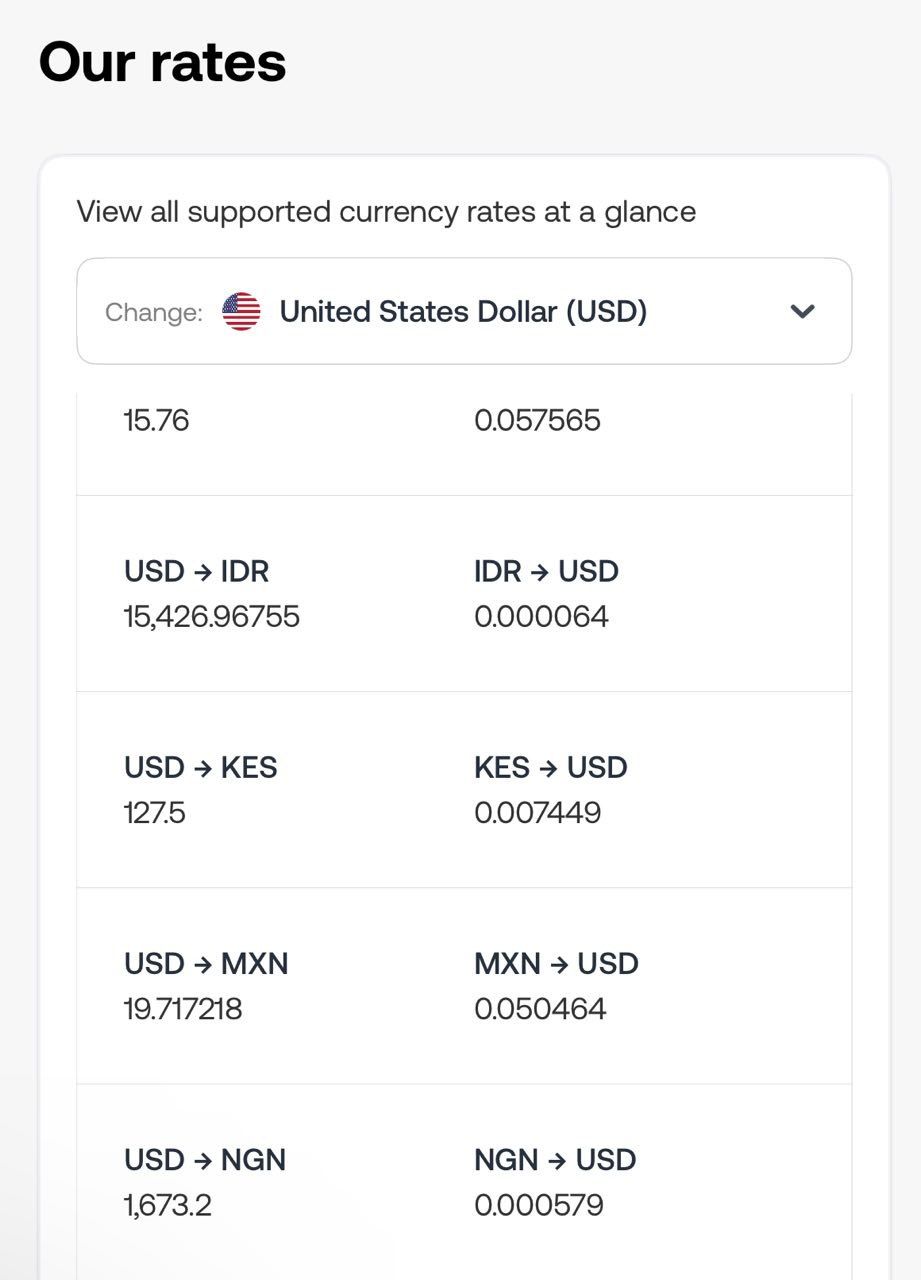

- Their exchange rates could be better.

