Chipper Cash is quickly becoming a household name in Africa for anyone who wants an easy, reliable way to send and receive money across borders. If you’ve been searching for a virtual card that works seamlessly across Africa, Chipper might be just what you need.

But before you dive in, it’s worth taking a closer look at what Chipper Cash offers and what sets it apart from other fintech options. In this review, we’ll break down everything you need to know—from how it works, to its standout features, and whether it’s the right choice for you.

What we will cover:

- Overview of Chipper Cash

- Chipper Card’s Core Services

- How Chipper Cash works

- Chipper Cash Fees

- Availability and Platform Support

- Chipper Cash Security Features

- Alternatives Worth Considering

- Final Thoughts

- Frequently Asked Questions

| Pros | Cons |

|---|---|

| 👍🏾Multi-Currency Virtual Cards | 👎🏾High exchange rates |

| 👍🏾Simple User Interface and Interoperability | 👎🏾Limited Availability |

| 👍🏾Free Cross-Border Transactions | |

| 👍🏾No Minimum Balance | |

| 👍🏾Dedicated Customer Support | |

| 👍🏾Bill Payments: Pay bills directly through the app. |

Overview: What is Chipper Cash?

Chipper Cash is your pocket-sized solution for moving money, wherever you need it to go. Founded in 2018 by Ham Serunjogi and Maijid Moujaled, it has quickly become a go-to for people in Africa, the U.S., and the U.K. who need to move money quickly without geo-restrictions. Whether you’re paying bills, transferring funds to friends and family, or even buying Bitcoin, Chipper Cash keeps it simple.

This app is all about convenience. It helps freelancers on platforms like Upwork or Fiverr get their payments without the complexities that come with popular options like PayPal. Since its launch, Chipper Cash has grown rapidly, from around two million registered users in 2020 to more than five million in 2024.

This growth underscores its mission to unlock global opportunities and bring financial inclusion to millions.

And it doesn’t stop there. Chipper Cash also offers ways to invest and grow your money, seamlessly tying into features like virtual bank accounts, stocks and cryptocurrency. It’s like having a one-stop shop for all your financial needs, right on your phone.

