Cryptocurrencies are revolutionizing finance, offering new ways to invest and earn passive income. Staking, a popular option, allows you to grow your crypto holdings over time. This is usually considered a low-risk investment but it’s important to find the right platform for it considering the numerous apps available.

To aid you in making this decision, we’ve analyzed the top crypto-staking apps that you can use in 2024, considering trustworthiness, features, and potential returns. Regardless of your crypto experience, this breakdown empowers you to make informed decisions for a profitable crypto journey.

Before you start staking cryptocurrencies

- Choosing the Right Crypto: First things first, not all cryptos are created equal. Staking only works with blockchains that use a Proof-of-Stake (PoS) system, different from the Proof-of-Work (PoW) system used by Bitcoin. Think of PoS as a more energy-efficient way to secure the network, and staking as your chance to contribute and earn rewards for doing so. Once you’ve identified some PoS blockchains, it’s time to pick your crypto of choice. Research different projects and consider factors like their long-term potential and the staking rewards they offer.

- Finding Your Staking Wallet: Now that you’ve got your crypto picked out, it’s time to find it a comfy home! You’ll need a crypto wallet that supports staking for your chosen blockchain. These wallets allow you to not only store your crypto securely but also delegate it to the staking process. Different wallets may have different features and security measures, so do some research to find one that best suits your needs.

- Understanding Minimum Stakes: Here’s a heads-up! Some blockchains have minimum staking requirements. This means you’ll need to hold a certain amount of crypto before you can start staking. These minimums vary depending on the blockchain, so be sure to check before you buy.

- Choosing Your Staking Platform: Now comes the fun part – picking your staking platform! You’ll have to connect your wallet, choose the amount of crypto you want to stake, and start earning rewards. But with so many platforms out there, how do you choose the right one? Don’t worry, we’ve got you covered! In the next section, we highlight the top platforms, ensuring you have a secure and rewarding experience.

The industry average reward rate is 5.32%

10 best Crypto Staking apps in Nigeria

Staking apps are divided into Centralised exchanges (CEX) and Decentralised exchanges (DEX). Here are the top choices for Nigerians in 2024:

Centralised Exchanges (CEX)

1. BITGET

Beyond fixed and flexible staking with competitive returns (up to 57.72%!), Bitget offers unique features. For popular coins (SOL, ETH, NEAR), choose fixed pools with specific rewards. Their PoolX platform lets you deposit BGB tokens (or others) to earn tokens from different projects.

Looking for stability? Stake USDT with up to 100% APY.

If you can handle the volatility, you can stake as low as (0.01 ETH) on Bitget and instantly redeem your staked ETH with a short redemption window.

How to start staking on Bitget

Sign in to your Bitget account

Go to the Bitget Staking page

Choose the PoS asset you want to stake

Click on ‘Stake now’ to proceed

Review the details and confirm your staking

2. OKX

Ethereum is the only coin that can be conventionally staked on OKX. However, there are advantages to staking your ETH here.

Unlike other platforms, OKX staking users are shielded from slashing penalties, commissions, gas fees, and even staking limits. That’s on top of daily incentives you’ll receive! Plus, you’ll get a staked Ethereum token (BETH) that you can freely trade or sell.

To further sweeten the deal, OKX utilizes an MEV-boost mechanism, which translates to a competitive Annual Percentage Rate (APR) for you. This essentially means OKX optimizes returns for participants in their staking programs.

How to start staking on OKX

Log into your OKX account

Locate the staking option within the platform

Select the cryptocurrency you want to stake

Enter the amount and confirm your staking transaction

3. BYBIT

Bybit allows you to stake over 100 crypto assets and earn interest on your holdings. Here’s how it works: Locked staking involves holding your crypto in a wallet for a set period to earn interest. It’s a simple way to earn without selling your assets. ByBit returns your staked funds along with your rewards at the end of the term. ByBit offers another perk – USDT staking with a 30% APY! They also allow staking for popular coins like Bitcoin (BTC), Ethereum (ETH), and others. To participate, you’ll need a verified ByBit account.

If you’re looking for even more options, ByBit’s locked staking boasts over 100 tokens, each with varying annual returns based on your staking term. The longer you lock your crypto, the higher the potential rewards (ranging from 0.52% to a whopping 79.89%). With a wider pool of tokens and high potential returns, ByBit allows you to maximize your earnings on your crypto holdings.

