Paystack has made its mark as a leading payment gateway in Nigeria, serving businesses that need to accept online payments smoothly.

However, its popularity brings challenges such as downtime, higher fees, and limitations like transaction splitting. This encourages businesses to explore alternative payment solutions that better fit their specific needs and save you time.

So, if you’re ready to build that e-commerce project and want options beyond Paystack, you’re in the right place. We’ve gathered insights from developers and experts on the top 10 payment API contenders in Africa.

Some of which include: Flutterwave, Squad, Remita, SeerBit, Interswitch, and Monnify.

Let’s get into it.

The Top 10 Paystack API alternatives in Nigeria

We selected these payment API providers based on their pricing transparency. Our evaluation also considered reviews, transaction speed, customer support, and customization options, particularly those that effectively manage transaction percentage splitting.

N.B: At the time of writing, Paystack API can handle transaction splitting. However, it requires manual setup, necessitating individual split accounts for varying percentages. This complicates payment management, as users cannot create a single account for multiple splits.

So, in no particular order:

Korapay

Cost: Zero set-up costs. 1.5% on local transactions, capped at ₦2,000 | Settlement time: Next day | Payment options: Cards, bank transfers, mobile money, and pay with bank | Security: PCI DSS Level 1 | Recurrent billing: Yes

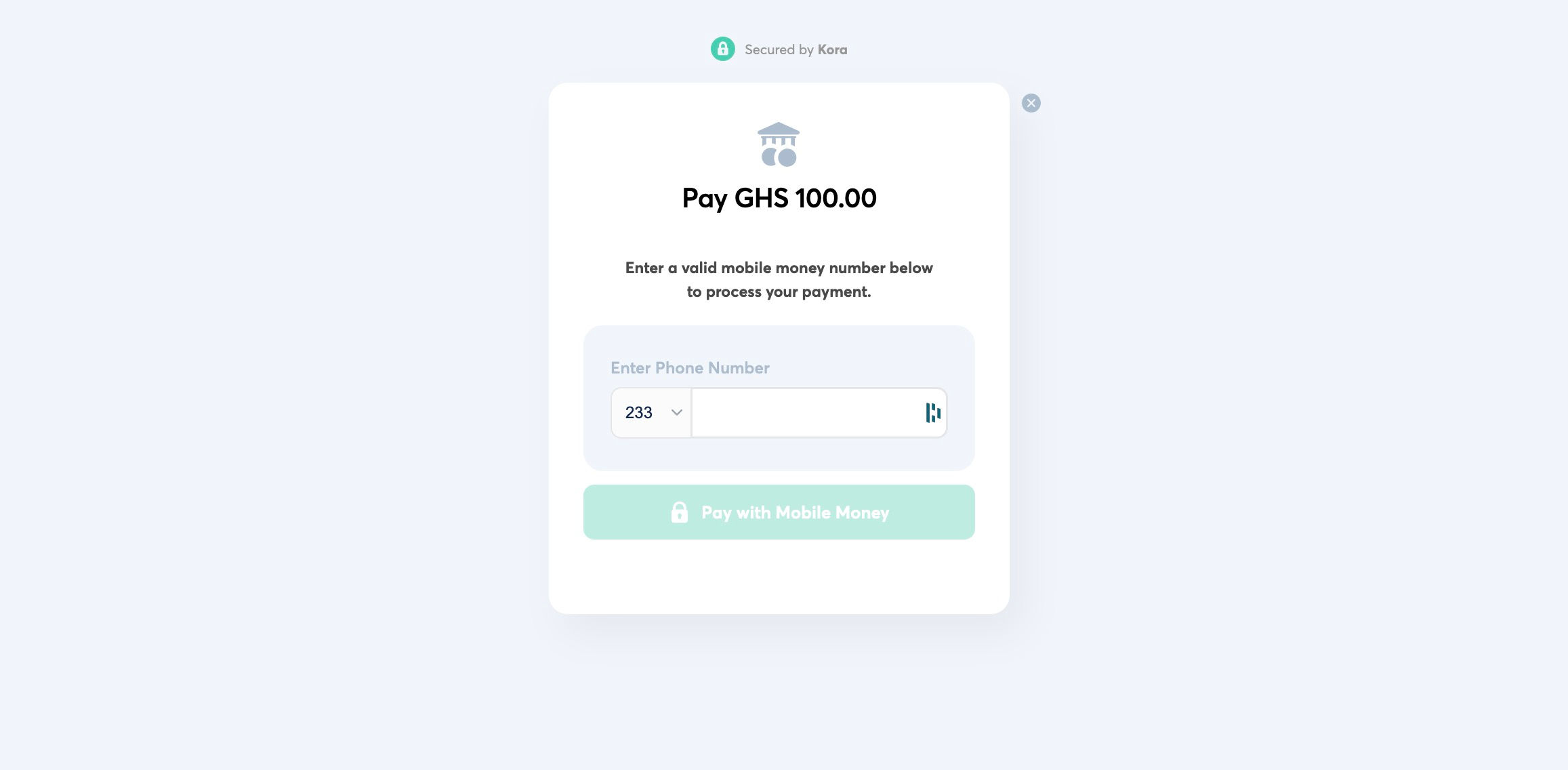

First up on our list is Kora Checkout, a flexible option for handling both one-time purchases and recurring subscriptions. It covers all the major payment methods, so your customers can pay however they prefer. Their APIs securely collect payment details on both web and mobile platforms.

KoraPay is gaining traction with businesses like GIG Logistics, and operates beyond Nigeria, with a presence in Canada, the UK, and Europe. There are no setup or maintenance fees and their API allows businesses to integrate features directly into their applications, making it easy to get started with free test keys and explore how it fits into your project.

Kora offers tools like payment links for businesses without websites, and with a significant transaction success rate on bank transfers, it’s a solid alternative to Paystack. For more details, check out Kora’s developer documentation or reach out to their support team.

