Triple Kings Ltd., a local tyre business on the brink of a breakthrough, had meticulously sourced high-quality Dunlop tyres known for their durability and performance. The deal was set with an overseas manufacturer, and the shipment was ready. But then, the unforeseen challenge of dollar scarcity hit. The funds to complete the transaction were trapped, the shipment of tyres was delayed, and with each passing day, the currency exchange rates fluctuated wildly, turning an advantageous deal into a costly ordeal.

This scenario is a textbook example of dollar scarcity, a pervasive issue where access to US dollars – the global currency of trade – becomes a bottleneck, especially in emerging markets. Dollar Scarcity is a term that signifies more than just a monetary shortage; it represents a significant hurdle for businesses aiming to compete on a global stage.

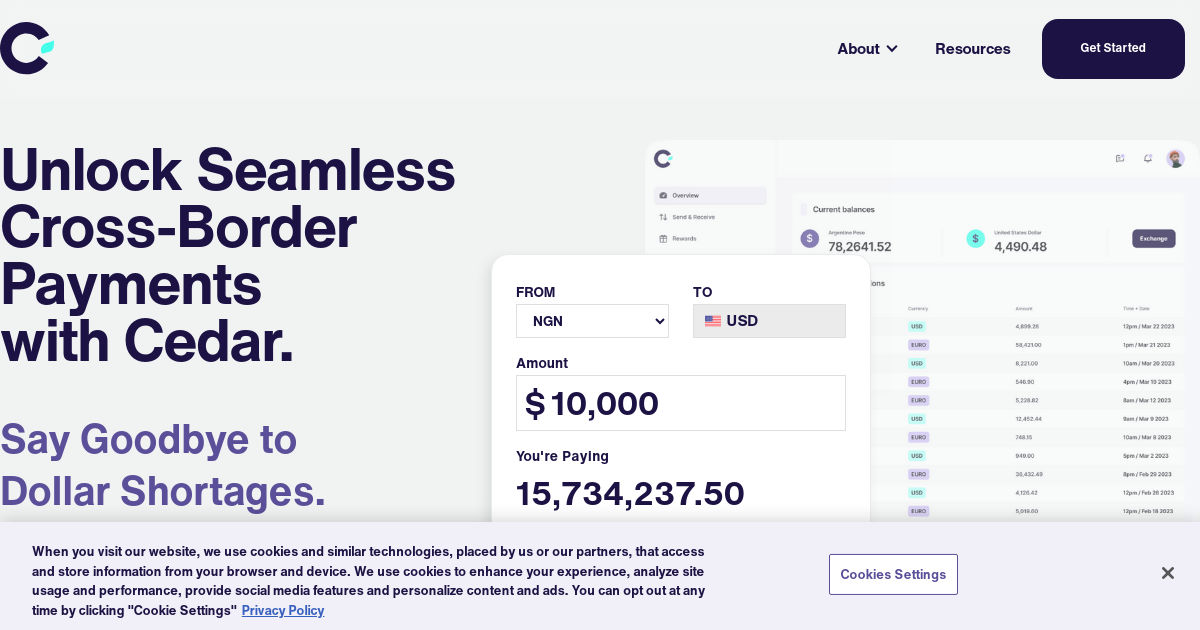

But here’s where Cedar Money enters the picture, a blockchain-based platform designed to mitigate the challenges of dollar scarcity. By leveraging the power of decentralized finance, Cedar aims to provide a more stable and accessible currency solution, ensuring that businesses like Triple Kings Ltd. aren’t left waiting for their shipment to come in.

Below is everything you need to know about Cedar Money and how it works:

- The Traditional Banking Bottleneck

- The Cedar Money Advantage: how it works

- How Cedar Money is Tackling Payment Security Threats

- Who Cedar Money serves

- Cedar Money Fees Compared

- Getting Started with Cedar Money

The Traditional Banking Bottleneck

Traditional banking methods, while familiar, can act as a frustrating constraint in your e-commerce journey.

Here’s why:

High transaction fees nibble away at your profits. Every international wire transfer, and every currency conversion, comes with a charge. These fees accumulate, silently eroding your financial margins.

Compounding this issue are slow processing times. Payments can take days, even weeks, to clear, disrupting your cash flow and delaying essential transactions. Imagine waiting to pay a supplier for materials, or delaying a shipment while waiting for a customer’s payment to clear.

These delays can stall your business momentum.

Limited access to foreign exchange (FX) can further impede your growth plans. The traditional system might not offer easy access to the exact currencies you need to conduct international business. This can make it difficult to source materials or expand into new markets.

Finally, the constant fluctuation of exchange rates adds another layer of uncertainty. Just when you think you’ve secured a profitable deal, sudden currency shifts can transform the situation, making it difficult to predict costs and profits. It’s like trying to plan your business finances on constantly shifting sands.

These combined limitations of traditional banking create a bottleneck, hindering your business’s ability to thrive in the global marketplace. Fortunately, innovative solutions like Cedar Money are emerging to address these very challenges.

Let’s delve deeper into how Cedar Money works and the advantages it offers businesses like yours.