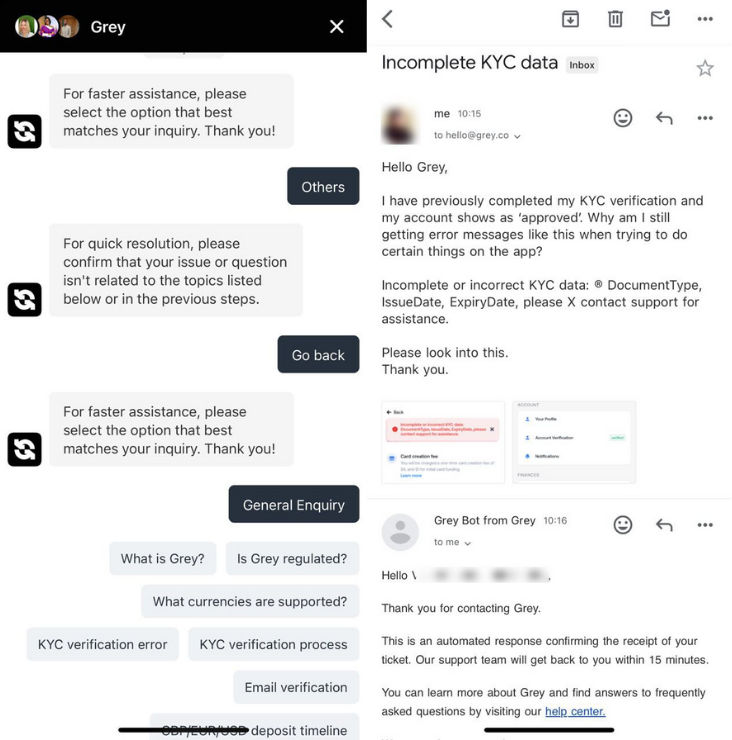

- Sometimes, getting a response from customer support can be a bit slow.

- Withrawals can take a bit longer than you might expect.

- They also have this thing where they ask for your sender’s bank statements and ID, which can be a bit of a hassle.

- Compared to other options, the card creation fee is a bit on the high side.

- And sometimes, the KYC verification process can be a bit frustrating.

- For users trying to navigate domiciliary accounts, Grey allows you to hold and manage foreign currencies but withdrawing those funds to a Nigerian domiciliary account might involve some limitations or extra steps.

Grey works with KYC verification

Grey.co uses a standard KYC (Know Your Customer) verification process to ensure the security of its platform and comply with regulations. While you can open an account without immediately completing KYC, you’ll need to verify your identity before withdrawing any money.

The verification process is straightforward and typically takes about 30 minutes. You’ll be asked to upload a government-issued ID and record a short video selfie. This helps Grey confirm your identity and protect against fraud.

Once your identity is verified, you can enjoy all the benefits of Grey, including:

- Easy account creation in multiple currencies like GBP and USD.

- International payments

- Currency exchange at competitive rates.

- Fast USDC transactions

- Invoice creation

- Airtime payments

Note: USD accounts are relatively new and may occasionally be temporarily disabled. However, they can be reactivated upon request at no additional cost, provided no payments have been processed.

Grey Fees

Grey, like most financial services charge for certain transactions. Here’s a quick rundown:

