Ever received a strange charge on your weekly bank statement or a higher-than-expected bill? Chances are, you might have encountered Value Added Tax (VAT). This indirect tax, often hidden in the final price of goods and services, is kind of a fee you pay to the government (the Nigerian government in this case.)

In this guide, we’ll break down the basics of VAT, explain when and how it’s applied, and clarify your payment obligations as a business owner or individual in Nigeria.

Understanding VAT in Nigeria

VAT is a little different from an income tax, which is based on your earnings. This bill is is tied directly to your spending. So, whether you’re picking up groceries, buying electronics, or paying for services like a haircut or meal at the buka, you’re contributing to VAT. It’s unavoidable—part of the cost of consumption.

VAT, or Value Added Tax, is essentially a consumption tax. It’s applied at various stages of production and sale, affecting both goods and services. For instance, when you pay for a recurring bill like an Apple Music subscription, you might notice a 7.5% VAT charge. So instead of paying ₦930, your total might come closer to ₦1,000. This extra charge, sometimes unnoticed, is VAT—why payments can get declined when your balance is tight.

While taxes aren’t anyone’s favorite, VAT plays a crucial role in funding public services like healthcare, education, infrastructure, and administration. These are essential services that benefit everyone in the country.

However, not everything in Nigeria is subject to VAT. Some goods and services are exempt, and we’ll dive into those details later in the guide.

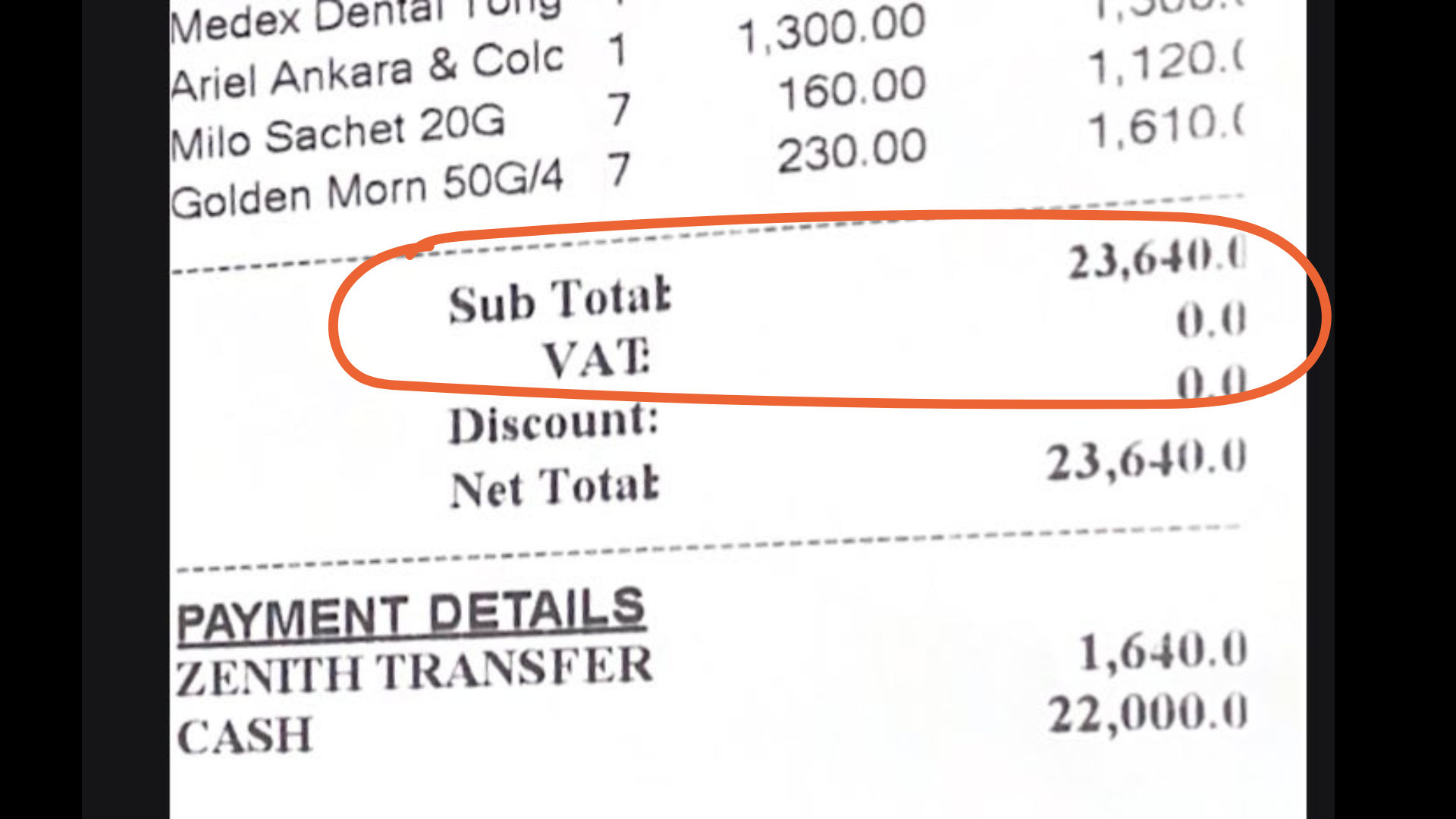

The image below shows an example of exempt taxes:

