Sending money to loved ones in Africa remains expensive, even with increased competition with remittances. The average cost of sending $200 to Sub-Saharan Africa is about 7.9%—higher than the global 6.65 average. And while that’s down from 12% in 2011, it’s still a reach from the UN’s 3% target. Yet, over $80 billion flows yearly from overseas to families and friends in the region. This shows the strength of bonds, and Nala understands this.

Available in 21 countries, Nala is a money transfer app built for those connections. Users in the UK, US, and EU can easily send funds to loved ones in Nigeria, Kenya, Ghana, and more.

If you want to experience how the platform works in terms of convenience, affordability, security and more, learn more in our full review below.

Also, compare Nala’s rates today with other platforms to find the best way to support your loved ones.

Here’s what’s great about Nala money:

- Send money home with personalized SMS updates.

- Offers payments for businesses.

- Expanded coverage.

For the not-so-great:

- Only available via mobile app; no web transfer option.

- No fee structure on the site yet, shown only at transfer time.

- Higher costs compared to options like Sendsprint.

- services for Africans within the continent.

What is Nala Money all about?

NALA is an international money transfer app designed for individuals and businesses. It allows users in the UK, US, or EU to send money to family, friends, or businesses in African countries like Kenya, Nigeria, Ghana, and more—all through their phones.

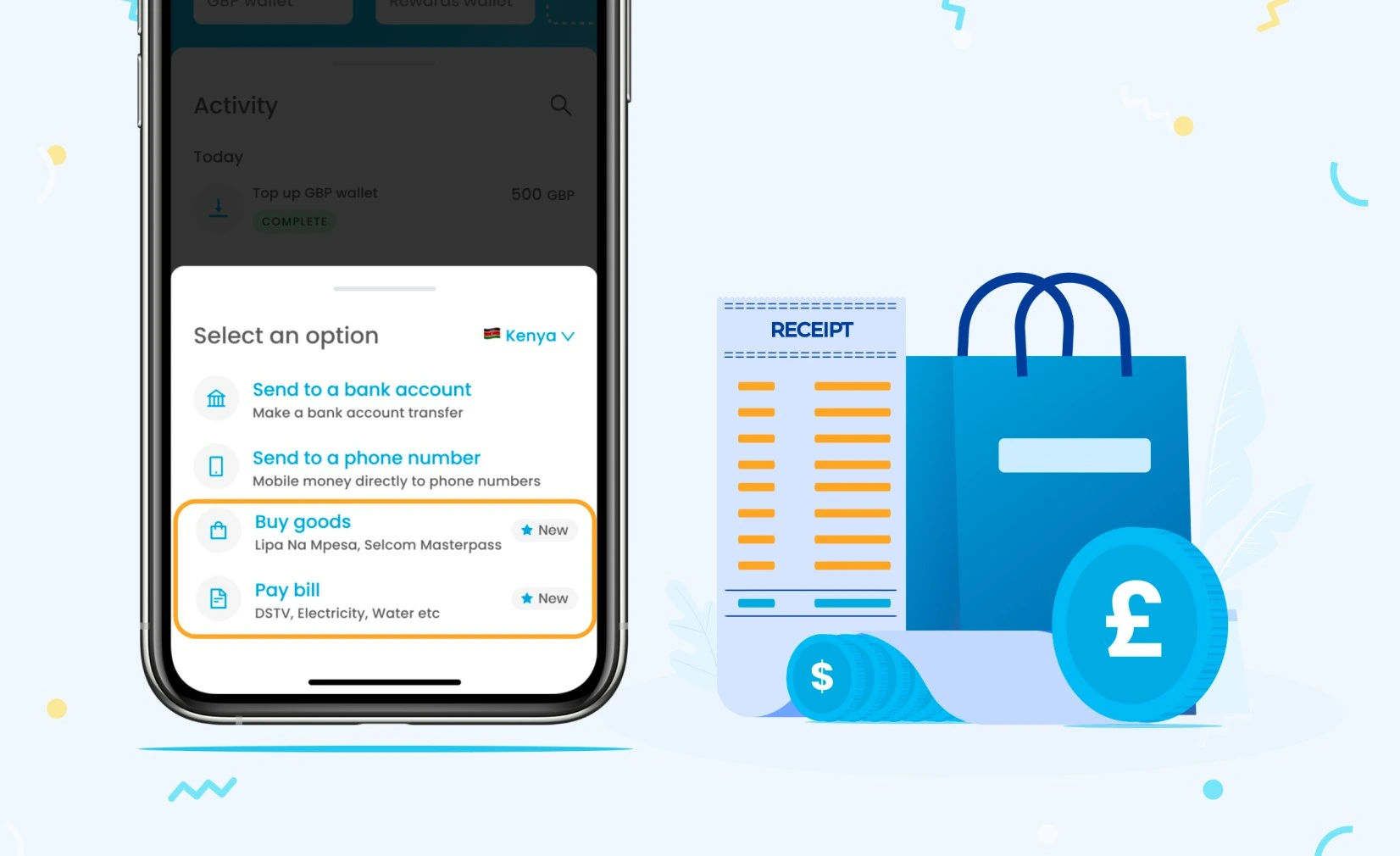

With features like bill payments, buying goods, and mobile money transfers, NALA simplifies financial transactions for users seeking fast, secure, and affordable solutions.