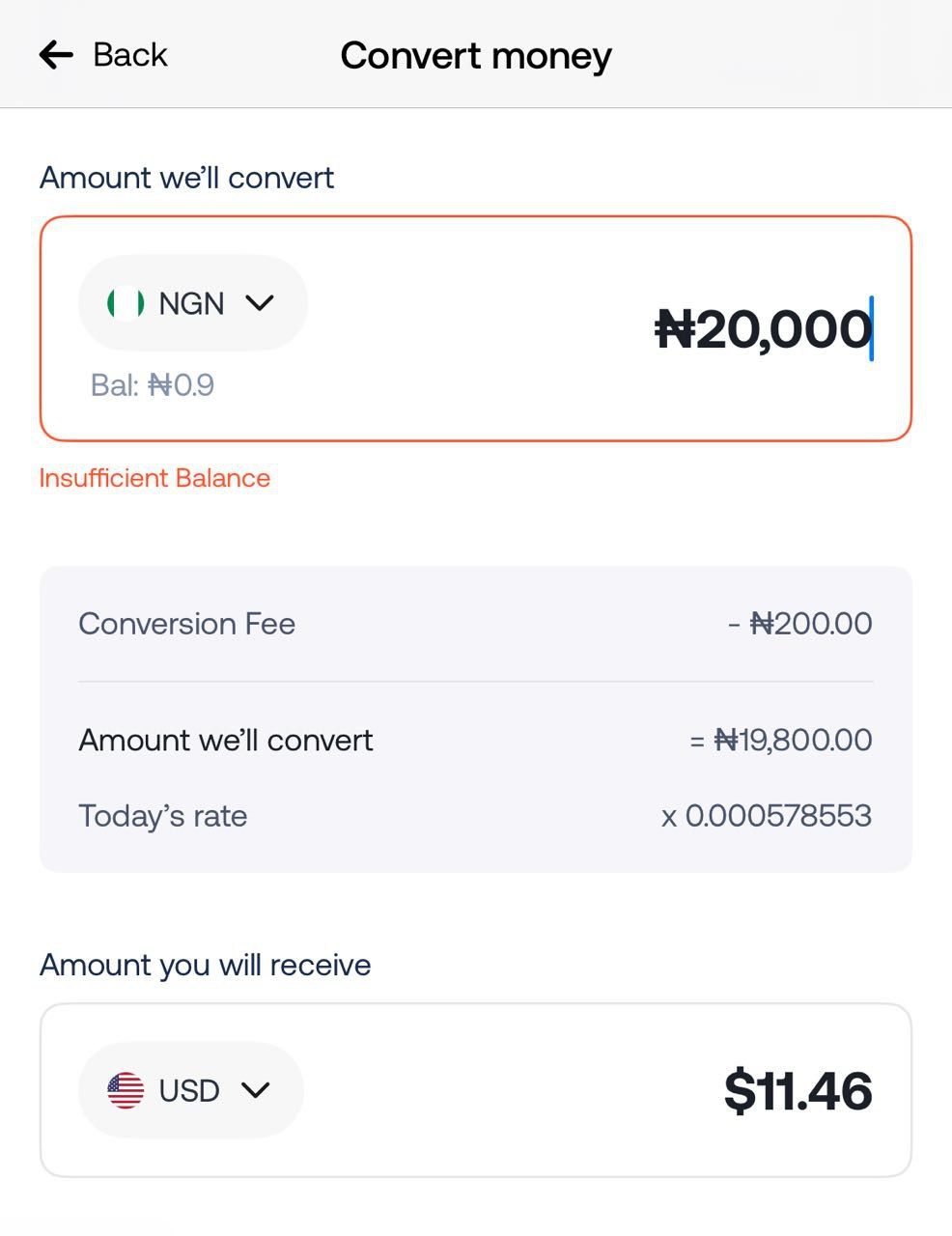

- For Currency Conversion: 1% of the amount you’re exchanging (capped at $6). This applies whether you’re buying a currency or receiving a refund in a currency other than USD.

- Cross-Border Fees: 2% of the transaction amount plus $0.50 when using your virtual USD card on non-US websites.

- Deposits: Fees vary by currency. For example, it’s 1% for USD and EUR deposits, and 0.50% + ₦60 for NGN deposits via Mono direct debit.

- Withdrawals: Fees also vary by currency. Check Grey’s website for the latest fee schedule.

- USDC Network Fees: Grey adds no extra withdrawal charges—just pay the standard network fee.

Virtual Card fees

First off, it’ll cost you $5 to create the card. Think of it as a one-time setup fee. The good news is that there are no other charges for things like using the card, keeping it active, or adding money to it.

Here are a few things to keep in mind:

- You’ll need to deposit at least $2 each time you add money to the card.