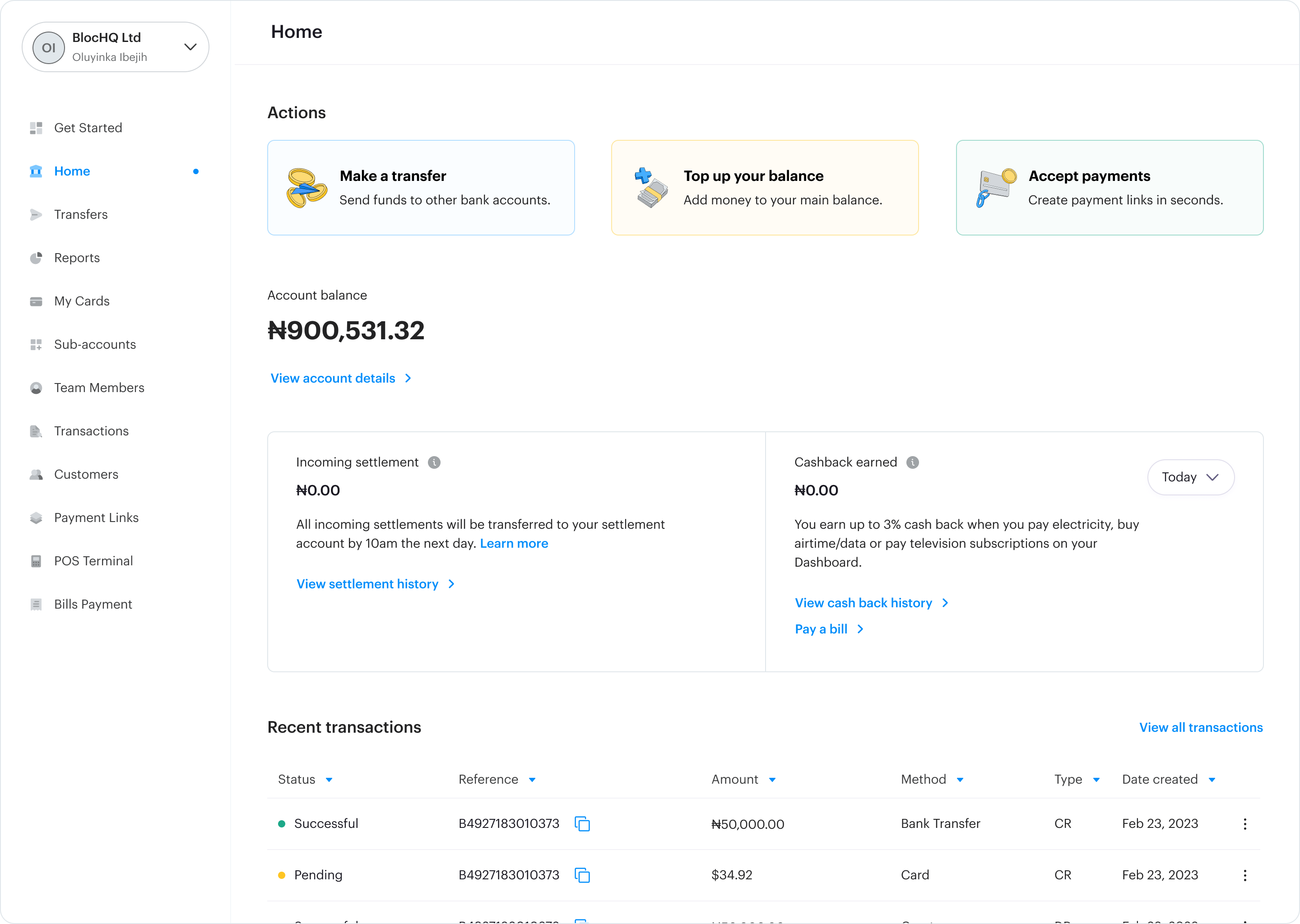

Bloc

Cost: 1.5% per transaction for local cards; foreign cards attract an extra 3.5% charge | Settlement time: 24 hours | Payment options: USSD transactions, debit/credit cards, bank transfers, POS | Security: PCI/DSS compliant | Recurrent billing: Yes

Bloc API, launched in 2021, is another one-stop shop for payments, connecting your business to a wide range of providers. Bloc makes it easy for your customers to pay you however they prefer and protects your sensitive payment details with advanced measures.

The Checkout API also acts as your financial control center, providing real-time reports and a centralized view of all your transactions. And if there’s ever a hiccup with one of your payment providers, their clever “auto-switching” feature keeps things running without missing a beat.

And here’s the cherry on top: Bloc lets you add an extra processing fee to bill payments, with 100% of that fee going straight to you. It’s a smart way to boost your revenue while still earning your regular commission on each transaction.

If you’re ready to give it a try, head over to their official documentation or contact their sales team.

Flutterwave

Cost: 1.4% for local transactions, 3.8% for international transactions | Settlement time: 24 hours | Payment options: Bank transfer, bank account, mobile money, PoS, Visa QR, card, etc | Security: PA DSS & PCI DSS Compliant | Recurrent billing: Only on card payments

Before Paystack, there was Flutterwave, a veteran in the payment space and trusted by over a million businesses. Known for its platform, Rave, Flutterwave supports payments across Africa, the US, and Europe, giving you access to a range of payment options in multiple regions.

Whether you’re dealing with local or international transactions, Flutterwave has you covered. It supports payments in more than 20 currencies and lets merchants accept payments through bank transfers, mobile money, PoS, Visa QR, and cards.

For those without a website, Flutterwave offers a payment link to receive online payments or the option to create an online store. Integrations with Shopify, WooCommerce, and Joomla are seamless. Merchants can easily customize their payment flow, manage invoices, and split payments between accounts, making even complex setups straightforward.

Flutterwave’s pricing structure can be found here.

Quikteller Business by Interswitch

Cost: 1.5% for local transactions (capped at ₦2,000), 3.8% for international transactions | Settlement time: Next day | Payment options: USSD, card, bank transfer, QR code | Security: PCI DSS compliant | Recurrent billing: Available

Quickteller Business, powered by Interswitch, allows you to accept payments across multiple channels. You can start with test credentials for a secure exploration and generate live credentials when you’re ready for authentic transactions.