Who uses NALA?

NALA Money caters to:

- Diaspora communities sending money home.

- Businesses making cross-border payments.

- Mobile money users managing daily transactions.

- Every day consumers paying bills and shopping conveniently.

Nala Money Review: Core Services

NALA provides a range of financial services tailored for individuals and businesses:

- International Money Transfers: Send money quickly and securely across borders.

- Business Transfers: Streamlined payments for businesses operating in or with Africa.

- Mobile Money Transfers: Transfer directly to mobile wallets.

- Bill Payments: Pay utility bills directly from the app, ensuring uninterrupted services for your loved ones back home.

- Buy Goods: This feature allows Kenyans to conveniently pay for goods and services directly from their NALA account to an M-Pesa pay bill or till number.

Supported currencies and destinations

NALA allows you to transfer money from the UK, US, and EU to several destinations in Africa and beyond, with a variety of supported currencies:

- PHP: Philippines

- NGN: Nigeria

- XAF: Central Africa (Cameroon, Chad, Gabon, etc.)

- KES: Kenya

- GHS: Ghana

- TZS: Tanzania

- UGX: Uganda

- RWF: Rwanda

- XOF: West Africa (Senegal, Côte d’Ivoire, Mali, etc.)

Nala Money Review: Payment methods

Currently, NALA supports personal debit card payments for transactions. Credit cards aren’t an option due to higher processing costs, which would mean passing those fees on to users—a move the platform avoids to keep things affordable.

For transfers, NALA integrates various methods, including digital wallets, bank accounts, debit cards, and even Google and Apple Pay. Recipients can also receive funds directly into their bank accounts or NALA’s digital wallet, offering flexibility for users.

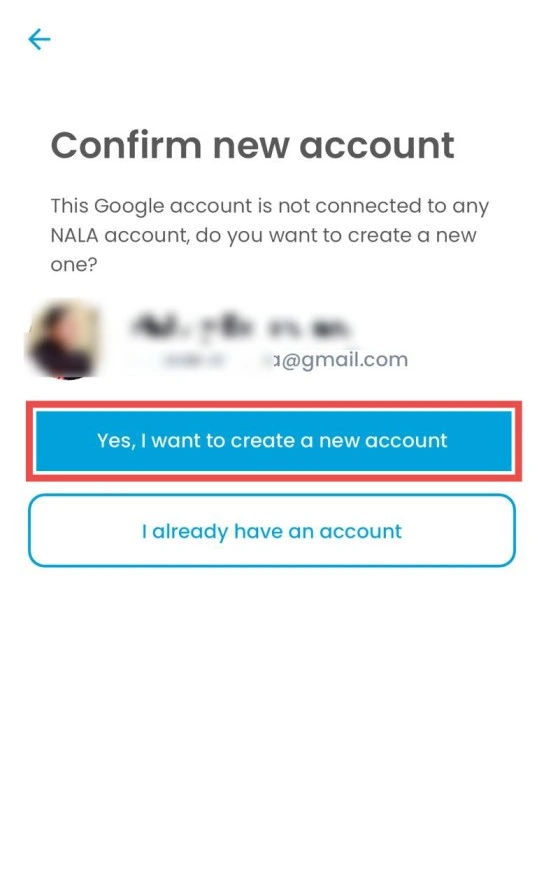

Nala Money Review: Mobile app

NALA operates exclusively through its mobile app, which has received impressive ratings—4.8/5 on Google Play and 4.7/5 on the App Store—with around 2,000 reviews across platforms. The app allows users to manage their digital wallets, send money internationally, track transfers, and pay bills, all in one place.

While the app is available for download in Africa, it’s not functional for residents there, as the service primarily caters to users in the UK, US, and EU. This limitation highlights Nala’s focus on diaspora communities rather than local users.

Nala Money Review: Fees

NALA doesn’t charge upfront fees for transfers, but if you’re sending money to a bank account, a fee of $0.99 may apply. However, the real cost lies in the exchange rates. NALA applies an average markup of 1.52% to the mid-market exchange rate, which is essentially a hidden fee embedded within the conversion rate.