How to start staking on Bybit

Go to the ByBit official website and open an account if you are new

Verify your account by following the given guidelines( only accounts who’ve successfully completed KYC Level 1 verification can buy products on ByBit Earn)

Head to accounts and either deposit crypto if you own one or buy crypto

Go to earnings and select ByBit savings

Go over the numerous products and choose the one in which you want to invest

If it is flexible, choose the duration you want and if fixed, stake.

4. MEXC

MEXC offers several ways to earn on your crypto holdings through MEXC Savings. For those who want guaranteed returns, there are Fixed and Flexible Pools. Fixed Pools require locking your crypto for a set time to earn a premium return. Flexible Pools simply require holding crypto in your spot account – the system automatically tracks your holdings and generates daily yield.

For even more options, MEXC offers Locked and Flexible Savings. Locked Savings lets you stake crypto for a fixed term (no access during) for higher yields, while Flexible Savings allows staking and earning while keeping the freedom to trade or withdraw your crypto anytime. Popular currencies like USDT, ETH, and BTC are supported for Flexible Savings.

Finally, if you’re just starting out, MEXC’s Simple Earn offers a low minimum to begin earning on USDC, USDT, ETH, and BTC. The lock-up period is just 1 day, but the APRs are lower compared to other options.

How to start staking on MEXC

Transfer crypto to your MEXC spot account

Go to the staking page on MEXC’s platform

Choose a fixed or flexible staking pool

Click “Stake now” for fixed or “Trade” for flexible pools

Read and agree to the staking conditions

Finalize your staking to start earning yields

5. BINGX

BingX prioritizes user safety with industry-standard security measures like two-factor authentication (2FA) and publically available Proof-of-Reserve (PoR) data. Beyond standard staking options, BingX offers a unique product called “Shark Fin.”

Think of Shark Fin like a bet on the future price of Bitcoin (BTC) or Ethereum (ETH). You choose bullish (price will go up) or bearish (price will go down) and set a price range. If your prediction lands within the range at expiry, you earn a higher interest rate. Even if your prediction is off, you’ll still get some basic interest.

BingX offers options for both popular coins (BTC, ETH, USDT) and lesser-known ones (XCH, HNY), catering to a wide range of investors. They also occasionally run promotions with very high APY (annual percentage yield) on USDT staking for just 7 days, allowing for flexible investment strategies. Combined with strong security and global compliance, BingX empowers users to confidently explore staking as a way to earn passive income on their crypto holdings.

How to start staking on BINGX

Log in to your BingX account.

Navigate to the staking section of the platform.

Choose the cryptocurrency you wish to stake from the list of supported assets.

Enter the amount you want to stake.

Review the staking terms, such as the APR and staking period.

Confirm the transaction to lock your funds for staking.

Decentralised Exchanges (CEX)

6. Jupiter

Jupiter Exchange, a DEX Aggregator and Perpetual Exchange on Solana offers more than just trading. By staking their native token, $JUP, on platforms like XBANKING, users can earn up to 18% APR. Staking $JUP on Jupiter itself unlocks additional benefits: participation in platform governance through voting on proposals and earning rewards via their Active Staking Rewards (ASR) system. This system distributes a portion of Launchpad fees and $JUP tokens to users who stake their holdings.

How to start staking on Jupiter

Select network

Connect wallet

Enter amount

Confirm staking.

7. PancakeSwap

PancakeSwap, a rising Decentralized Exchange (DEX) on Binance Smart Chain (BSC), is built to challenge as the top liquidity provider. They not only support a wide range of BEP-20 tokens but also incentivize users with their CAKE token.

Earning CAKE on PancakeSwap goes beyond just trading. You can become a liquidity provider, stake your existing CAKE tokens, or even try your luck in the platform’s lottery.

But PancakeSwap isn’t all about earning – security is a priority with features like 2FA and withdrawal lock-in periods. They’re even working on adding atomic swaps for increased security.

How to start staking on Pancake swap

Connect your wallet to PancakeSwap

Add liquidity to a liquidity pool of your choice

Click the ”connect wallet” button on PancakeSwap and connect your wallet to the platform

Start staking

8. Uniswap

Uniswap, a major decentralized exchange (DEX), operates on the Ethereum blockchain. Unlike traditional exchanges with order books, Uniswap uses an innovative system called the Automated Market Maker (AMM) protocol for ERC-20 token swaps.