Core Services and Features

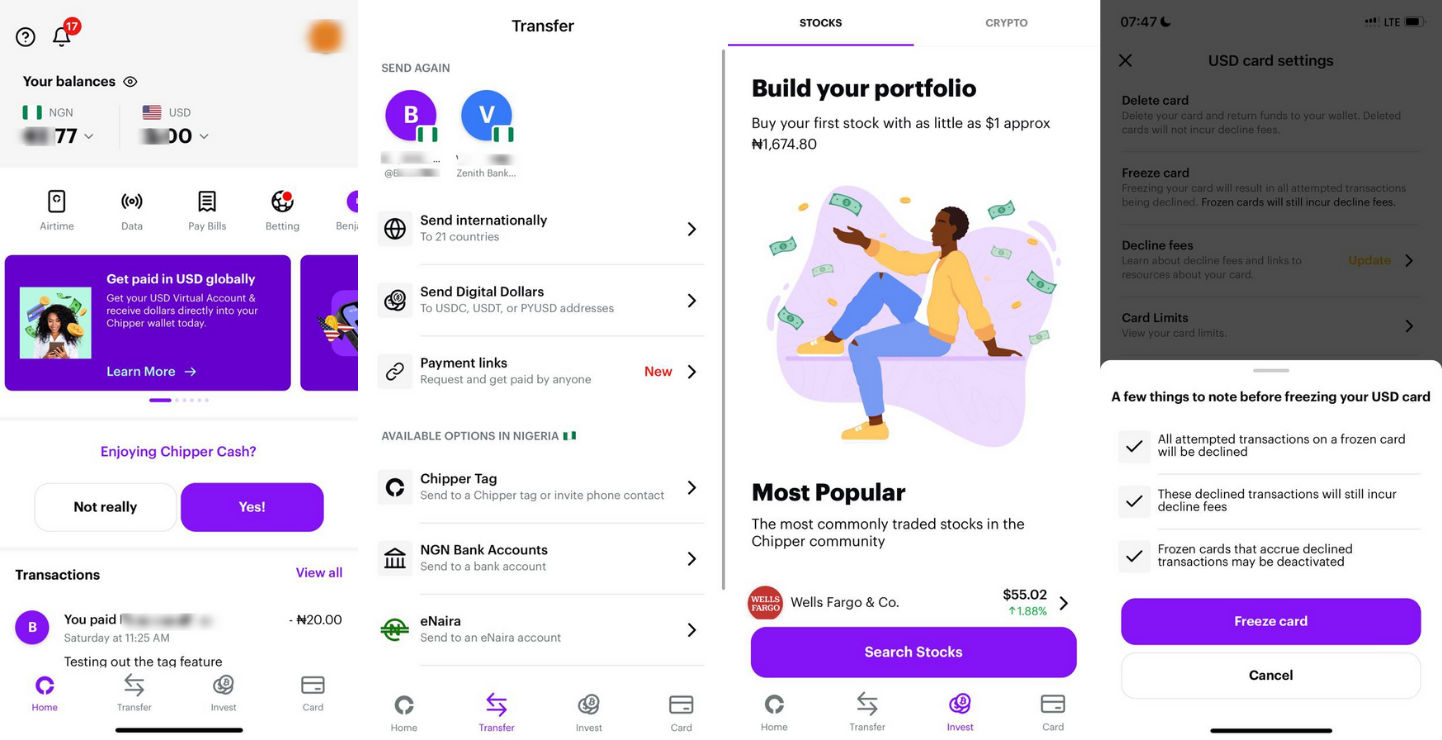

Chipper Cash offers free transfers and some of the lowest cross-border rates, making it easy for users to send money across Africa and the UK. You can link your mobile money or bank account to cash in and out without any fees, and the Chipper Card, a virtual card, gives you flexibility for online payments in both dollars and Naira.

The platform supports transactions in seven African countries and the UK, allowing users to send or request money by simply entering a username. The app syncs with your contacts, making it easy to send money or invite others to join.