The exact markup varies depending on the currency pair, but NALA’s partnerships with Sendwave and Remitly enable competitive options with multiple rates for the same currencies. When using Apple Pay for transfers, you won’t encounter extra processing fees, but the exchange rate markup still applies, ensuring some cost for every transfer.

Based on general insights, NALA’s transfer limits typically depend on the country you’re sending from, the destination country, and the payment method. For most users, daily and monthly transfer caps are in place to comply with regulatory standards, often ranging between a few hundred to several thousand dollars, euros, or pounds. Specific limits may also vary for first-time users or based on verification levels. Always check the app for the exact limits relevant to your transaction.

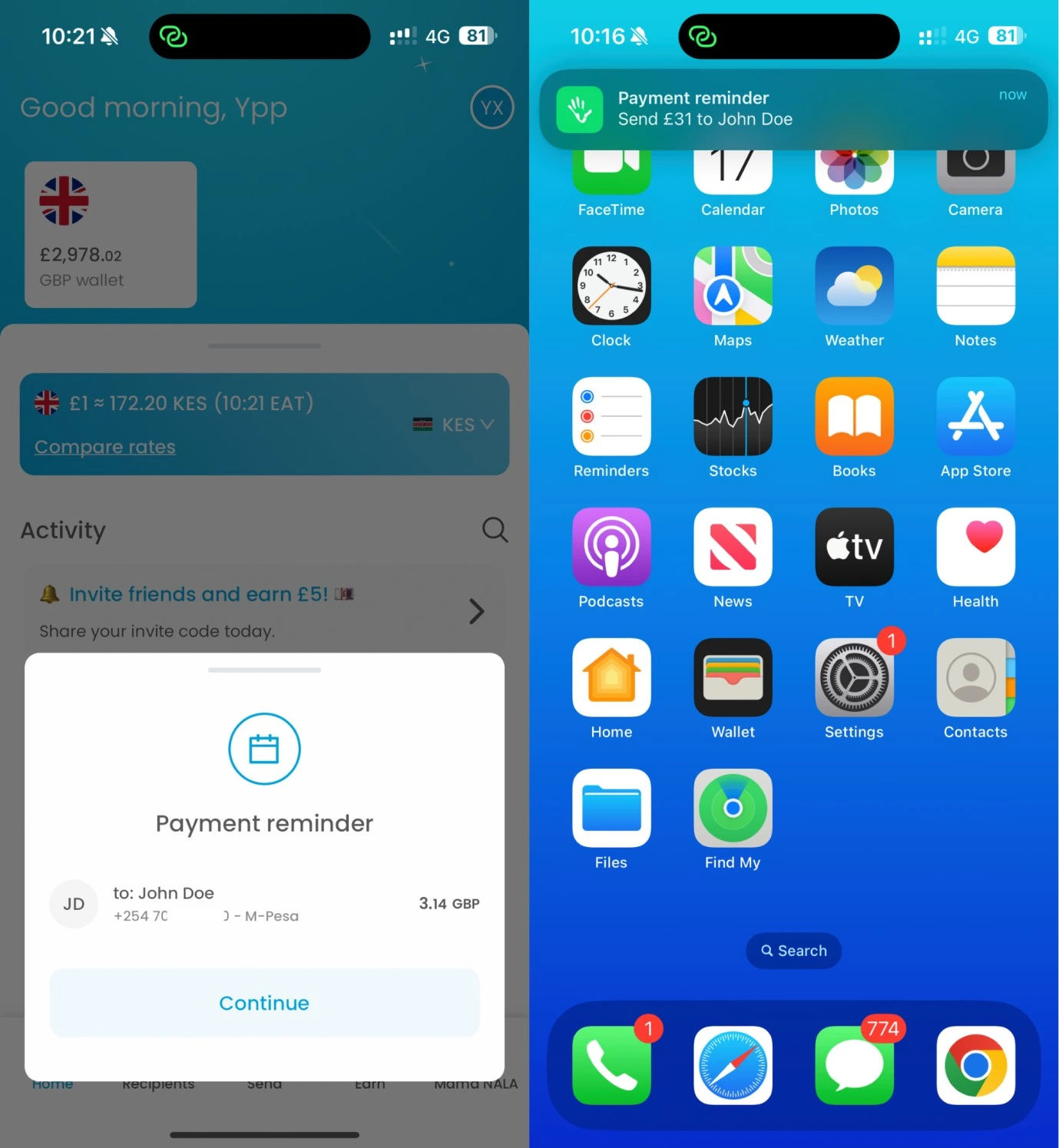

NALA Wallet

Whether you’re planning regular remittances or hoping to save time on recurring payments, the built-in NALA Wallet is a practical tool. Here’s what it provides:

Main Wallet

The Main Wallet lets you transfer funds from your bank account into your NALA account at your convenience. Available for £GBP and €EUR users, it supports transfers to various recipient countries, including Tanzania, Kenya, Nigeria, and more. It also lets you top up monthly, enabling controlled, incremental transfers directly from your wallet.