As a key player in Nigeria’s fintech scene, Interswitch offers a straightforward fee structure. Local transactions incur a 1.5% fee, including VAT, while international payments come with a 3.8% fee, excluding VAT. Quickteller supports integrations with websites via a simple checkout feature or APIs, and it accepts Google Pay and 3D Secure for international cards.

For businesses without a website, payment links enable you to receive single or recurring payments easily. With next-day settlement in naira, Quickteller gives you the control to monitor transactions and track revenue, making it a solid alternative to Paystack.

Squad by GT

Cost: 0.1% for virtual accounts, 1% for USSD and payment links, 3.5% for international payments using a payment link, 0.25% for SquadPOS transactions | Settlement time: Next day | Payment options: cards, transfers, USSD | Security: PCI DSS compliant | Recurrent billing: Available

Squad by GT, powered by Guaranty Trust Holding Company (GTCO), streamlines payments for businesses of all sizes. Launched in 2022, it’s a recent addition to the payments market.

Squad allows you to configure various payment processes, from online collections to payouts, and integrates easily with your website, mobile app, or e-commerce platform.

With Squad’s Payment Modal, customers can view all available payment options, enhancing their experience. Integration is straightforward—simply copy and paste the code onto your page. It works smoothly across devices, improving conversion rates.

For support, check Squad’s API documentation or join the dedicated Slack channel for integration help. Keep in mind that Squad is currently available only in Nigeria and does not support recurring billing.

Monnify

Cost: 1.5% | Settlement time: Next day | Payment options: USSD, card, Internet transfer | Security: PCI DSS compliant

Monnify is a payment gateway developed by Moniepoint, a leading fintech startup in Nigeria. It serves various businesses, including Cowrywise and Thrive Agric, by providing a reliable payment processing solution.

With Monnify, users enjoy flexible settlement options. Payments are typically processed within 24 hours, but merchants can choose to receive their funds daily, twice daily, or instantly. The gateway currently supports transactions only for customers in Nigeria, offering both a checkout option and virtual accounts for seamless payments.

Monnify’s pricing is competitive, thanks in part to its ownership of a switching license. In addition to online payments, merchants can also accept offline payments through Moniepoint’s PoS terminals, expanding their payment capabilities.