The Federal Inland Revenue Service (FIRS), backed by the VAT Act of 1993, handles VAT collection and enforces these exemptions. VAT was introduced in 1993 to replace the outdated sales tax law from 1986, and it’s now one of Nigeria’s fastest-growing sources of revenue.

Zero-rated VAT

As mentioned earlier, certain goods and services are zero-rated in Nigeria, meaning VAT applies but at a 0% rate—so either way, there’s no additional cost. These include essential items like non-oil exports, goods purchased by diplomats, and humanitarian projects. Some basics, like foodstuffs and medical services, are also exempt from VAT altogether.

This tax relief applies to key sectors, helping keep costs down for items such as:

- Agricultural equipment

- Basic foodstuffs

- Commercial vehicles

- Residential rents

- Medical supplies

- Educational materials

- Non-oil exports

- Books and newspapers

- Machinery in the solid minerals sector

- Humanitarian projects

Zero-rated VAT helps reduce the financial burden on essential goods and services, particularly in agriculture, healthcare, and education.

Who is supposed to pay VAT in Nigeria: businesses or individuals?

In Nigeria, VAT is paid by consumers of taxable goods and services. This just means anyone engaging in economic activities—whether you’re a business owner, trader, or service provider. If you’re selling taxable goods or offering services, you’re required to charge VAT and remit it to the authorities.

And yes, even government agencies have to pay VAT. Ministries and statutory bodies, are expected to deduct VAT at the source and pay it directly to the tax office. Alongside VAT, the government collects other taxes like Companies Income Tax (CIT), Withholding Tax (WHT), and Pay As You Earn (PAYE).

This system ensures that both individuals and businesses contribute their fair share.

So, how do you pay VAT in Nigeria?

Most tax payments in Nigeria, including VAT, are now electronic to combat corruption. VAT can be collected at the point of sale or deducted at the source.

Individuals can also voluntarily make their tax payments through approved platforms like Remita, Interswitch, NIBSS, and eTranzact Online Payment.

By using these electronic methods, everyone involved can fulfill their VAT responsibilities efficiently and securely.

How much is VAT in Nigeria and when am I charged?

Currently, the VAT rate in Nigeria is 7.5%, raised from 5% in February 2020.

The 2024 VAT (Modification) Order added new exempt items, such as equipment for compressed natural gas (CNG), liquefied petroleum gas (LPG), electric vehicles, and biofuel equipment aimed at promoting cleaner energy.

Some state governments, including Lagos and Rivers, add an extra 5% VAT, raising the total rate to 12.5% for goods and services in those regions.

You are typically charged VAT when you purchase or consume taxable goods and services, as well as for any goods or services used within Nigeria. The VAT is applied when you receive an invoice or make a payment.

So how do you know you’re not overpaying or underpaying when it comes to Value Added Tax? Whenever the need applies, it is expected that individuals have basic knowledge of how to calculate VAT.

How to calculate VAT in Nigeria

When you are a registered VAT payer, 7.5% of the amount you receive from customers for goods or services is considered your Output VAT. Likewise, when you buy products and services, 7.5% of that amount is your Input VAT.

To determine how much VAT you owe to the government, use this formula:

Total VAT Payable = Output VAT – Input VAT

For example

Let’s say you go to a local electronics store and buy a new smartphone for ₦100,000. The accessories for that smartphone, like a case and charger, cost ₦20,000.

- Calculate Output VAT:

- Output VAT = 7.5% of ₦100,000

- Output VAT = ₦7,500

- Calculate Input VAT:

- Input VAT = 7.5% of ₦20,000

- Input VAT = ₦1,500

- Calculate Total VAT Payable:

- Total VAT Payable = Output VAT – Input VAT

- Total VAT Payable = ₦7,500 – ₦1,500

- Total VAT Payable = ₦6,000

If you still can’t wrap your head around it, use online tools like the VAT calculator at percentagecalculator.net.

Claiming VAT Refunds

If you find yourself paying more VAT on your purchases (Input VAT) than you collect from your sales (Output VAT), you have the right to claim that extra money back. Here’s how it works:

Direct Cash Refund: You can request a cash refund from the tax office for the extra VAT you’ve paid. However, this can be slow and involve a lot of paperwork.

