In this article, we will cover how you can use various risk-free methods to pay your Chinese suppliers from Nigeria.

If you’re sourcing your business products in bulk or wholesale volumes from China and you’re looking to play the long-term game, you need to take precautionary measures to avoid getting ripped off, one of which is choosing the right payment methods.

This article explores alternative payment methods for Nigeria-China importers other than the traditional banking method, and how you can benefit from them.

We will discuss these methods shortly.

What is crucial, however, is to follow these golden principles:

Don’t use personal accounts for payments: Always request the business account details from the company you’re transacting with. If they fail to provide this information, it’s best to avoid doing business with them. Sending money to personal accounts is risky and could result in losing your funds and not receiving your goods.

Establish a Solid Contract: Before transferring any funds to suppliers, protect your interests by incorporating clear payment terms in your contract. These should specify the payment schedule and the preferred payment method.

What is the main currency in China?

When transferring money to China, you might encounter terms like CNY, CNH, or RMB, which can be confusing. To clarify, the Renminbi (RMB) is China’s official currency.

The distinction lies between CNY and CNH: CNY refers to the Renminbi traded within Mainland China, while CNH denotes the Renminbi traded internationally, outside of Mainland China.

Why Opt for Chinese Suppliers When Importing to Nigeria?

Cost Benefits: China can offer lower prices because they pay less for labour and make lots of products at once. This means you can save money for your business.

Diverse Range: China makes all kinds of products, so it’s easy to find what you’re looking for.

Streamlined Supply Chains: China’s top-notch shipping and manufacturing systems make getting your products fast and without hassle.

Expertise: Chinese suppliers, known for their international dealings, bring quality and dependability to the table.

Considerations Before Committing:

Lead Times: Be prepared for potentially longer shipping times.

IP Risks: Counterfeiting issues may arise due to the large manufacturing base and inconsistent IP enforcement in China

Cultural Nuances: Each successful deal may require an understanding of cultural and communication differences.

Choosing to import from China to Nigeria means weighing what you need against possible challenges like the ones above. By doing your homework and picking reliable suppliers, you can make this process smooth and end up with successful deals.

Now the tea– the various modes of payment that Nigerians sourcing products from China can use to pay their suppliers.

What To Pay Attention To When Choosing Payment Methods For Chinese Suppliers

When choosing a payment method, you need to consider the following factors:

Price: As a business owner, you want to maximize your profits and minimize your costs. International payment options have different fees, charges, and exchange rates, so you need to compare them and choose the one that suits your budget.

Transaction success rate: As a customer, you want to complete your purchases smoothly and quickly. However, not all payment gateways have the same reliability and performance. You need to check the customer reviews and ratings of each payment option and choose the one with the highest transaction success rate.

Settlement period: Settlement period refers to the time it takes for you to receive your money. Unlike peer-to-peer payments, some payment options may take longer to process and deliver your money. You need to check the settlement time of each payment option and choose the one that has the shortest settlement time.

Security: Security is crucial when it comes to online payments. You want to choose a payment option that has a high level of encryption, authentication, and fraud prevention. You also want to choose a payment option that offers buyer protection and dispute resolution services in case something goes wrong with your order.

Read also: How to Buy on Alibaba and Pay Easily

Top 7 Methods to Send Money to China Suppliers

Learn how to use these payment methods to pay your Chinese suppliers safely and easily.

1. Bank Wire Transfer

This is the simplest and most common way to pay your Chinese suppliers. If you have a business account, you can make the transfer online or at your local branch. Wire transfers are preferred by most Chinese suppliers, especially smaller ones.

To make a wire transfer, you need to include these details in your invoice:

Reference number

Payment amount

Order date

Order Quantity

Shipping company name

You may also need to provide more information in some cases, as China hasstrict capital controls. Wire transfers are often checked and require a lot of information about the transaction.

Wire transfers typically involve higher fees, such as processing fees, conversion fees, and transfer fees.

2) Credit Letter

Credit letters are a great option for both buyer and supplier and they’re about as traditional as you can get. These letters guarantee that the seller will receive payment from the buyer and in a situation where the buyer is unable to pay, the bank is obliged to cover the cost.

Note that Chinese Suppliers are often hesitant to accept them as they are mostly favoured by international corporations making large payments. However, if you choose to pay with this option, be sure to do so with a third-party inspection clause — this will ensure that you only transfer the payment if the quality of the goods received has matched your expectations.

3) Sourcing Agencies

If you buy through a local Chinese office, you have a higher chance of acceptance. That’s why some importers use a local sourcing agent to buy their order, using an escrow arrangement. The risks are lower, as long as the communication is clear.

However, the agency can reject the goods and keep the escrow payment. Using an agency also adds more cost to the deal.

Sourcing agencies may be good for small transactions if you want to pay more to avoid risk.

4) Escrow

Escrow protects both parties. It means that you pay an initial deposit before dispatch, but the funds are held by a third party. The third party won’t release the funds to the supplier until you’ve received your goods.

Although popular within China, acceptance for international transactions is still low. However, if you’re buying through Alibaba, you might be offered payment using Alipay Escrow.