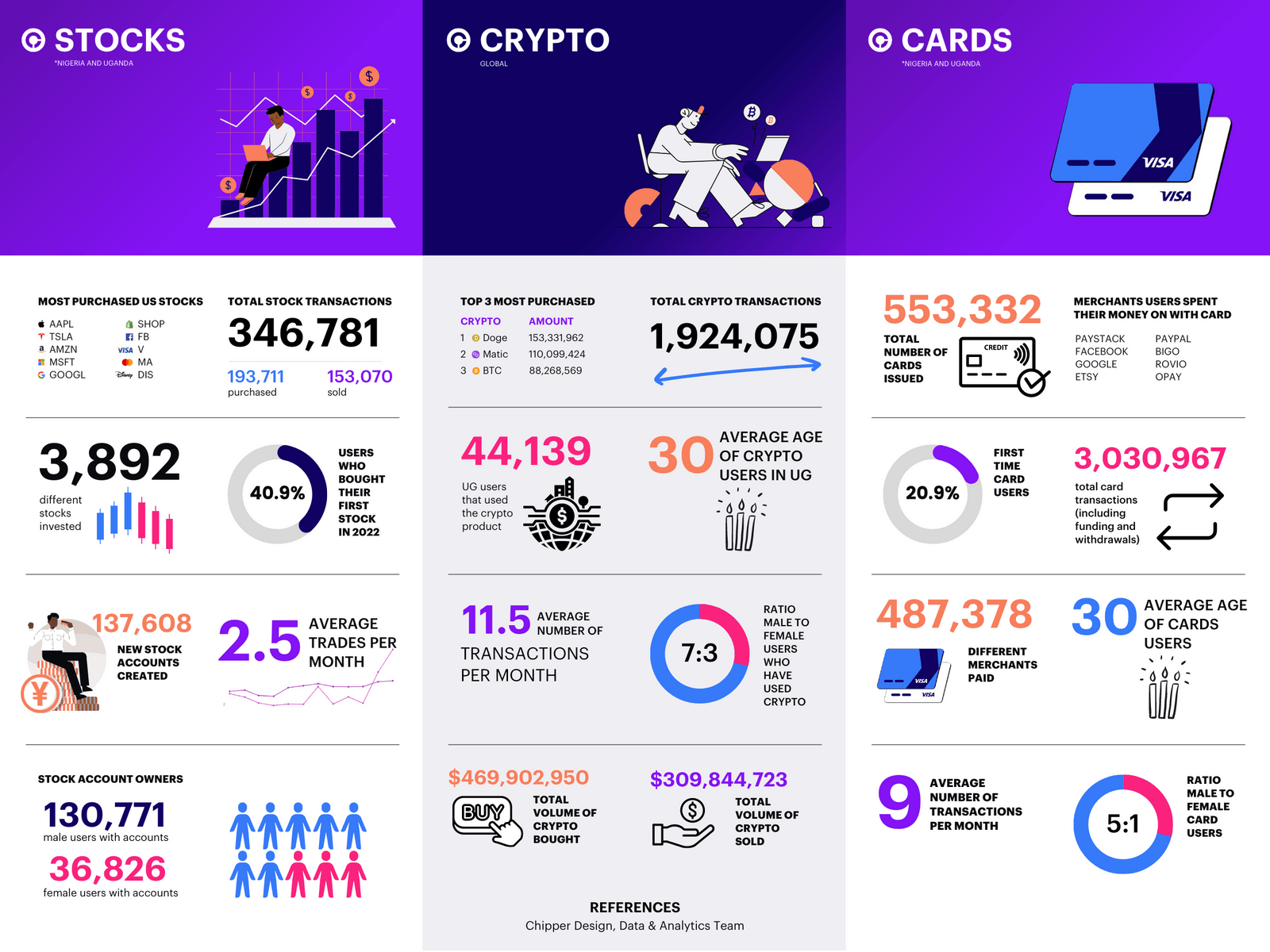

For online purchases, the virtual Visa card works globally. Chipper Cash also supports cryptocurrency transactions, letting you trade in Bitcoin, Ethereum, and Solana. Additionally, the app offers an easy way to invest in fractional shares of major global companies, starting with just $1.

Chipper Cash also integrates with mobile money services, making it a versatile tool for financial transactions, bill payments, and more. For businesses, Chipper for Business offers | payments, collections, and foreign exchange services, streamlining large-scale transactions and international payments.

The table below will break down Chipper Cash’s features for you as an individual or businesses:

| For Individuals | For Businesses |

|---|---|

| Money Transfers: Send and receive money across borders with no fees. | Bulk Disbursements: Send payments to multiple recipients at once. |

| Chipper Card: Virtual Visa card for global online transactions. | Bulk Collections: Collect payments from multiple sources efficiently. |

| Cryptocurrency Transactions: Buy, sell, send, and receive cryptocurrencies like Bitcoin, Ethereum, and Solana. | Foreign Exchange Services: Access competitive exchange rates for international transactions. |

| Stock Investments: Invest in fractional shares of global companies starting with as little as $1. | Payment Solutions: Use Chipper for Business to process payments and manage transactions. |

| Mobile Money Integration: Send and receive funds directly to and from mobile money accounts. | |

| Bill Payments: Pay bills like Airtime, Data, etc. directly through the app. |

How Chipper Cash works

Chipper Cash is a user-friendly platform designed for easy money transfers. With just an email address or phone number, you can send and receive funds across borders without any fees. Adding money to your account is simple: click “Add Cash” and enter your bank details to withdraw whenever needed.

Chipper Cash connects you with contacts in your phonebook or on social media, making money transfers as easy as a tap. The platform also offers competitive exchange rates for seamless currency conversions.

Setting up your Chipper Cash Account

Opening an account is straightforward. You need:

- A smartphone

- A valid email address or phone number and

- Your Bank Verification Number (BVN). After signing up, you’ll receive a six-digit verification code to confirm your account. Next, you can create a username and set a default currency for transactions. Chipper Cash allows you to link multiple phone numbers or email addresses for flexible access.

To fully unlock all features, you’ll need to validate your BVN and verify your identity with a government-issued ID.

Chipper Cash will review your documents within 2 working days after submission if you are in Ghana, Uganda, Kenya, Tanzania, Rwanda, and South Africa. For Nigerian users, BVN will normally be verified instantly.

The interface is intuitive, with a clear layout showing your balance, recent transactions, and quick links for essential actions like adding funds, buying airtime, and sending or receiving money.

Fees and Limits on Chipper Cash

Chipper Cash is designed to be as cost-effective as possible. You won’t pay a dime to send money—whether it’s within your country or across borders. This platform uses live exchange rates, ensuring you get an accurate deal without any hidden fees.