The Cedar Money Advantage: How it works

Traditional banking methods often hinder the growth and efficiency of businesses operating globally. Cedar Money’s innovative model directly addresses these pain points by harnessing a powerful combination of blockchain technology, stablecoins, and seamless integration with existing financial networks. Let’s break down how this translates into tangible benefits for your business:

Speed That Keeps Pace with Your Business: Blockchain technology enables transactions to be processed with near-instant speed, significantly faster than the traditional banking system. This means your funds arrive where they need to be, when you need them there, minimizing delays.

Reducing Hidden Costs: Cedar Money offers lower transaction fees by bypassing unnecessary intermediaries. Those savings go directly to your company’s bottom line.

Stability in an Unpredictable Market: Stablecoins, pegged to fiat currencies like the US dollar, minimize the risks associated with fluctuating exchange rates. This allows you to accurately predict costs and ensure reliable international transactions.

Liquidity When You Need It Most: Cedar’s system provides access to liquidity even during times of dollar scarcity, ensuring your business operations continue unchecked, regardless of external financial conditions.

Cedar Money was founded in 2022 by the visionary Benjy Feinberg. Headquartered in Tel Aviv, Israel – the nation’s economic and technological hub – the company’s mission is clear: to revolutionize the way businesses interact with the global economy. This dedication to innovation has resulted in rapid growth, including the completion of its second Early Stage VC round in August 2023.

How Cedar Money is Tackling Payment Security Threats

The global marketplace thrives on two key pillars: trust and security. While speed ensures transactions reach their destination quickly, businesses also rely on robust security to safeguard their funds and prevent fraud.

Recognizing this critical need, Cedar Money has implemented robust security measures to ensure your transactions reach their destination swiftly and securely throughout the entire trading process.

Blockchain’s Immutability and Transparency: The core of Cedar Money’s security is blockchain technology. Once a transaction is recorded, it cannot be altered. This, paired with the transparency of an open ledger, creates a verifiable record that all parties can trust.

Smart Contracts: These self-executing contracts automate processes and enforce agreements, reducing the potential for human error and fraud.

Account Takeover Prevention: Cedar Money employs advanced security protocols to prevent unauthorised access, ensuring your accounts and funds remain protected.

Cedar Money also prioritizes security by requiring that payouts are linked to verifiable invoices for goods or merchandise. This reduces the risk of fraud and helps maintain the platform’s integrity.

These layers of security are not simply tech features; they create a foundation of trust – the lifecycle of a successful global exchange. With Cedar Money, businesses of all sizes can confidently transact internationally, with their funds safeguarded.

But who specifically benefits from Cedar Money’s secure and innovative approach?

Who Cedar Money serves

Real-world use cases of Cedar Money’s impact on businesses include:

Importer Sourcing Materials Quickly: Cedar’s fast processing speeds allow an importer to swiftly secure payment to an overseas supplier, ensuring production materials arrive without delay.

Exporter Mitigating Currency Risk: By utilizing Cedar’s stablecoin-based transactions, an exporter can minimize the impact of currency fluctuations, leading to more predictable revenue.

Small Business Expanding Internationally: Exporters can lock in favourable exchange rates with Cedar Money, protecting their profit margins and accelerating their global growth.

Cedar Money Fees Compared

Choosing the right cross-border payment solution can significantly impact your business’s end goal. Cedar Money’s transparent fee structure is a major selling point but let’s see how it compares to popular alternatives:

| Platform | Transaction Fee | Currency Conversion | Additional Services |

| Cedar Money | 0.5% flat fee | Market rates | Blockchain technology, stablecoin support |

| Wise Business | From 0.43% | Mid-market rate | Borderless accounts, API available |

| Payoneer | Up to 2% | Market rates | Mass payouts, invoicing tools |

| OFX | Varied, often lower than banks | Competitive rates | 24/7 support, global reach |

| Stripe | 1% + 30 cents, additional 1% for currency conversion | Conversion fee applies | Extensive integrations, API |

Beyond Fees: Factors to Consider

While Cedar Money’s low, flat fee is attractive, choosing a platform goes beyond simply cost. Here’s what else to keep in mind:

Currencies and Volume: If you frequently work with specific currencies, compare exchange rates between platforms. High-volume transactions might make a lower variable percentage fee more attractive.

Technology: Cedar Money’s use of blockchain and stablecoins could be advantageous if security and minimizing currency volatility are priorities.

Additional Features: Payoneer’s mass payouts or Stripe’s integrations might be essential to your business model.

Support: If you anticipate needing frequent assistance, factor in a platform’s reputation for customer service.

The Right Fit: The best payment solution for your business depends entirely on your individual needs and priorities.

Getting started with Cedar Money

Dollar scarcity and traditional banking limitations no longer have to hinder your global ambitions. Cedar Money offers a powerful solution through its innovative blockchain platform. With secure, efficient, and cost-effective cross-border payments, Cedar Money empowers small businesses to operate seamlessly on the world stage.

Ready to unlock these Cedar benefits? Visit their website and fill out the required fields to get started today.