Credit Method: Alternatively, you can apply the extra VAT to reduce your future VAT payments. This method is often quicker and easier, which is why many businesses prefer it.

Combination of Both: If it suits your needs, you can use a mix of both methods—getting some cash back now while crediting the rest for future use.

Before you can claim a refund, you need to ensure a few things:

- Your business must be VAT-registered with the Federal Inland Revenue Service (FIRS).

- You should keep detailed records of all your VAT invoices and receipts.

- You need to submit your VAT returns, where you can apply any excess Input VAT against future Output VAT.

Alright, let’s break what VAT returns are down:

VAT returns are documents that your business would send to FIRS to report the VAT they’ve collected and paid. Here’s a quick breakdown:

- Reporting Period: You’ll typically submit these returns either monthly or quarterly.

- Calculating VAT: In your return, you’ll need to tally:

- Output VAT: The total VAT you’ve charged customers.

- Input VAT: The total VAT you’ve paid on purchases.

If your Input VAT exceeds your Output VAT, you have an excess. Instead of paying the full amount of Output VAT to FIRS, you can deduct this excess.

Example:

- Output VAT: ₦50,000 (from sales)

- Input VAT: ₦70,000 (from purchases)

In this case, your excess is ₦20,000. You can carry this amount forward to offset your future VAT liabilities. For the next period, if you owe ₦30,000 in VAT, you’ll only need to pay ₦10,000 after applying your excess.

VAT returns can be filed manually or online via the FIRS e-Tax platform.

Filing Requirements

In Nigeria, businesses must submit monthly VAT returns on Form 002. These returns are due no later than the 21st of the month following the reporting period.

Any VAT owed must be paid by this date through a transfer from an approved bank. Returns can be submitted both online and in paper format.

Your VAT return must include:

- A list of all VATable supplies received and supplied.

Relevant Documents for Filing VAT Returns

To file your VAT returns, ensure you have the following documents ready:

Evidence of payment, such as a bank teller, e-ticket, or e-acknowledgment from a designated FIRS revenue-collecting bank.

A completed VAT Returns Form 002 (applicable for individuals, enterprises, and companies).

A schedule of VAT collected, including the name and Taxpayer Identification Number (TIN) of the company or individual on whom the VAT was charged, along with the relevant amounts.

Failing to file your VAT return may incur a fine of ₦5,000 per month, while failure to remit any VAT due results in a fine equal to 5% of the liability plus interest.

What is a VAT Number and How can I get it in Nigeria

A VAT number, also known as a VAT ID, is a unique identifier assigned to businesses registered for Value Added Tax (VAT) in Nigeria. It’s essential for compliance and necessary for collecting and remitting VAT.

To ensure your business is VAT-compliant, keep in mind that only businesses with an annual turnover of ₦25 million or more are required to register for VAT. Here’s how to get started with the registration process:

Complete the VAT Registration Form: Fill out and submit the Taxpayer Registration Input Form or VAT Registration Form 001. This form is crucial for registering for VAT and can be found on the FIRS website.

Gather Supporting Documents: Along with your registration form, you’ll need to provide essential documents such as: Business registration certificate; Audited accounts; and Bank statements.

Obtain a Tax Identification Number (TIN): This can also be done online through the FIRS website. Your TIN is necessary for tax purposes and ties your business to its tax obligations.

By completing these steps, you’ll be registered and authorized to collect VAT, ensuring your business adheres to Nigerian tax laws.

VAT Filing and Remittance in Nigeria

Once registered, it’s crucial to understand the VAT filing and remittance process. Remitting VAT means paying the net VAT owed to the FIRS, which involves submitting your payment receipts or e-tax payment receipts alongside your VAT returns.

Late filing or failure to remit VAT can lead to penalties and interest charges.

To file and remit VAT in Nigeria, you must:

- Ensure your business is registered for VAT with the FIRS.

- Charge 7.5% VAT on all taxable goods and services.

- File VAT returns monthly and remit the VAT collected.

- Maintain accurate records of sales and purchases to determine your VAT liability.

Staying on top of your VAT obligations is essential to avoid complications with tax authorities. Consider engaging an accountant to ensure accurate VAT filing and timely remittance, giving you peace of mind.