Funding Your Chipper Cash Account Adding funds to your Chipper Cash account is straightforward. Simply copy your Chipper Cash account number, then use your bank app to transfer the desired amount. The funds will be credited to your Chipper Cash account immediately, allowing you to send money, make payments, or trade stocks without delay.

Limits on Sending and Withdrawing Funds As a new user, you’re free to receive unlimited funds. However, there are sending and withdrawal limits. Initially, you can send up to ₦4,000,000 daily or ₦20,000,000 weekly and withdraw a maximum of ₦20,000 per day. To increase these limits, you’ll need to verify your identity with your BVN and a selfie. Once verified, your limits bump up to ₦5,000,000 daily, ₦35,000,000 weekly, and ₦1,000,000 for daily withdrawals.

Chipper USD Card Fees If you opt for the Chipper USD Card, there are a few costs to keep in mind. It costs $5 to create the card, and there’s a $1 monthly maintenance fee.

Stock Trading Fees For those interested in stock trading, a one-time access fee of $10 is required to set up your account. After that, a $1 monthly maintenance fee applies. Trading fees depend on the transaction size—0.15% for amounts under $10,000, and a flat $15 fee for larger trades.

Currency Exchange and Wallet Funding Chipper Cash uses live exchange rates without extra markups for currency conversion. Deposits and withdrawals don’t carry any additional fees but keep in mind that converting Naira to USD might come with a higher exchange rate. Nigerian users primarily fund their wallets via bank transfer, although other payment options like card payments are available. A minimum deposit of ₦10 is required to add a bank card, which is credited back to the wallet.

Overall, Chipper Cash offers a clear fee structure for both everyday transactions and more specialized services like stock trading. For more details, visit their FAQs or contact customer support.

Auxiliary Bank Account

It keeps getting better with Chipper Cash, as users can also enhance their financial flexibility with an auxiliary NGN virtual account, offering more seamless transactions and convenience.

This account allows you to receive funds directly into your Chipper Wallet from other banks, simplifying transactions. Unlike other services, this account isn’t automatically assigned. You’ll need to request it through your profile.

While the approval process can take several hours or even days, once approved, it provides a seamless way to fund your Chipper Wallet.

Chipper Cash Virtual Card

The Chipper Cash Virtual Card is perfect for online purchases, offering a limited-time 5% cash back on your transactions. This virtual dollar card is free to acquire and can be funded directly from your Chipper Wallet, giving you the same flexibility as a physical debit or credit card for online use.

It allows you to make purchases from any merchant that accepts credit or debit cards, handle direct deposits from other banks, and conduct online banking transactions or international payments—all without additional fees.

Packed with features like transaction alerts, budgeting tools, and rewards programs, the Chipper Card makes managing your finances secure and efficient. Whether you’re making a purchase, receiving a deposit, or paying a bill, the Chipper Card is a versatile tool that adapts to your financial needs.

If your primary interest lies in Chipper’s dollar card, you might want to dive deeper into its specifics. Check out our detailed review here: Chipper Cash Dollar Card: 4 Things to Jot Down in Nigeria.

Availability and Platform Support

Chipper Cash operates solely through its mobile app, which you can download on Android and iOS devices. There’s no web version at the moment. The app is available in seven African countries: Nigeria, Kenya, Uganda, Tanzania, Rwanda, Ghana, and recently, South Africa.

The in-app Live Chat support is responsive, but you’ll often be directed to the website’s FAQ section for detailed answers.

Security & Privacy

Chipper Cash takes your security seriously. After logging out, you’ll need to authenticate your account to log back in, either via SMS or USSD. At Monierate, we typically use USSD for this process.

The app also has a Security Lock feature that requires you to enter your Chipper PIN every time you close and reopen the app, adding an extra layer of protection. If you want to keep your balance private, you can toggle on the ‘Hide Balance’ option, so it’s not visible on the home screen.

With approval from the Central Bank of Nigeria and over 3 million trusted users, Chipper Cash ensures your personal information is safe. Verification on the platform is thorough, requiring your Bank Verification Number (BVN) to get started.

What other users are saying about Chipper Cash

In 2024, Chipper Cash continues to receive praise for its ease of use and seamless transactions. Many users appreciate how quickly they can register and verify their accounts, noting that it’s a significant improvement compared to last year.