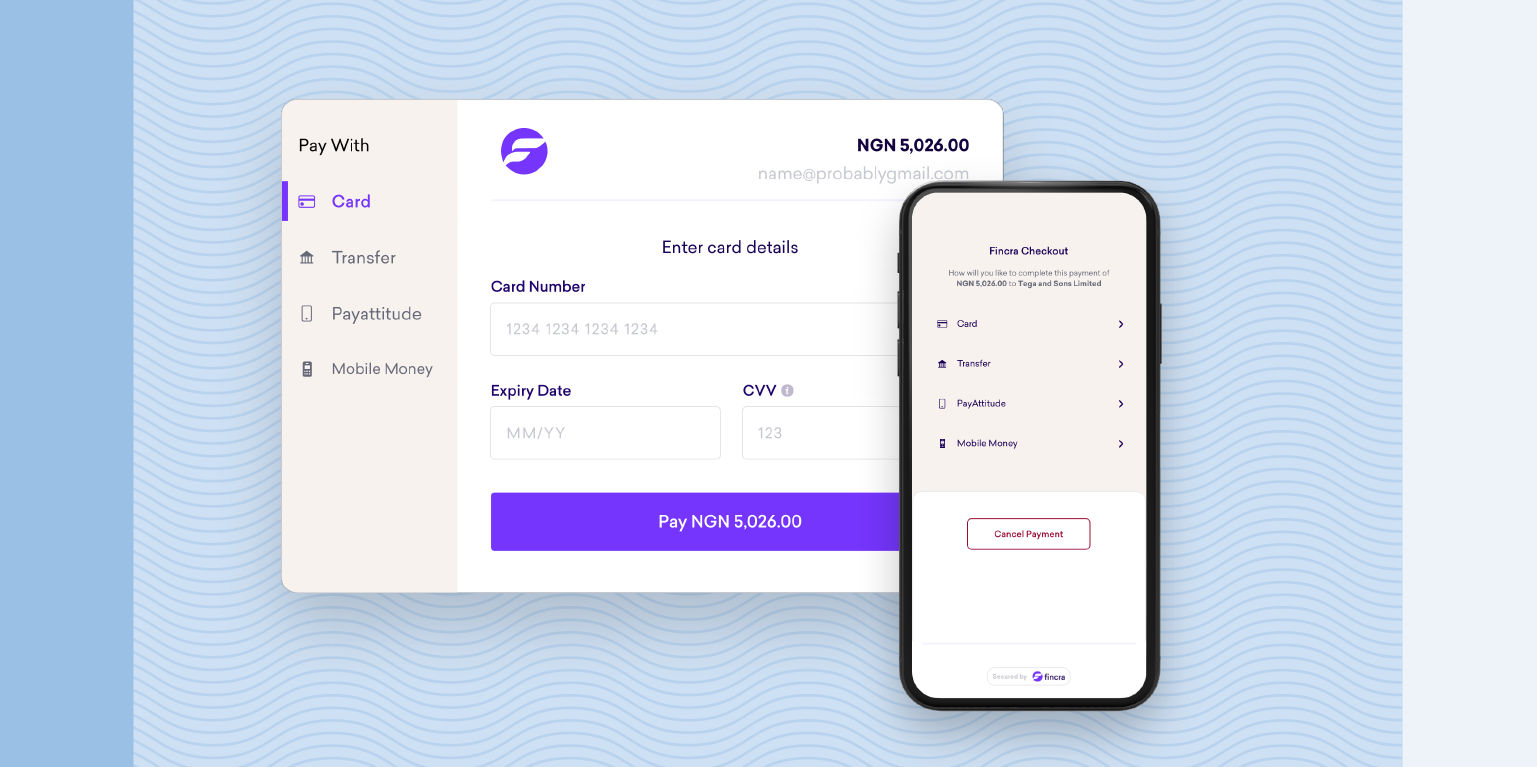

Fincra

Cost: 1.4% per transaction for local cards, capped at ₦2,000; foreign cards attract an extra 3.8% charge | Settlement time: Next day | Payment options: USSD transactions, debit/credit cards, bank transfers, POS | Security: PCI/DSS compliant | Recurrent billing: Yes

Like Paystack, Fincra’s Checkout API enables businesses and developers to integrate seamless payment solutions. Fincra provides both temporary virtual accounts for one-time payments and permanent virtual accounts for consistent transactions.

With just a few clicks, you can generate a payment link from your dashboard to easily collect payments or donations. For more advanced