The idea of escrow is to reduce risk due to the long wait between order and receipt. There are still disputes, though, and it can be hard to get the dispute resolution team working on your behalf.

Fees are around 3.25% of the transaction.

With a provider such as Escrow.com, transactions with a buyer outside the United States will be charged an additional $25.00 to cover any intermediary bank fees.

Escrow can be convenient for low-value transactions. However, you might want to skip them on larger transactions due to both the added expense and the reality that it can tie up your money for some time.

5) Cash

Many suppliers prefer cash payments, and Chinese suppliers are no different. Paying by cash is common in China, and cash discounts are sometimes available.

For you, however, it’s the riskiest way of paying. There’s little protection if you’re unhappy with your goods.

You still face costs, particularly the expenses associated with any foreign exchange transaction.

You’ll need to check what exchange rate mark-ups you’ll face in addition to the stated fee.

If you boil it down, though cash is popular in China, it’s quite risky for you.

Not only that, but have to beware of hidden charges in the exchange rate.

6) Western Union

Western Union is a convenient payment method for sending money across the world quickly, but serious buyers should be wary of it. It does not offer any payment protection and has high fees.

When you send money via Western Union, you get a 10-digit code that you give to the recipient. They can collect the money from a Western Union branch with the code and their ID.

The problem is that if you get ripped off, you have no way to get your money back. Legitimate suppliers seldom ask for payment via Western Union, so be careful if a supplier demands this method.

N.B.: We have not included PayPal as an option because it has some limitations in Nigeria. Nigerian PayPal accounts cannot receive payments from other PayPal accounts, but they can receive payments from PayPal accounts in other countries.

7) Wise

Wise, formerly known as TransferWise, is an online exchange service that lets you send money around the world with fair exchange rates and low fees.

Wise offers personal and business accounts to move and manage your money in different currencies.

If you have to make a big payment to China, Wise can be a secure and fast way to pay as the exchange solution has better exchange rates than, for example, Western Union.

Send Payments via a Third-Party Source

Third-party payment refers to alternative payment methods outside traditional banking, such as WeChat Pay, Veem, TransferWise, and PayPal.

Chinese regulations require large transactions to be processed through the central bank’s official clearing system, making Chinese suppliers cautious about using Third Party Payment services for business-to-business deals. However, for smaller transactions, many Third Party Payment platforms offer excellent options.

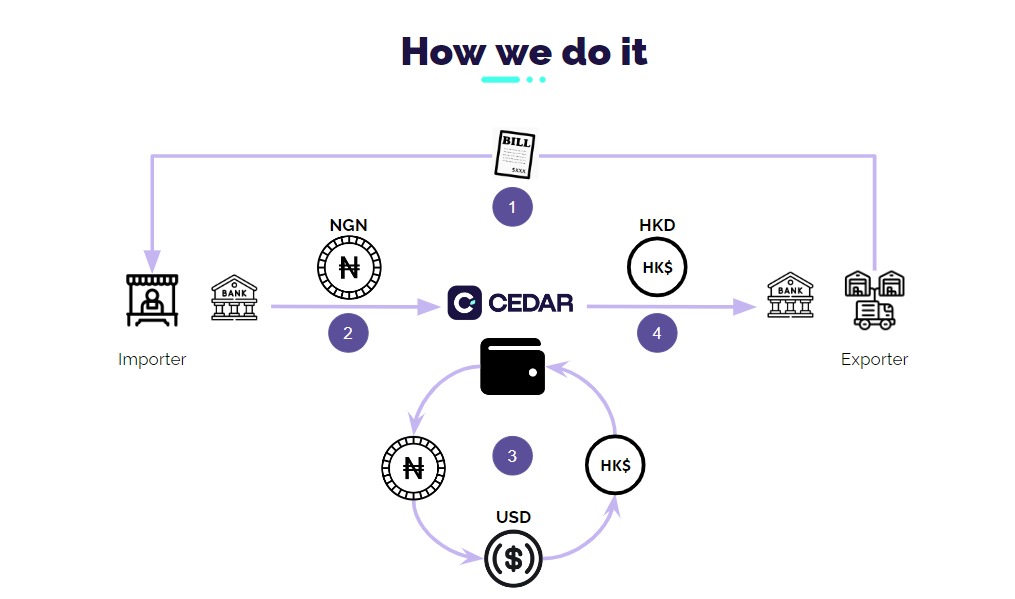

Filling the gap left by B2C systems like PayPal and WeChat Pay, Cedar Money offers cross-border payment solutions for businesses. Their services include a local collection and Chinese merchant settlement.

For your suppliers, Cedar Money makes settlements directly to their corporate bank accounts — which most Chinese suppliers prefer.

Importantly, Cedar offers the best dollar rate in countries they support and their fees (if any) are lower than most payment solutions.

How much does it cost to transfer funds to China via Cedar Money?

Exchange rate: based on real-time mid-market rate

Extra Fees: None

Reliability: High

Setup Difficulty: Low

Speed: Between 1 to 3 business days

Conclusion

Based on your individual needs and priorities, compare the options discussed above and choose the payment method that best suits your requirements. Also, keep in mind that choosing the right payment method is an investment in your business efficiency and financial well-being.