- The maximum you can add in a single transaction is $2,500.

- When it comes to withdrawing money, you can take out as little as $1 or as much as $1,000 per transaction.

- Oh, and one more thing: like some other online platforms, Grey doesn’t offer physical cards yet. So, this one’s just for your online spending!

It’s always a good idea to be aware of these fees and factor them into your financial decisions.

Grey Support

For support, you can start with the Grey bot in the app, though it may not be ideal for complex issues. A better option is to email support@grey.co. Typically, the bot will confirm receipt of your query almost instantly, but it may take around 3-4 hours for a response from the team.

Grey’s support is known for handling KYC issues efficiently, so it’s best to reach out immediately if you run into problems with verification or payments. If your card gets frozen, for example, they can help resolve it quickly once contacted.

You can also use the in-app help documentation by typing in your query to search for relevant guides.

They are also responsive on social media—find them on Twitter and Instagram under @greyfinance for quick inquiries.

Does Grey have a mobile app?

Yes, the platform is available on both the Google Play Store and the Apple App Store.

Grey also integrates with various payment apps, freelance platforms, and e-commerce websites like Stripe, Wise, Payoneer, Upwork and Amazon Kindle Direct Publishing (KDP)

Is Grey Secure?

Grey.co is legitimate and licensed by FINTRAC and FinCEN, regulatory bodies that protect users’ interests. While there are no reports of data misuse, the app collects personal data during registration and installation, and there’s no guarantee it won’t be shared with partners.

What are users saying about Grey?

Grey receives both praise and criticism from users.

Samuel Ajala shared a positive experience: “I used Grey and I must say they are far more reliable than PayDay” Source

Nuel Wogundu appreciated Grey’s simplicity: “There’s something about @greyfinance that excites me. From the account number to the card usage to the UI design simplicity. The team are doing a good job 👍” Source.

Bright Bassey highlighted the app’s ease of use in an article: “For the first time in my life, I was able to pay for a Udemy course.” Source.

However, like most digital payment platforms, Grey isn’t free from issues.

Godswill Isikaku complained about delayed transactions: “I made a payment to my NGN account (Wema) and haven’t received it for over 7 hours.” Source.

Some users have voiced concerns over product transparency. One anonymous user reported:

“I bought a Grey card, expecting a credit card, but it turned out to be a Mastercard debit. They didn’t disclose this, and I lost $5 in fees. My regard for @greyfinance has dropped since then.”

Mostly, Grey’s Dollar card and their other features will serve you well.

Verdict: Is Grey the right choice for you?

Grey is a solid choice for managing your money across borders, especially if you value convenience and need a versatile platform. It’s great for currency exchange, international payments, and online spending with their virtual USD card.

However, be aware that fees can be a bit high, and transactions might not always be instant.

Still, Grey’s services mark a positive step forward so, it’s up to you to decide if it’s the right fit.

FAQs on Grey payment app

Q: Can I send dollars from my Grey USD account to a Nigerian domiciliary account? A: Not directly within Grey.co. Currently, you can only withdraw USD to a Nigerian domiciliary account via bank transfer. This means you would first withdraw the USD from your Grey account to your local bank’s domiciliary account, and then you could make transfers from there.

Q: How can I receive money from someone overseas using Grey? A: Just create a foreign currency account (like a USD account) within your Grey profile. Then, share your account details with the person sending you money. They can send it directly to your Grey account.

Q: I added money to my virtual card, but the expiry date didn’t update. What should I do? A: That happens sometimes. Just reach out to Grey’s support team through the app or website. They’ll fix it for you quickly.

Q: How do I open a USD account with Grey? A: You can do that right from your Grey dashboard. Just look for the option to create a new account and select USD as the currency.

Q: Can I get a virtual card for GBP transactions? A: You don’t need a separate card for that! Your Grey virtual USD card can also be used for GBP payments. Just make sure you have enough USD in your account to cover the transaction, as Grey will automatically handle the conversion.