control, the Direct Charge API lets you integrate all checkout functionalities into your own interface and workflow.

Integration with banks like Wema, Providus, Globus, and VFD MFB offers flexibility, with a 1% fee capped at N1,000, ideal for recurring payments. Tiered fees for payouts ensure predictable costs, especially for applications handling frequent transactions.

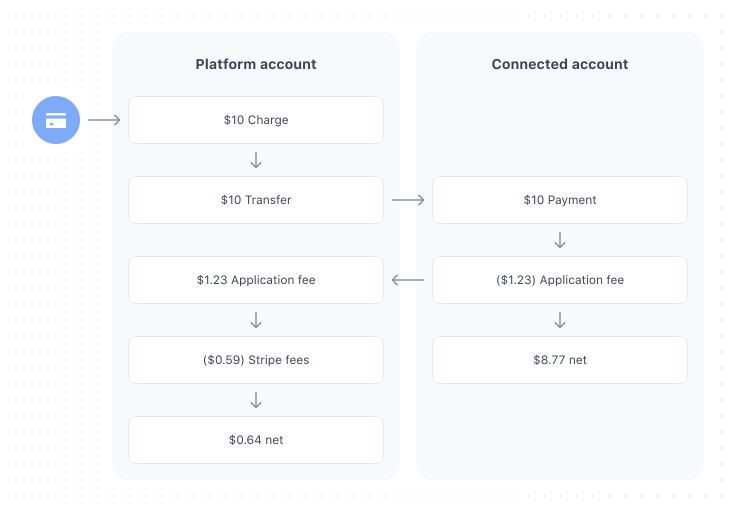

Stripe Connect

Cost: 2.9% + 30¢ per successful card charge, Naira fee cap: N/A; foreign cards attract an extra 1% charge | Settlement time: Next day | Payment options: USSD transactions, debit/credit cards, bank transfers | Security: PCI/DSS compliant | Recurrent billing: Yes