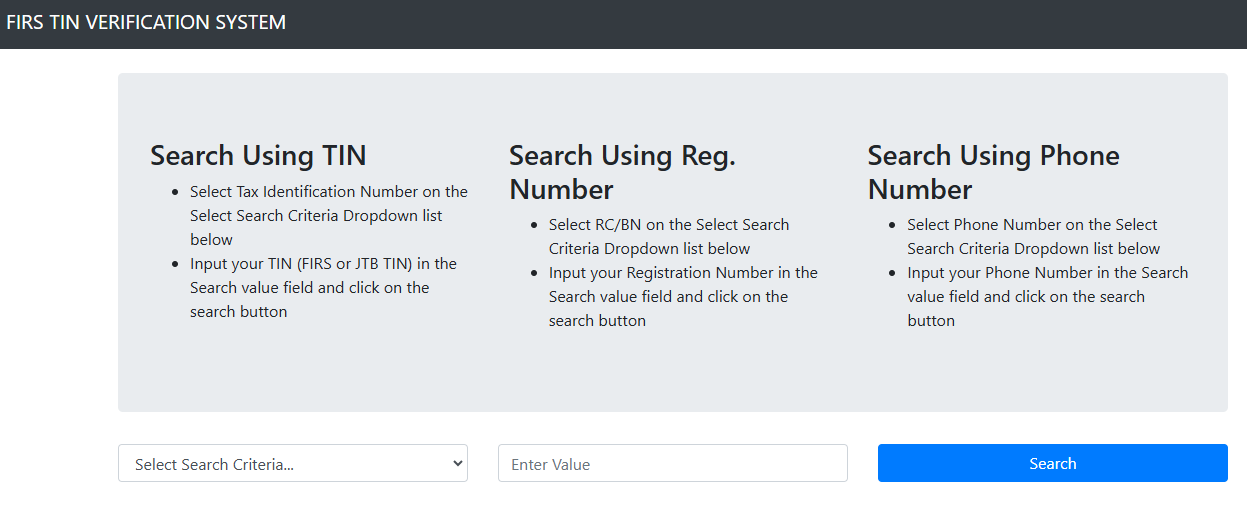

How to check my VAT Number in Nigeria

To check your VAT number in Nigeria, you can use the Federal Inland Revenue Service (FIRS) TIN Verification portal. Here’s how:

- Go to the FIRS TIN Verification page.

- Choose the relevant option for your search, such as Tax Identification Number (TIN), Registration Number, or Phone Number.

- Input your selected criteria (TIN, Registration Number, or Phone Number) in the provided search field.

- Click the search button to verify your details

Alternatively, you can also check your VAT number by visiting the Joint Tax Board (JTB) website for TIN verification.

Penalties for VAT Non-Compliance

Businesses that fail to register for VAT face a penalty of ₦10,000 for the first month and ₦5,000 for each subsequent month, potentially leading to closure. Non-deduction of VAT results in a penalty of 150% of the uncollected tax, with an additional 5% interest above the Central Bank of Nigeria’s rediscount rate. For non-remittance of VAT to the FIRS, the penalty is 5% per annum, plus interest at a commercial rate, due within 30 days of notification.

FAQs on VAT in Nigeria

What is VAT Receivable or Input VAT? Input VAT refers to the VAT a business pays on goods and services it purchases for its operations. This amount can be claimed back when calculating VAT liabilities.

What is VAT Payable or Output VAT? Output VAT is the VAT charged to customers on sales. VAT payable is calculated as the difference between output VAT and input VAT

Who should register for VAT? Individuals and businesses must register for VAT if their annual turnover exceeds ₦25 million. This registration is compulsory for those providing VATable goods or services, though exceptions exist—consult the Federal Inland Revenue Service (FIRS) for details.

Can VAT be paid in Dollar? Imported goods and services incur VAT at the point of importation, charged in the currency of the transaction. For example, if you import goods from the US and pay in USD, the VAT will also be charged in USD.

Are entertainment services VATable? Yes, entertainment services, including those provided by hotels, restaurants, cinemas, nightclubs, and recreational clubs, are subject to VAT.

When should I register for VAT? You must register for VAT within six months of starting your business if your annual turnover exceeds ₦25 million. Voluntary registration is allowed for businesses below this threshold.

How much does it cost to register for VAT in Nigeria? Registering for VAT is free and can be completed on the FIRS website.

When should a taxable person register for VAT? Taxable individuals and entities should register for VAT upon being registered with the Corporate Affairs Commission (CAC) or upon commencing business operations.

Who is a VAT Agent? VAT agents are authorized representatives who facilitate the collection and submission of VAT on behalf of businesses, including government agencies and oil companies.

Is VAT multiple taxation? No, VAT is a multi-stage tax applied at different stages of production and distribution, not a form of multiple taxation.

Should VAT be paid on Commercial Rent Yes, tenants are required to pay 5% VAT on rent for commercial property use.

Conclusion

You now have a clear understanding of how VAT works in Nigeria. It may seem complex at first, but the main point is that when you shop, a small part of your payment goes toward VAT, helping to fund things that benefit everyone. So, it’s basically a civic duty, even as controversial.

As discussions about future VAT rate increases continue, knowing when a product is VAT-exempt or understanding the implications of VAT can empower you as a consumer in Nigeria.

Stay in the loop for more financial guides like this. We also covered how you can track your account balances as way to better manage your finances and everything you need to know about fees.