Uniswap itself utilizes two types of smart contracts: Factory contracts and Exchange contracts. Factory contracts automate the addition of new tokens to the platform, while Exchange contracts handle all token swaps within existing pools. Whenever a trade occurs, liquidity providers supplying tokens to the pool earn a portion of the fees, typically set at 0.3%. This fee can vary depending on the type of tokens being traded, reaching up to 1% for less common pairs and dropping to 0.05% for stablecoins.

How to start staking on Uniswap

Purchase Uniswap (UNI) or other compatible tokens on a crypto exchange.

Select a crypto wallet that supports staking and ERC-20 tokens.

Consider joining a staking pool to combine your UNI with others for potentially higher rewards.

Visit the staking portal on the Uniswap website and connect your compatible wallet.

Choose the amount of tokens you want to stake and pay the gas fee (in ETH).

Once confirmed, your staked tokens will automatically validate transactions and earn rewards.

9. Stake.Fish

Stake.Fish, unlike others, is a decentralized platform focused on ETH staking. Joining the ETH pool requires a minimum deposit of 32 ETH and offers a 3.45% annual reward. The pool already boasts over 450,000 ETH coins.

While their primary focus is ETH, Stake.Fish also allows staking other coins like Cosmos, Tezos, Solana, and Near. Yields here vary depending on the chosen coin and specific conditions, ranging from 3% to a much higher 21%. Keep in mind platform fees when selecting a staking pool, as they can range from 4% to 15%.

How to start staking on Stake.Fish

Sign up on the Stake.Fish platform.

Go to your dashboard to view staking options.

Choose the blockchain network you want to stake on.

Click on ‘Stake Now’ to begin the staking process.

Complete the staking process by following the on-screen instructions.

10. Lido

Lido offers a unique staking solution for Ethereum 2.0. Users can stake their ETH with Lido and receive stETH tokens in return, representing their staked ETH at a 1:1 ratio. Unlike regular staked ETH, stETH tokens are liquid and can be used across various DeFi protocols to earn additional yield.

Lido prioritizes security with robust protocols and partnerships. They boast an efficient Proof-of-Relay (POR) algorithm and attractive staking rewards that increase after the first year. There’s no minimum requirement to start staking, and users receive daily rewards on their staked ETH through stETH.

This combination of liquidity, security, and potential for compounded yields makes Lido a compelling option for Ethereum holders looking to earn passive income on their assets.

How to start staking on lido

Choose a crypto wallet for your tokens. Metamask works well for ETH and LUNA, while Phantom is ideal for SOL.

Head to the Lido website and connect your chosen wallet.

Select the network and enter the amount of crypto you want to stake.

Approve the transaction and wait for confirmation (typically under 30 seconds).

Track your rewards

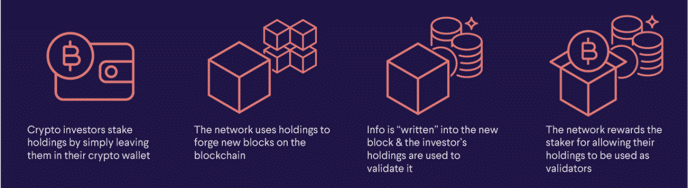

How does Crypto Staking work?

Crypto staking lets you earn rewards for holding certain cryptocurrencies. Unlike Bitcoin’s mining process, staking uses Proof-of-Stake (PoS) to validate transactions and secure the network.

Think of it like putting your crypto in a safe deposit box at a bank. Your crypto helps verify transactions, and in return, you get rewarded with more crypto–like interest on your savings! It can be riskier than a traditional savings account, but potentially more rewarding too.

Conclusion

Staking can be an efficient tool for passive income in crypto. Unlike bank accounts, staking offers higher annual yields and acceptable partnership terms. With platforms like Bybit, lido, and MEXC, you can take advantage of this opportunity with ease and security. Remember, it’s essential to understand the features and risks of each platform before making a decision.

Disclaimer: The content of this article is intended solely for informational purposes. It should not be construed as legal, tax, investment, financial, or any other form of advice.