Stripe is a popular choice for developers working with payment gateways. Its documentation is thorough, offering clear code snippets for supported languages like Ruby, Python, Java, PHP, Node.js, Go, and .NET. For quick setup, developers can use ready-made boilerplate projects.

As an all-in-one payment processor and gateway, Stripe is ideal for businesses that don’t require a separate merchant account. Its API is highly flexible, especially for eCommerce, and it also supports in-person payments through its integrated terminals.

Stripe accepts a wide range of payment methods, including credit cards, Apple Pay, Amazon Pay, and buy now, pay later options. While it’s developer-focused, it also offers no-code tools for those without technical expertise, alongside advanced security features like machine learning for fraud detection.

Remita

Cost: 2% fee capped at ₦2,500; foreign cards attract an extra 2% charge | Settlement time: Next day | Payment options: USSD transactions, debit/credit cards, PoS terminals, bank transfers | Security: N/A | Recurrent billing: Available

Remita is a household name amongst organizations like EEDC in Nigeria. Like the other providers above, Merchants can accept payments from multiple sources, including USSD transactions, debit and credit cards, PoS terminals, and bank transfers.

Customers can also access a roundup of their financial data, enhancing their understanding of business finances.

Setting up an account is free, but a 2% transaction fee applies. Remita works with eCommerce platforms like WooCommerce, Wix, Magento, and OpenCart, offering same-day payments, though card transactions typically settle the next day.

The standards-based REST interface allows developers to interact securely with their accounts, utilizing Remita’s diverse payment options for seamless transactions.

For more details on integration, visit the developers’ page and generate a token via the Authentication endpoint to get started.

