In the last few years, there’s been an increase in financial literacy. More and more people are curious to explore the local finance ecosystem and one of the most eye-catching aspects has been the foreign exchange market.

This article, therefore, focuses on the forex market as it is fondly called. It lists out the functions/uses, explains how to interpret exchange rates, and gives a detailed history of the foreign exchange market in Nigeria.

Foreign Exchange Market In Nigeria

Nigeria has a foreign exchange market just like every other country does. This institution, which is otherwise called a forex market, is responsible for organizing and overseeing the trade or exchange of local currencies against foreign currencies.

The foreign exchange market in Nigeria has gone through a number of reforms. Ultimately, these activities have helped shape the mechanism, bringing it up to what is today.

Four Major Functions of the Foreign Exchange Market in Nigeria

The foreign exchange market has very critical functions. No matter the country, these functions remain the same. They include:

Currency Exchange:

The most important function of any forex market is currency exchange. This is also the most obvious. Forex markets provide the platform for the demand of currencies to be made and a supply of the same fulfilled.

Traders and business owners particularly benefit from such services. Take an international trader for example. They may want to purchase goods from several different countries and to do this, they need to convert their local currency to that used locally by their sellers.

Currency Hedging:

Foreign exchanges possess the risk of currency rate fluctuations. This is a situation where the value of a currency rapidly increases or decreases. When the currency rate/value decreases, holders of such currencies experience a loss. The same happens when the currency rate increases. But this time, it is holders of other currencies that experience a loss.

Now, currency hedging refers to practices by forex market agents and financial players to minimize loss due to rate fluctuations.

Entities engaged in international transactions carefully consider exchange rate fluctuations. Usually, they want to make foreign currency payouts at a time when the exchange rate is low. That way, the amount of money they expend is less.

Currency Arbitrage:

Currency arbitrage is the instantaneous purchase and sale of a currency, for profit.

The arbitrage process was previously undertaken by individuals who sat and watched a huge screen. This terminal would display the exchange rates for a long list of currencies. Buyers then purchase a currency based on the rate in different countries.

Today, currency arbitrage processes have taken a huge turn. The availability of digital exchanges allows traders to view exchange rates instantaneously on digital devices, and execute arbitrage within seconds.

Currency Speculation:

Sometimes, forex market users do not go after making immediate profit. In this case, what they do is to perform currency speculation. This is done by purchasing a particular currency in hopes that the value of such will increase profitably.

Currency speculation involves purchasing and holding a currency for as long as it will take for it to bring returns. Usually, holders make this move when they speculate an ROI in a couple of weeks or months.

Most of the bunch of trader’s today see currency speculation as a high-risk venture. Many companies and entities will, therefore, choose to avoid this option completely. In addition, traders might want to avoid arbitrage for the same high-risk reasons.

How to Interpret Foreign Exchange Market Rates

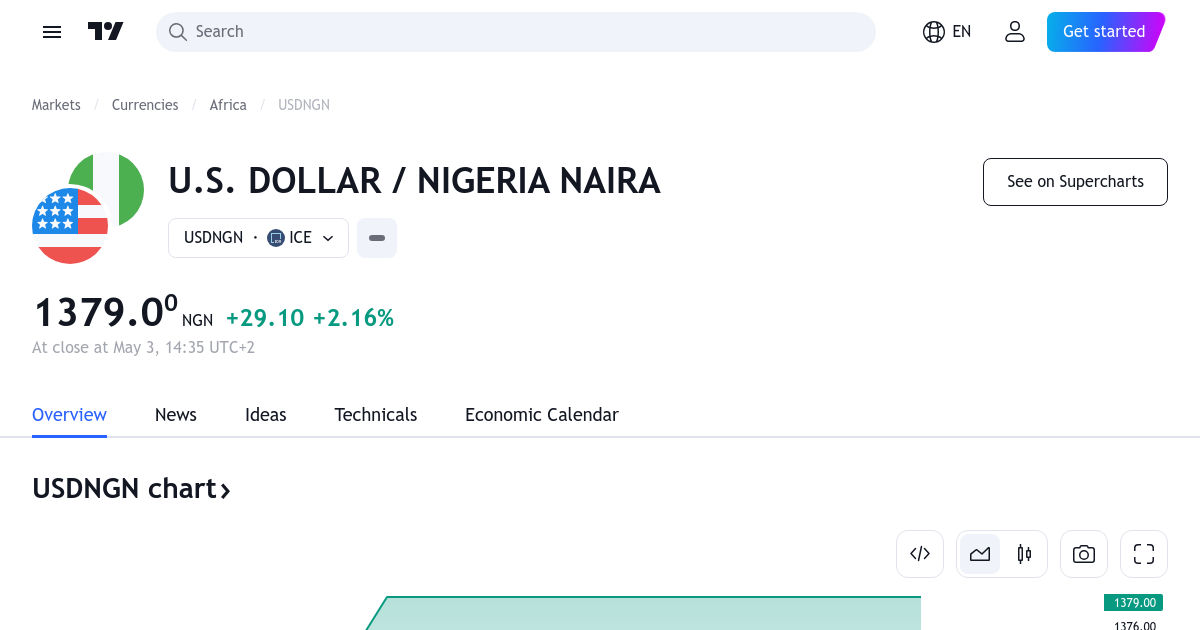

Foreign exchange deals with currency pairs (described below) and rates. For the pairing, two currencies are placed side by side, like USD/NGN. The first currency (USD) is called the base currency, and the second currency (NGN) is called the quote currency.