Rewards Wallet

The Rewards Wallet ties into NALA’s Refer a Friend program. When you refer someone, and they complete a transaction, both of you receive a reward deposited into your Rewards Wallet. Available in €EUR, £GBP, and $USD, rewards can only be used for transactions to a recipient of your choice, adding extra value for loyal users.

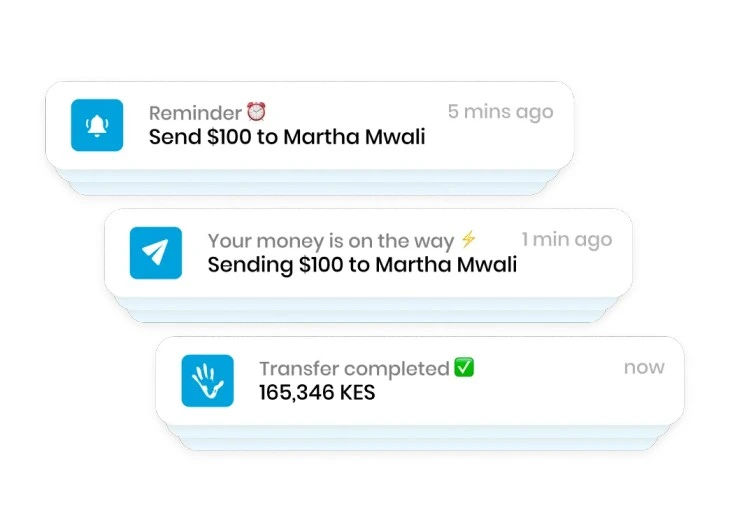

Payment Reminders

NALA lets you easily set up and manage payment reminders through the app. You can create reminders from the settings menu or by scheduling a repeat for any past transaction. Scheduling options include start date, time, and recurrence (weekly, bi-weekly, or monthly).

You get to also edit or delete reminders as long as the scheduled time is at least an hour away. When a reminder is due, a push notification guides you to complete the payment in just a few taps—confirm the amount and authorize your transaction.

Nala Money Review: Security

NALA is a regulated platform incorporated under UK law and it operates as an authorized agent of Modulr FS Limited, regulated by the Financial Conduct Authority (FCA). The platform adheres to stringent security protocols, including bank-grade encryption, 3D Secure (3DS) for card payments, and PSD2 compliance for strong customer authentication.

To protect transactions, NALA uses Face ID (iOS), Fingerprints or passcodes (Android) and requires basic Know Your Customer (KYC) details upon sign-up. Since its launch, NALA has maintained an impeccable security track record, offering users peace of mind.

Nala Money Review: Support

NALA offers a robust support system that users may seldom need due to the app’s intuitive design. The platform features an extensive help section where users can search for answers to common questions. For direct assistance, NALA provides email support via support@nala.money or mamanala@nala.money.

For additional queries or updates, NALA is active on social media platforms like Twitter, LinkedIn, YouTube, and Instagram, ensuring multiple channels for customer engagement.

Alternatives to Nala Money

Factors such as transfer fees, exchange rates, transfer speed, and the availability of services in specific countries can influence the decision to explore other options from Nala. Based on user feedback and market analysis, here are a few options worth exploring:

- SendSprint: Offers a flat fee model for simplicity.

- Afriex: Popular among Nigerians for fast transactions.

- Sendwave: Charges no fees and provides rates lesser than TapTap, though it has monthly limits.

- LemFi: Efficient service with higher exchange rates; ideal for Canada-to-Naira transactions.

- Remitly: Reliable with stringent processes but slightly lower rates than LemFi.

- TapTap Send: Offers fair rates but lacks Canada-to-Naira support.

Nala Money Review: FAQs

Why can’t I send money from Africa?

Currently, NALA does not support sending money from Africa. The platform is designed for users in the UK, US, and EU sending funds to African countries.

What are the transaction limits for mobile money recipient accounts in Africa?

Transaction limits depend on the regulations in the recipient’s country and the mobile money service provider.

How long does it take to send money using the NALA wallet to a recipient in Africa?

Transfers to mobile money recipients are typically credited within 30 seconds, 99.9% of the time.

Does the recipient need to have a NALA account to receive money?

No, recipients can receive funds directly into their mobile money account or bank account without needing a NALA account.