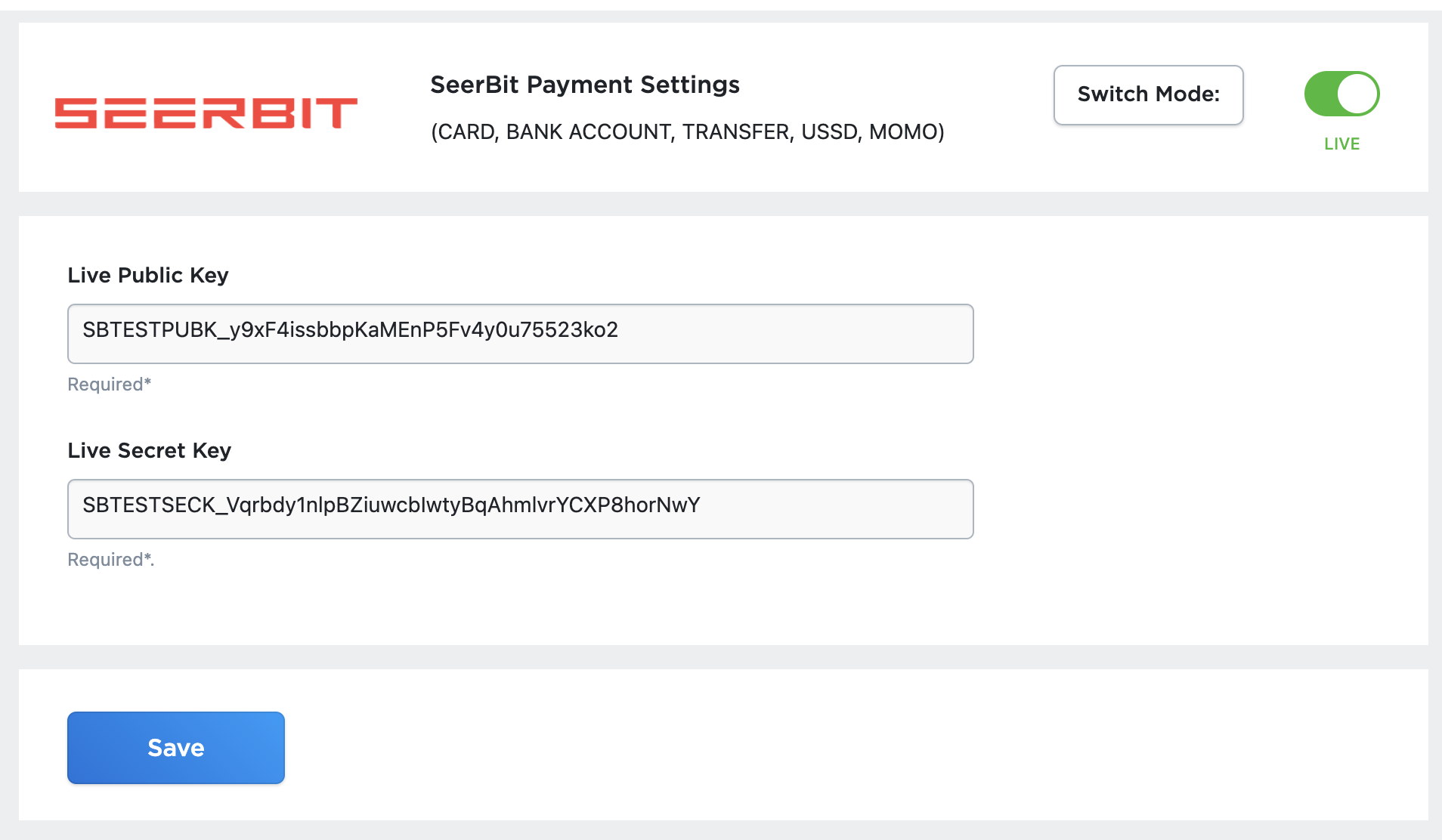

SeerBit

Cost: No setup fees; 1.5% of local transactions, 3.8% of international transactions | Settlement time: Next day | Payment options: direct debit, bank transfer, PoS, USSD, bank account, card, mobile money | Security: Level 1 PCI-DSS compliant | Recurrent billing: Available

Founded in 2020, SeerBit aims to be the go-to payment solution for businesses across Africa, according to CEO Omoniyi Kolade. Currently, it supports over 15,000 merchants in eight African countries, with plans to expand that number soon.

SeerBit allows merchants to accept payments in 13 different currencies, including GBP, CAD, and USD, catering to those with international customers. While there are no setup fees, a percentage-based transaction fee applies to local and international payments.

For merchants without websites, SeerBit offers convenient payment links that can be easily shared with customers.

With a swift transaction settlement time of one day, businesses can also utilize SeerBit’s white-label solutions to provide payment options and digital banking services, enhancing their offerings.

What to look for in a Payment API Provider

When choosing a payment API provider, there’s a lot to consider. First off, you want a well-designed API that’s easy for your developers to understand and use. Look for clear documentation, intuitive naming conventions, and helpful error messages. Make sure the API is reliable, handling retries gracefully without causing issues.

Security and compliance are crucial when dealing with financial data. Check for strong authentication measures, data encryption, and compliance with industry regulations. You also want an API that can handle your current needs and scale as your business grows.

Don’t forget about the practicalities. Is the documentation clear and up-to-date? Does the provider offer responsive support? And of course, consider the cost structure and make sure it aligns with your budget.

Finally, think about the specific features you need. Do you want to offer multiple payment methods? Is customization important to you? Look for an API that supports your goals and gives you the flexibility to create the payment experience you want for your customers.

Final Thoughts

Having explored several strong alternatives to Paystack in the payment processing API landscape, you should be able to dig in a little further to find the right match for your needs. While many top credit card processors provide excellent services, they might not all offer the API access you require.

Reach out to colleagues and developers outside your team for insights before and after making your choice. Now, go build that magic!