The exchange rate for this pair indicates how much of the quote currency (NGN) is needed to purchase one unit of the base currency (USD). So, if the exchange rate for USD/NGN is 1,000, it means that 1 USD is equivalent to 1,000 NGN, showing the strength or value of the NGN relative to the USD.

The exchange rate for USD/NGN is a number that tells how strong the NGN is compared to the USD.

Increasing Exchange Rate:

When the market value of USD increases against the market value of NGN, it means that USD has become stronger relative to NGN. In this scenario, the exchange rate for the USD/NGN trading pair would increase because it would require more NGN to purchase one USD.

Decreasing Exchange Rate:

In the same vein, when the market value of USD decreases against the market value of NGN, it means that USD has become weaker relative to NGN. In this scenario, the exchange rate for the USD/NGN trading pair would decrease because it would require fewer NGN to purchase one USD.

To put the above in other words:

When the market value of NGN increases against the market value of USD, it means that NGN has become stronger relative to USD. In this scenario, the exchange rate for the USD/NGN trading pair would actually decrease because it would require fewer NGN to purchase one USD.

So, an increase in the market value of NGN against USD would result in a decrease in the exchange rate for the USD/NGN pair.

Components of Foreign Exchange Market

Interpreting foreign exchange rates requires knowledge of trading pairs, quotes, and the like, known as components. Here’s a list of forex market components and what they mean:

Currency Pairs:

Currency pairs refer to the standard way of presenting currencies for trading in a foreign exchange.

Each pair consist of the base currency and the quote currency. Typically, the base currecny appears first, followed by a forward slash (/) and then the quote currency. A example is NGN/USD - the Nigerian Naira trading against the United States Dollars or EUR/USD - the European Euro trading against the United States Dollar.

Bid and Ask Prices:

The bid and ask prices are another important component of the forex market. The Bid price refers to the price at which buyers are willing to buy the base currency. Alternately, the Ask price refers to the price at which sellers are willing to sell the base currency.

You see, like every regular market, the forex market has buyers and sellers influenced by sentiments and factors such as supply and demand. This impacts both parties when biding for the purchase or sale of a currency on the foreign exchange market, creating changing market conditions.

Bid and Ask Price Spread:

The Bid and Ask price spread represents the difference between the Bid and Ask prices. This component of the forex market indicates the cost of trading. It is one that should be paid rapid attention as it could forecast market conditions.

Charts:

Forex market charts are an essential component. They provide visual information on the performance of currency pairs over a period of time, hours, days, weeks, or years. Charts basically serve as a tool for technical analysis. They reveal support, resistance levels, and other market behaviors.

History of the Foreign Exchange Market in Nigeria

According to the Central Bank of Nigeria, foreign exchange was once-upon-a-time earned by the private sector. More importantly, the balances were held by commercial banks overseas. These acted as agents for local exporters.

This period was the time when the Nigerian pound was in par with the British pound sterling. Both currencies were pegged 1:1, making it easy to convert from one to the other. The ease in converting from the Nigerian pound and the British pound sterling ensured that the a foreign exchange market was never fully considered.

However, things began to change around the late 50’s. It started with the development of the Central Bank of Nigeria (CBN) in 1958 and the enactment of the Exchange Council Act of 1962. CBN brought about the centralization of the foreign exchange authority in banks.

In 1982

A foreign exchange crisis reportedly ensued in 1982. To the government, this proved the need to implement foreign exchange market controls. Rapid export of crude oil and sharp increase in its price became another key driver for this decision.

In 1986

In September 1986, the Second-tier Foreign Exchange Market (SFEM) was established. This was done as a response to the inabilities of the foreign exchange market controls developed four years earlier.

As it appeared, the 1982 forex market controls could not properly handle forex allocations for internal balances. Thankfully, the Second-tier Foreign Exchange Market (SFEM) succeeded at this. Market forces were used to determine the Naira exchange rate and the allocation of foreign exchange.

Bureaux de Change was also established three years later in 1989. Their primary objective was to handle privately sourced foreign exchange.

In 1994

1994 brought some of the most prominent changes to the Nigerian foreign exchange market. One of these was the formal pegging of the Naira exchange rate. Another was the centralization of the forex market in CBN.

What followed were bans and discontinuations. Open accounts were discontinued, parallel market remained illegal, and the Bureaux de Change was stopped from working as an agent of the Central Bank of Nigeria.

After 1994

Foreign exchange market controls which regulated price, quantity, and market behavior were removed in 1995. This liberalization happened through the Autonomous Foreign Exchange Market (AFEM). More was to come in October 1999 with the Inter-bank Foreign Exchange Market (IFEM).

Between 2002 and 2015, a whole lot of things happened. The Real Dutch Auction System (RDAS), Wholesale Dutch Auction System (WDAS), and Interbank Rate System Regime were introduced.

These changes significantly temporarily improve the performance and status of the foreign exchange market in Nigeria.

Conclusion

The foreign exchange market in Nigeria is well developed for anyone to profitably and safely engage in. Nevertheless, new users are often advised to undertake training and carefully consider the potential risks before venturing into forex trading.