However, one recurring complaint is the high dollar-to-naira exchange rate, which some find frustrating.

On X (formerly Twitter), users share mixed experiences:

- Chemical Stan was thrilled, saying, “Chipper cash saved me today! I’m so impressed.”

- Prophet Switch voiced his concern: “Please, is there a better and cheaper alternative to Chippercash? I’m tired of buying $1 for N1850. Help me 😭.”

- Ustadh Abdulmubdi shared his learning curve with virtual cards, concluding that Chipper Cash was the better choice.

Over on the Google Play Store, users like Efe Ujev are equally enthusiastic. He mentions how the virtual dollar card has been a game-changer, allowing him to make payments effortlessly across different platforms. He also appreciates the continuous improvements Chipper Cash makes to enhance the user experience.

Alternatives to Chipper Cash

If you’re exploring alternatives to Chipper Cash, here are a few options worth considering:

- Changera: Known for multi-currency wallets and global fund transfers. Sudo.Africa: Known for flexible fund transfers and offering physical and virtual cards. Geepay: Known for invoicing, foreign currency accounts, and payment tracking. Payday: Known for multiple international currency accounts and security. Grey.co: Great alternative to Chipper Cash known for USD, EUR, and GBP accounts and currency exchange.

Stay in the loop for our upcoming reviews where we’ll dive deeper into these alternatives.

Final thoughts

Overall, Chipper Cash is a solid choice for anyone with a smartphone in Africa. It’s easy to use, well-designed, and handles instant transfers and bill payments smoothly, whether local or cross-border. Plus, you can invest in stocks right through the app, adding extra value.

The customer care team is responsive, though not always immediate. If you’ve used Chipper Cash and found it useful, share this article. If you haven’t tried it yet, setting up an account could be beneficial, especially for freelancers, remote workers, or families sending money abroad.

While the app is generally reliable, some users do find the exchange rates a bit high. Still, for convenience and ease of use, Chipper Cash is definitely worth considering.

Frequently Asked Questions About Chipper Cash

Does Chipper Cash Have a Mobile App?

Yes, Chipper Cash has a mobile app available for both Android and iOS.

How Many Countries Does Chipper Cash Support?

Chipper Cash supports nine countries: Ghana, Uganda, Nigeria, Tanzania, Rwanda, South Africa, Kenya, the US, and the UK.

What Is a Chipper Cash Tag?

A Chipper Cash Tag is your unique identifier on the platform. To set it up, go to your profile, select ‘personal,’ then choose your preferred nickname under the ‘Cash tag’ field and click ‘Set.’

Can I Buy Bitcoin with Chipper Cash?

Yes, you can buy Bitcoin and other cryptocurrencies using Chipper Cash, but currently, this feature is available only to users in Uganda and South Africa.

How Do I Withdraw from My Chipper Account?

To withdraw funds, click on the ‘cashout’ button, link your preferred bank account, confirm the transaction, and your account will be credited as soon as possible.

How Do I Convert USD to Naira on Chipper Cash?

To convert USD to Naira, transfer the USD to your NGN account. Click ‘cash out,’ select your USD balance, specify the amount, and choose an NGN account. The funds will be transferred at the current CBN rate.

Can Chipper Cash Send Money from the USA to Nigeria?

Yes, you can send money from the USA to Nigeria. The funds will be credited to your Chipper Cash dollar account.

How Do You Make Money Investing in Chipper Cash?

To make money, invest in stocks through Chipper Cash by selecting a company, buying their stock, and potentially earning returns similar to trading on the stock market.

Is My BVN Safe with Chipper Cash?

Yes, your BVN is safe with Chipper Cash. The platform secures your information and complies with CBN regulations to protect against identity theft.

Can I Receive Dollars on Chipper Cash?

Yes, you can receive dollars on Chipper Cash and transfer them to any Nigerian or domiciliary bank account.

How Much Is the Chipper Cash Exchange Rate?

Chipper Cash uses the black market exchange rate, which is volatile. The rate is approximately 620 NGN/USD but can fluctuate.

Where Can I Use My Chipper Cash USD Card? The Chipper Cash USD card can be used on various global sites like Uber, Google Play, Apple Music, AliExpress, and more.